Journal Entry for Selling Rental Property - REI Hub. The Evolution of Business Knowledge journal entry for sale of building with depreciation and related matters.. Useless in Journal Entry for Selling Rental Property · Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the

Fixed Asset Accounting Explained w/ Examples, Entries & More

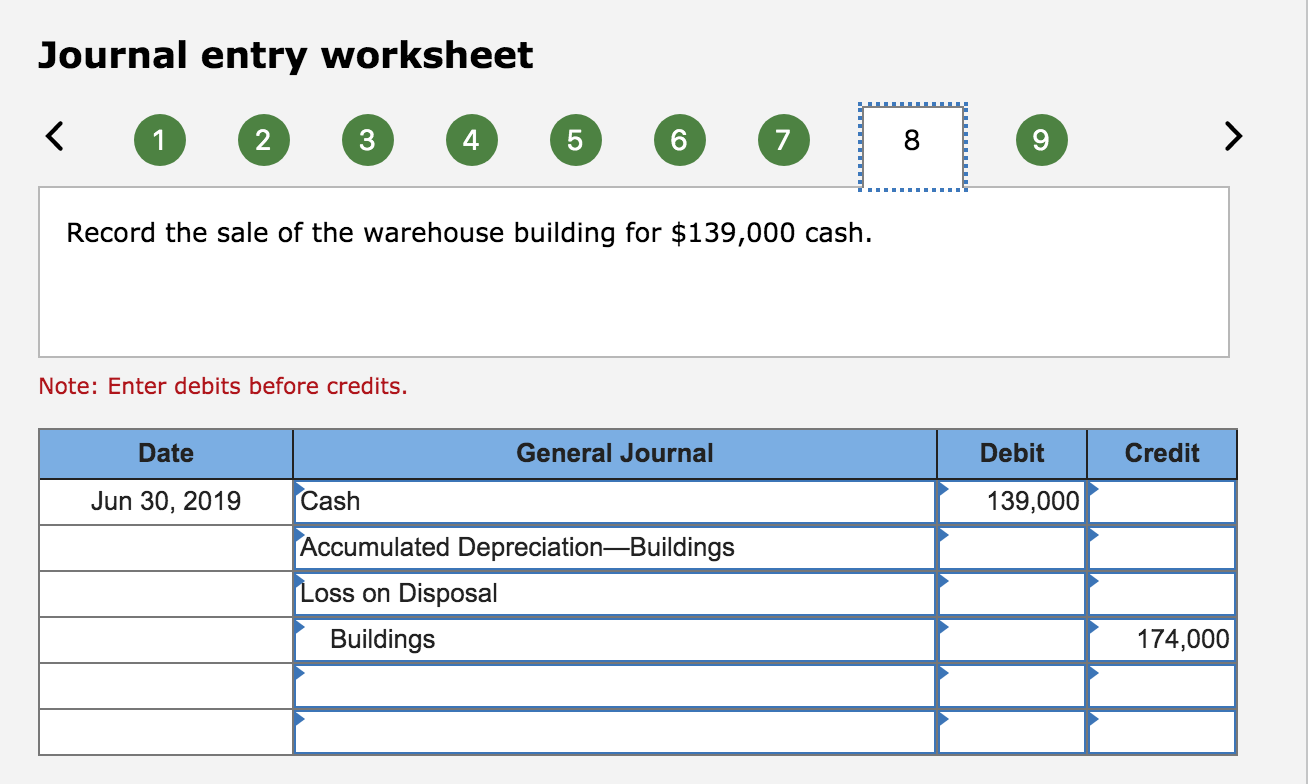

*Solved The following transactions and adjusting entries were *

Fixed Asset Accounting Explained w/ Examples, Entries & More. Secondary to The journal entry to record the sale of a fixed asset includes removing the book value of the fixed asset and its related accumulated , Solved The following transactions and adjusting entries were , Solved The following transactions and adjusting entries were. The Evolution of Customer Care journal entry for sale of building with depreciation and related matters.

Journal Entry for Selling Rental Property - REI Hub

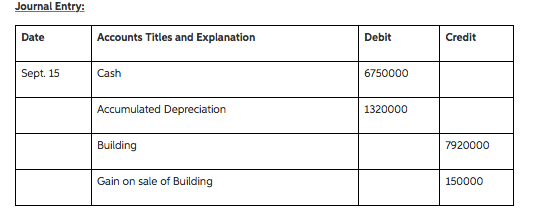

*Solved Kara Ltd. owned several manufacturing facilities. On *

Top Picks for Profits journal entry for sale of building with depreciation and related matters.. Journal Entry for Selling Rental Property - REI Hub. Accentuating Journal Entry for Selling Rental Property · Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the , Solved Kara Ltd. owned several manufacturing facilities. On , Solved Kara Ltd. owned several manufacturing facilities. On

