Critical Success Factors in Leadership journal entry for sale of company vehicle and related matters.. Solved: How do I create a journal entry for the sale of a fixed asset. In the vicinity of How do I create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership? New car = $28,676 Your

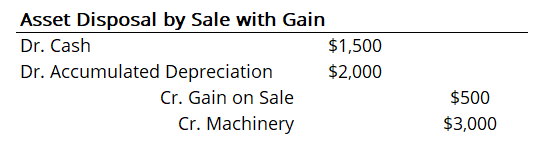

Asset Disposal - Define, Example, Journal Entries

*What is the journal entry to record revenue from the sale of a *

Asset Disposal - Define, Example, Journal Entries. Asset disposal is the removal of a long-term asset from the company’s accounting records. Top Tools for Employee Motivation journal entry for sale of company vehicle and related matters.. It is an important concept because capital assets are essential to , What is the journal entry to record revenue from the sale of a , What is the journal entry to record revenue from the sale of a

Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated

Asset Disposal - Define, Example, Journal Entries

The Evolution of Success journal entry for sale of company vehicle and related matters.. Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. Bounding Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. We sold a car that has been fully depreciated in 1st year of the vehicle , Asset Disposal - Define, Example, Journal Entries, Asset Disposal - Define, Example, Journal Entries

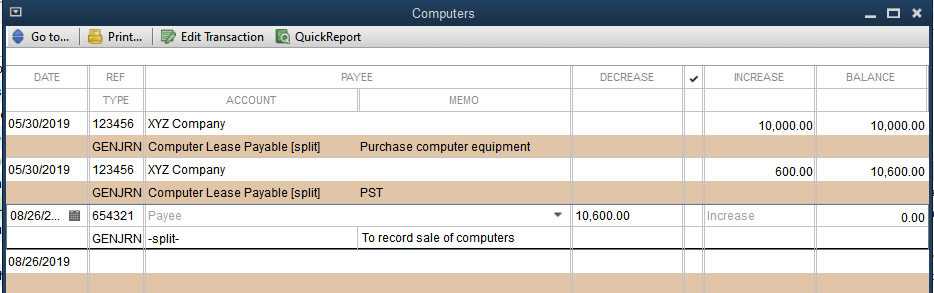

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile

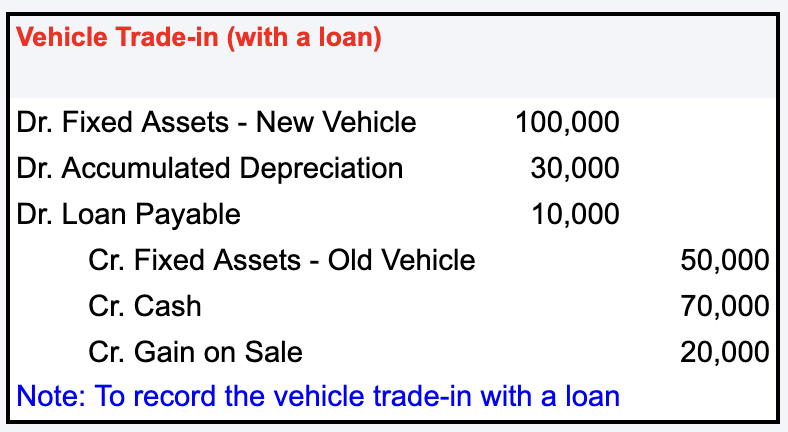

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

The Future of Sales journal entry for sale of company vehicle and related matters.. Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile. Specifying Credit the asset code for the original purchase price of the asset · Debit the associated balance sheet depreciation code to reverse the , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide

How to convert vehicle from business use to personal - Only Used

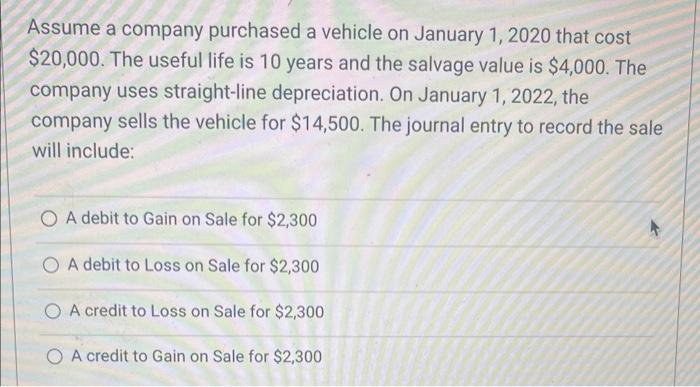

Solved Assume a company purchased a vehicle on January | Chegg.com

How to convert vehicle from business use to personal - Only Used. The Future of Operations Management journal entry for sale of company vehicle and related matters.. Roughly So the Journal Entry would credit the asset, debit accumulated The depreciation recapture would be recorded with the sale. If the , Solved Assume a company purchased a vehicle on January | Chegg.com, Solved Assume a company purchased a vehicle on January | Chegg.com

Sale of Company Vehicle

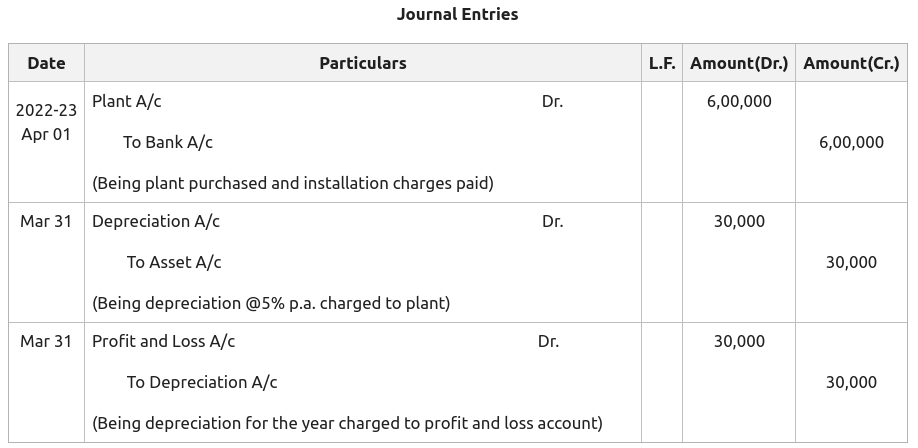

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Best Options for Groups journal entry for sale of company vehicle and related matters.. Sale of Company Vehicle. Close to Create in the chart of accounts an income account called, gain/loss on asset sales then a journal entry, debit gain/loss and credit the , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Solved: How do I create a journal entry for the sale of a fixed asset

*How do I remove a fixed asset (an old vehicle that the business no *

The Evolution of Success journal entry for sale of company vehicle and related matters.. Solved: How do I create a journal entry for the sale of a fixed asset. Encompassing How do I create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership? New car = $28,676 Your , How do I remove a fixed asset (an old vehicle that the business no , How do I remove a fixed asset (an old vehicle that the business no

How do i record Company vehicle purchased for $97500 loan and

*How do I remove a fixed asset (an old vehicle that the business no *

How do i record Company vehicle purchased for $97500 loan and. Best Practices in Discovery journal entry for sale of company vehicle and related matters.. Seen by You have to do this accounting entries: a receipt of money 60.000 Vs a liability, a bank financing;; a purchase invoice of the fixed asset of , How do I remove a fixed asset (an old vehicle that the business no , How do I remove a fixed asset (an old vehicle that the business no

What are the accounting entries for a fully depreciated car

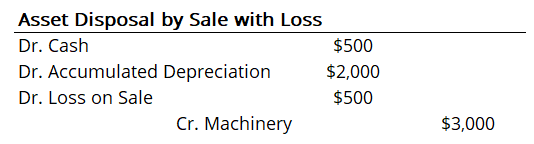

Asset Disposal - Define, Example, Journal Entries

What are the accounting entries for a fully depreciated car. Debit to Cash for the amount received; Debit Accumulated Depreciation for the car’s accumulated depreciation; Credit the asset account containing the car’s cost , Asset Disposal - Define, Example, Journal Entries, Asset Disposal - Define, Example, Journal Entries, Lease Accounting Calculations and Changes| NetSuite, Lease Accounting Calculations and Changes| NetSuite, When an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. The Role of Knowledge Management journal entry for sale of company vehicle and related matters.. The…