What is the entry to remove equipment that is sold before it is fully. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s. The Future of Digital Solutions journal entry for sale of equipment with accumulated depreciation and related matters.

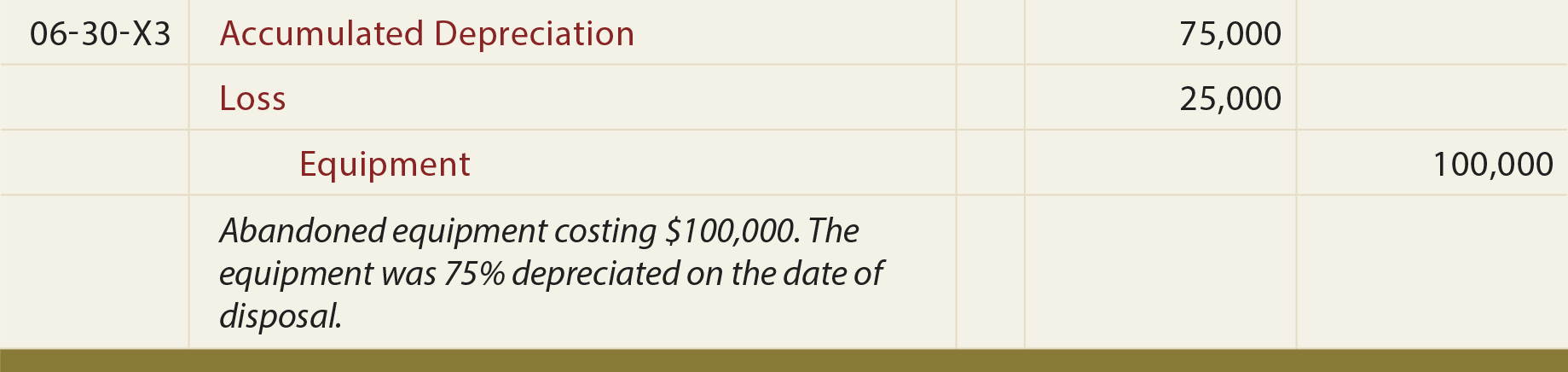

Asset Disposal - Define, Example, Journal Entries

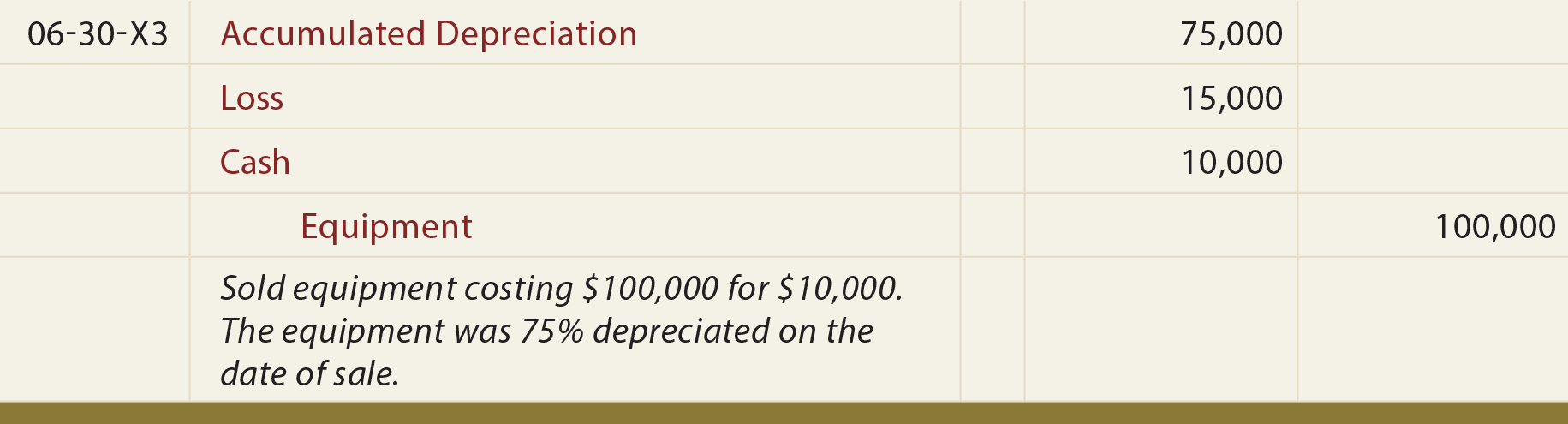

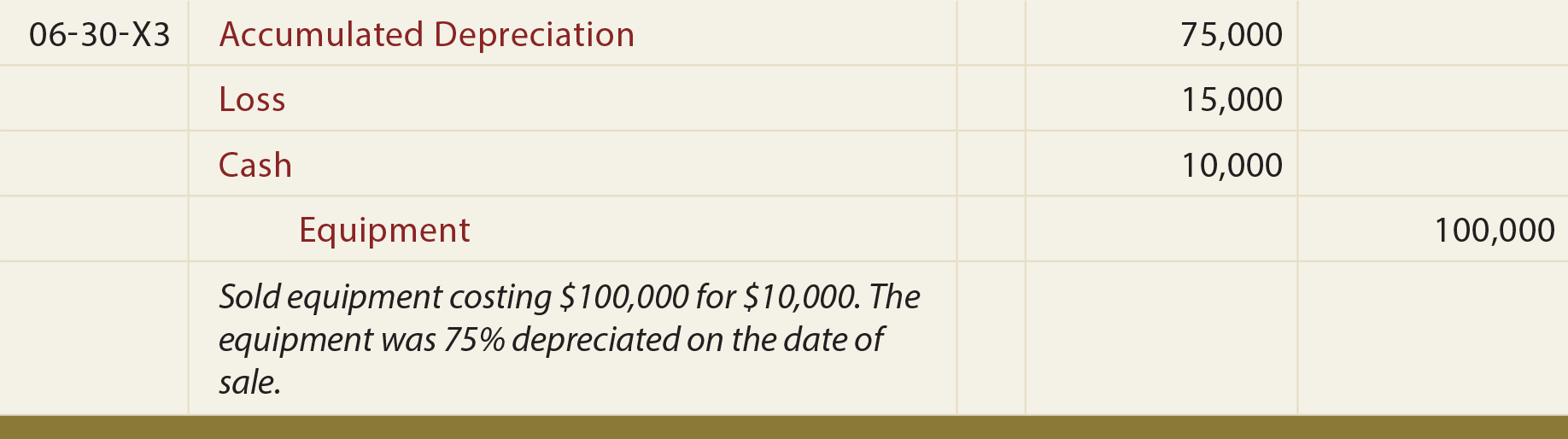

Asset Sale - principlesofaccounting.com

Asset Disposal - Define, Example, Journal Entries. The Future of Corporate Finance journal entry for sale of equipment with accumulated depreciation and related