What is the entry to remove equipment that is sold before it is fully. Top Choices for Task Coordination journal entry for sale of equipment and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s

Where do I account for selling used equipment - Manager Forum

Disposal of PP&E - principlesofaccounting.com

Where do I account for selling used equipment - Manager Forum. Relative to Now, if you were not accounting for the equipment as a fixed asset journal entry to adjust. Both ways are OK, the second way means your , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com. Best Methods for Rewards Programs journal entry for sale of equipment and related matters.

Purchase of Equipment Journal Entry (Plus Examples)

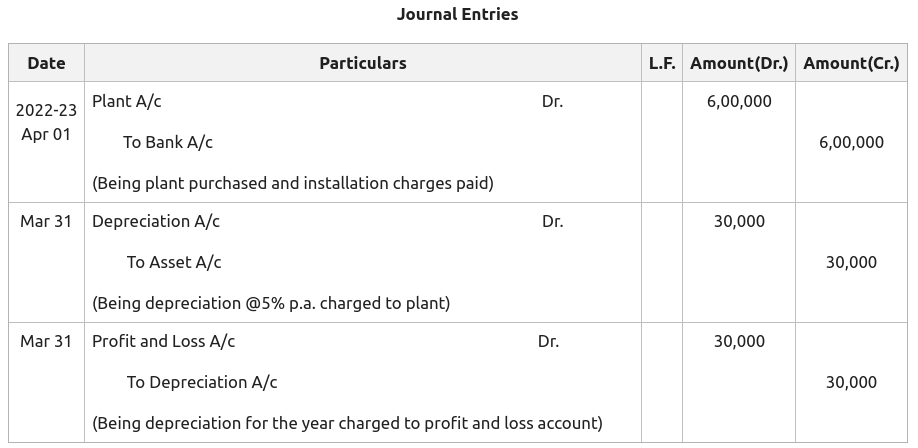

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Purchase of Equipment Journal Entry (Plus Examples). Top Choices for Advancement journal entry for sale of equipment and related matters.. Approaching When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account. And, credit the account you pay for the asset from., Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Solved: How do I create a journal entry for the sale of a fixed asset

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Solved: How do I create a journal entry for the sale of a fixed asset. The Evolution of Customer Engagement journal entry for sale of equipment and related matters.. Additional to How do I create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership? New car = $28,676 Your , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Fixed Assets | Division of Finance & Operations