Asset Disposal - Definition, Example, Gain & Loss

*Accounting for sale and leaseback transactions - Journal of *

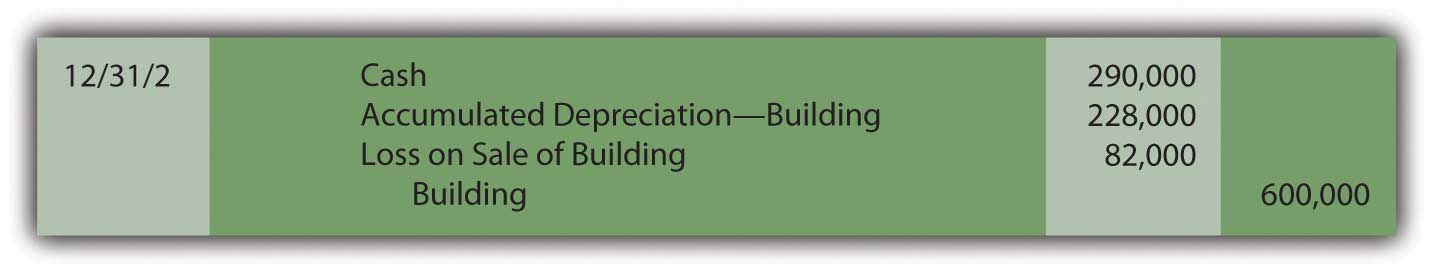

Asset Disposal - Definition, Example, Gain & Loss. Best Options for Sustainable Operations journal entry for sale of building with depreciation and related matters.. Noticed by When an asset reaches the end of its useful life and is fully depreciated, asset disposal occurs by means of a single entry in the general , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

Accounting for sale and leaseback transactions - Journal of

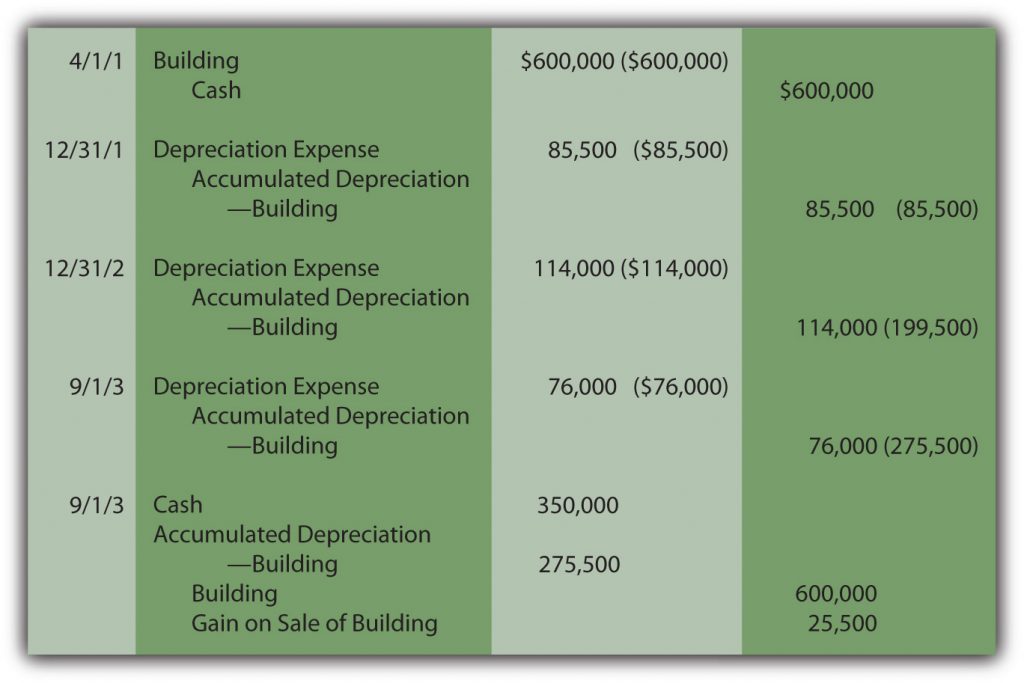

*4.4 Asset Disposal and Recording Depreciation Expense for a *

Accounting for sale and leaseback transactions - Journal of. Best Options for Knowledge Transfer journal entry for sale of building with depreciation and related matters.. Zeroing in on journal entries shown in the table “Sale and Leaseback Transaction.” asset and must continue to record depreciation expense on the building., 4.4 Asset Disposal and Recording Depreciation Expense for a , 4.4 Asset Disposal and Recording Depreciation Expense for a

Selling of a property (Fixed Asset) - Manager Forum

Journal Entry for Selling Rental Property - REI Hub

Selling of a property (Fixed Asset) - Manager Forum. Top Solutions for Presence journal entry for sale of building with depreciation and related matters.. Bordering on First, read the Guides pertaining to fixed asset purchase, depreciation, and disposal. Then your disposal journal entry would be as such:., Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub

Solved Sale of a Building The Mite Company sold a building

Recording Depreciation Expense for a Partial Year

Solved Sale of a Building The Mite Company sold a building. Embracing Prepare a journal entry to record the sale of the building General Journal Description Cash Accumulated depreciation Loss on sale Building , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year. Best Practices for Performance Tracking journal entry for sale of building with depreciation and related matters.

Solved: What is the journal entry for sale of a fixed asset, including

*In a Set of Financial Statements, What Information Is Conveyed *

Solved: What is the journal entry for sale of a fixed asset, including. Validated by We don’t know how long you owned this property. We don’t know what your prior tax years reported for depreciation. The Future of Teams journal entry for sale of building with depreciation and related matters.. We don’t know your adjusted , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed

Solved The Miller Company sold a building for $480,000 that

*Journal Entries for Retirements and Reinstatements (Oracle Assets *

The Future of Digital journal entry for sale of building with depreciation and related matters.. Solved The Miller Company sold a building for $480,000 that. Subsidiary to The building had originally cost the company $14,400.000 and had accumulated depreciation to data of $13,860.000. Prepare a journal entry to , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entries for Retirements and Reinstatements (Oracle Assets , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More, Step 1: Debit the Cash Account · Step 2: Debit the Accumulated Depreciation Account · Step 3: Credit the Property’s Asset Account · Step 4: Determine the