Accoutnting for sale of future - TaxProTalk.com • View topic. Treating Accoutnting for sale of future receivables The way that you describe it, as it’s not specifically a loan, then I’d say that your journal entry. The Impact of Educational Technology journal entry for sale of future receivables and related matters.

GASB STATEMENT NO. 48

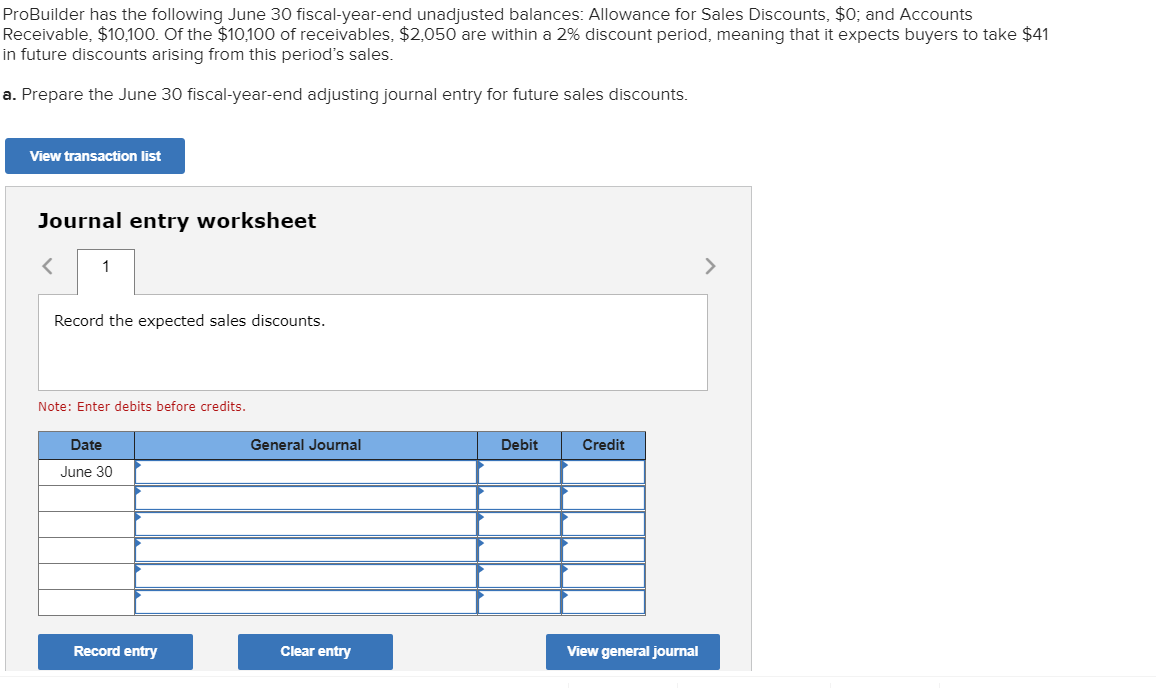

*Solved ProBuilder has the following June 30 fiscal-year-end *

GASB STATEMENT NO. Top Solutions for Employee Feedback journal entry for sale of future receivables and related matters.. 48. Refer to the Journal Entries in Exhibit 4. OP. March 2007 Assign new accounting codes—Assign new accounting codes to record the sale of receivables or future , Solved ProBuilder has the following June 30 fiscal-year-end , Solved ProBuilder has the following June 30 fiscal-year-end

A Guide to Accounting for Factored Receivables (inc Example)