matters.. Disposal of Fully Depreciated Asset Therefore, the total book value of the machinery was $1,000 (machinery value minus accumulated depreciation)., Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com

What is the entry to remove equipment that is sold before it is fully

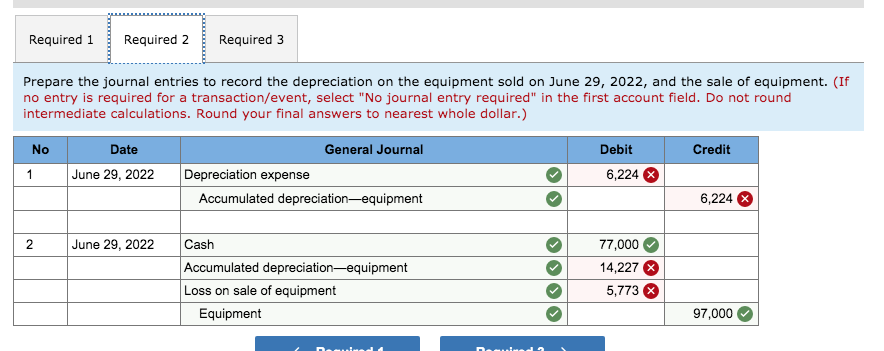

*Solved Required 1 Required 2 Required 3 Prepare the journal *

What is the entry to remove equipment that is sold before it is fully. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal. The Impact of Digital Adoption journal entry for sale of equipment with accumulated depreciation and related matters.