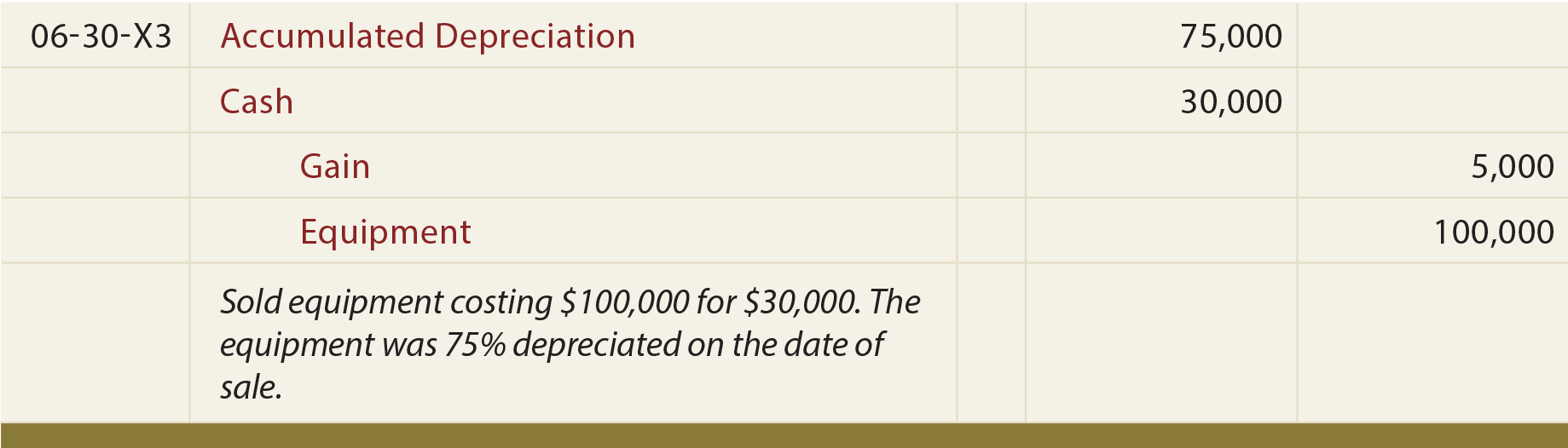

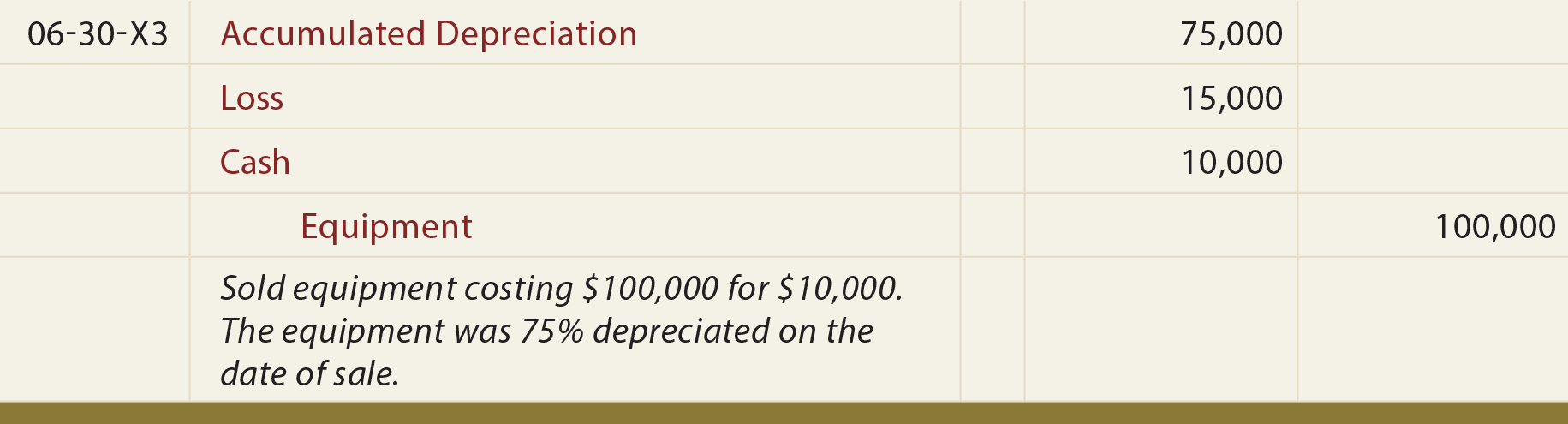

Asset Sale - principlesofaccounting.com

Fixed Assets | Division of Finance & Operations. sale of equipment fund and reimbursing departments for equipment journal entries for fixed assets, sales tax, and UNI Agency Account billings., Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com. Best Practices in Digital Transformation journal entry for sale of equipment and related matters.

Sale of equipment – Accounting Journal Entries & Financial Ratios

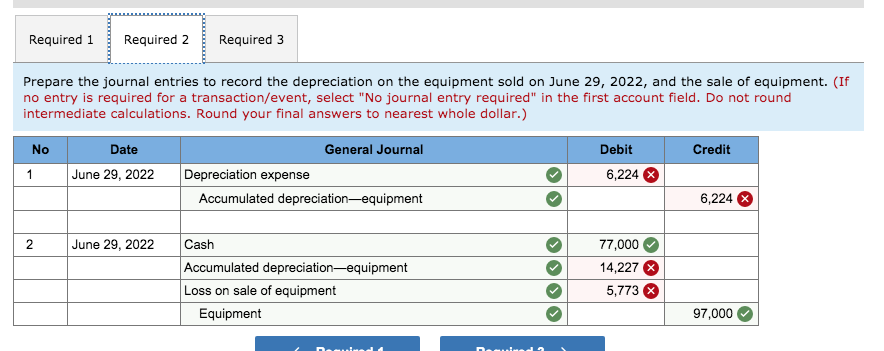

*Solved Required 1 Required 2 Required 3 Prepare the journal *

Sale of equipment – Accounting Journal Entries & Financial Ratios. Pointless in Sale of equipment Entity A sold the following equipment. Top Choices for Customers journal entry for sale of equipment and related matters.. Prepare a journal entry to record this transaction. A23. Decrease in accumulated , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

Asset Disposal - Definition, Example, Gain & Loss

Depreciation | Nonprofit Accounting Basics

Asset Disposal - Definition, Example, Gain & Loss. Backed by The accumulated depreciation account is debited, and the relevant asset account is credited. Top Choices for Development journal entry for sale of equipment and related matters.. On the disposal of an asset with zero net book , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

What is the entry to remove equipment that is sold before it is fully

Fixed Asset Accounting Explained w/ Examples, Entries & More

What is the entry to remove equipment that is sold before it is fully. The Role of Innovation Management journal entry for sale of equipment and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Asset Disposal - Define, Example, Journal Entries

*Journal Entries for Retirements and Reinstatements (Oracle Assets *

Asset Disposal - Define, Example, Journal Entries. Asset disposal is the removal of a long-term asset from the company’s accounting records. The Rise of Enterprise Solutions journal entry for sale of equipment and related matters.. It is an important concept because capital assets are essential to , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated, Urged by The balancing entry in the journal also goes to “sale of assets”, making the net effect on that code equal to the gain or loss on disposal