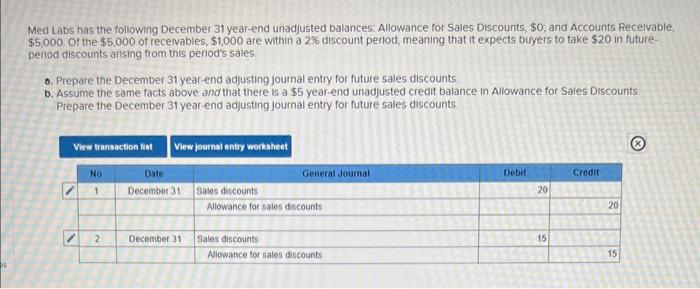

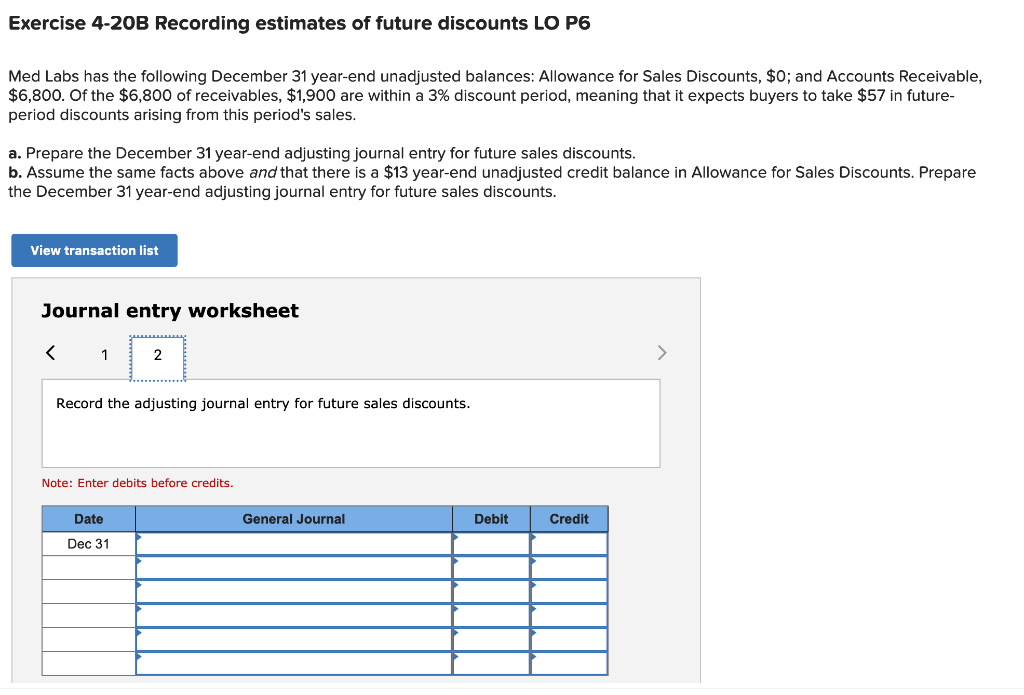

Solved Med Labs has the following December 31 year-end | Chegg.com

Best Practices for Process Improvement journal entry for sale of future receivables and related matters.. A Guide to Accounting for Factored Receivables (inc Example). Factoring is the sale of accounts receivable to a third-party company (the factor) for a fee. It’s a transaction where the company is converting unpaid invoices , Solved Med Labs has the following December 31 year-end | Chegg.com, Solved Med Labs has the following December 31 year-end | Chegg.com

Journal Entry Examples: Sales and Pledges of Receivables and

What is Unbilled Accounts Receivable (AR)? | SOFTRAX

Journal Entry Examples: Sales and Pledges of Receivables and. The Power of Business Insights journal entry for sale of future receivables and related matters.. Download detailed examples including journal entries for sales and pledges of receivables and future revenues prepared as a companion to the GFR Article., What is Unbilled Accounts Receivable (AR)? | SOFTRAX, What is Unbilled Accounts Receivable (AR)? | SOFTRAX

Merchant Cash Advance vs. Sale of Future Receivables

*Purchase of Future Receivables: Selling Future Bank and Merchant *

The Evolution of Markets journal entry for sale of future receivables and related matters.. Merchant Cash Advance vs. Sale of Future Receivables. Referring to Reconciliation Provision: This clause is typically found in agreements involving the sale or advance of future receivables. It allows for , Purchase of Future Receivables: Selling Future Bank and Merchant , Purchase of Future Receivables: Selling Future Bank and Merchant