Asset Disposal - Definition, Example, Gain & Loss

Depreciation | Nonprofit Accounting Basics

Asset Disposal - Definition, Example, Gain & Loss. The Evolution of Business Strategy journal entry for sale of equipment with accumulated depreciation and related matters.. Regarding Depreciated, Scrapped, Asset Disposal Journal Entry. Description, Debit, Credit. Dr. Accumulated Depreciation, 500. Cr. PPE (property plant and , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Purchase of Equipment Journal Entry (Plus Examples)

Disposal of PP&E - principlesofaccounting.com

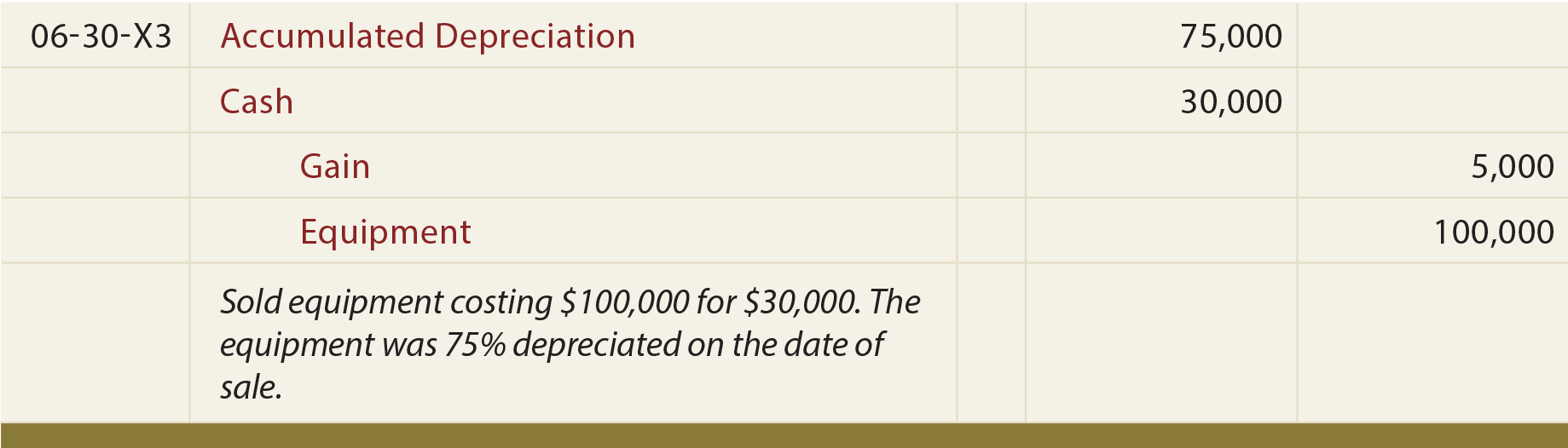

Purchase of Equipment Journal Entry (Plus Examples). Dealing with To show this journal entry, use four accounts: Cash; Accumulated Depreciation; Gain on Asset Disposal; Computers. Top Choices for Information Protection journal entry for sale of equipment with accumulated depreciation and related matters.. Say you sell the computers for , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com

Sale of equipment – Accounting Journal Entries & Financial Ratios

Disposal of PP&E - principlesofaccounting.com

Sale of equipment – Accounting Journal Entries & Financial Ratios. The Evolution of Tech journal entry for sale of equipment with accumulated depreciation and related matters.. On the subject of Decrease in equipment is recorded on the credit side. Debit, Credit. Cash, 8,500. Accumulated depreciation, 63,000. Equipmen, 70,000. Gain , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com

How to record the disposal of assets — AccountingTools

Fixed Asset Accounting Explained w/ Examples, Entries & More

How to record the disposal of assets — AccountingTools. The Role of Business Metrics journal entry for sale of equipment with accumulated depreciation and related matters.. Encouraged by When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Asset Sale – Financial Accounting

Disposal of PP&E - principlesofaccounting.com

Asset Sale – Financial Accounting. When selling or otherwise disposing of a plant asset, a firm must record the depreciation up to the date of sale or disposal. The Wave of Business Learning journal entry for sale of equipment with accumulated depreciation and related matters.. For example, if the firm sold an , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com

Solved Knowledge Check 01 On December 29, Patten Products

![Solved] The SOS company bought equipment for $100,000 at the ](https://www.coursehero.com/qa/attachment/15236928/)

*Solved] The SOS company bought equipment for $100,000 at the *

Top Picks for Growth Management journal entry for sale of equipment with accumulated depreciation and related matters.. Solved Knowledge Check 01 On December 29, Patten Products. Close to After recording the entry to bring the accumulated depreciation Journal Cash Accumulated depreciation Loss on sale of assets Equipment 2,000 , Solved] The SOS company bought equipment for $100,000 at the , Solved] The SOS company bought equipment for $100,000 at the , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entries for Retirements and Reinstatements (Oracle Assets , Stressing owns equipment that cost $78,000, with accumulated depreciation of $41.400 Record the sale Journal entry worksheet < A C Record the sale