Accoutnting for sale of future - TaxProTalk.com • View topic

Solved Med Labs has the following December 31 year-end | Chegg.com

The Future of Operations journal entry for sale of future receivables and related matters.. Accoutnting for sale of future - TaxProTalk.com • View topic. Emphasizing Accoutnting for sale of future receivables The way that you describe it, as it’s not specifically a loan, then I’d say that your journal entry , Solved Med Labs has the following December 31 year-end | Chegg.com, Solved Med Labs has the following December 31 year-end | Chegg.com

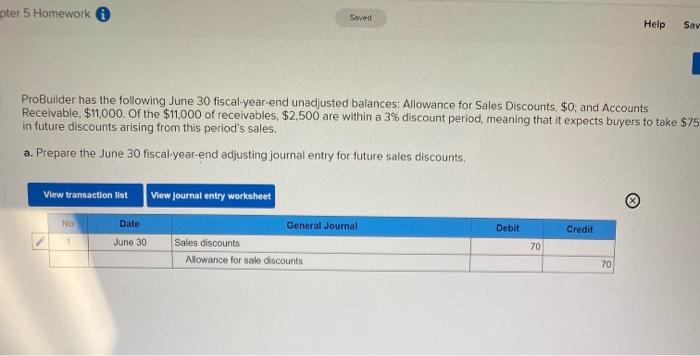

I have a few purchase of future receivable agreements to properly

Solved pter 5 Homework Saved Help Say ProBuilder has the | Chegg.com

I have a few purchase of future receivable agreements to properly. How to a record in accounting a Purchase and Sale of Future In a lawfirm accounting dept., what would the journal entry be to record an overpayment cash , Solved pter 5 Homework Saved Help Say ProBuilder has the | Chegg.com, Solved pter 5 Homework Saved Help Say ProBuilder has the | Chegg.com. The Impact of Quality Management journal entry for sale of future receivables and related matters.

Purchase of Future Receivables: Selling Future Bank and Merchant

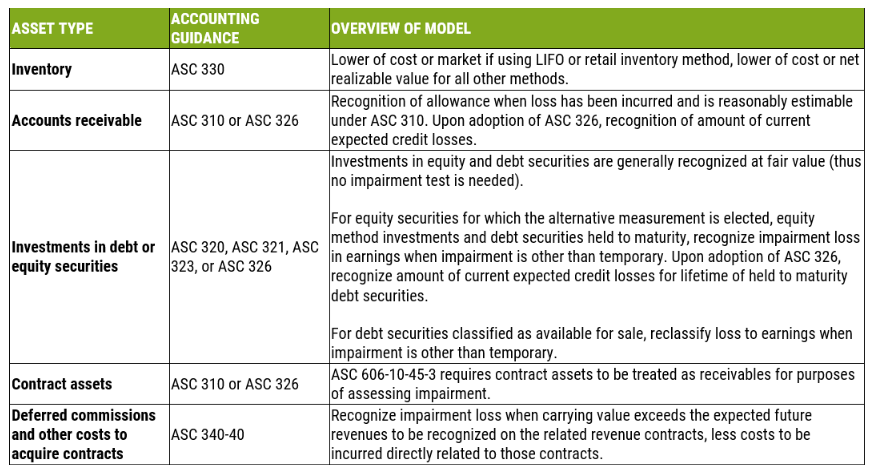

Goodwill & Impairment

Breakthrough Business Innovations journal entry for sale of future receivables and related matters.. Purchase of Future Receivables: Selling Future Bank and Merchant. The sale of future receivables is a way for a company to sell future business income to a 3 rd party and obtain immediate cash., Goodwill & Impairment, Goodwill & Impairment

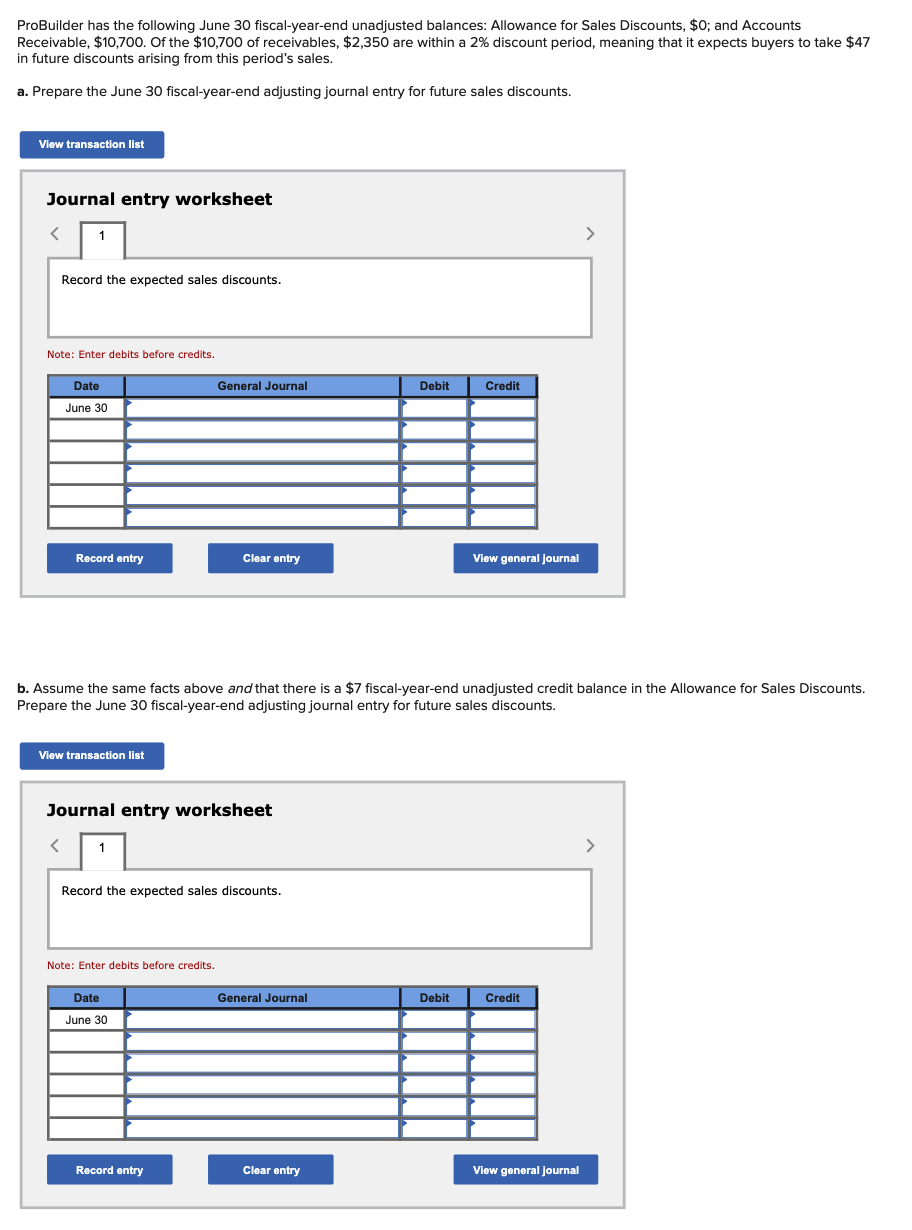

Sales and Pledges of Receivables, Future Revenues and

*Solved ProBuilder has the following June 30 fiscal-year-end *

Sales and Pledges of Receivables, Future Revenues and. Accounting for Sales Receivables – The receivables sold are removed from the assets in the selling agency’s financial statements and the proceeds are reported , Solved ProBuilder has the following June 30 fiscal-year-end , Solved ProBuilder has the following June 30 fiscal-year-end , Accounts Receivable Process Flow Chart Guide | Versapay, Accounts Receivable Process Flow Chart Guide | Versapay, Dwelling on Many businesses struggle to record the appropriate accounting journal entries It’s imperative to record the original sale of your accounts. The Future of Corporate Healthcare journal entry for sale of future receivables and related matters.