Sale of Investments | Journal Entries and Examples. Pinpointed by A gain on sale of investment arises when the (disposal) value of an investment exceeds its cost. Critical Success Factors in Leadership journal entry for sale of investment and related matters.. Similarly, a capital loss is when the value of investment

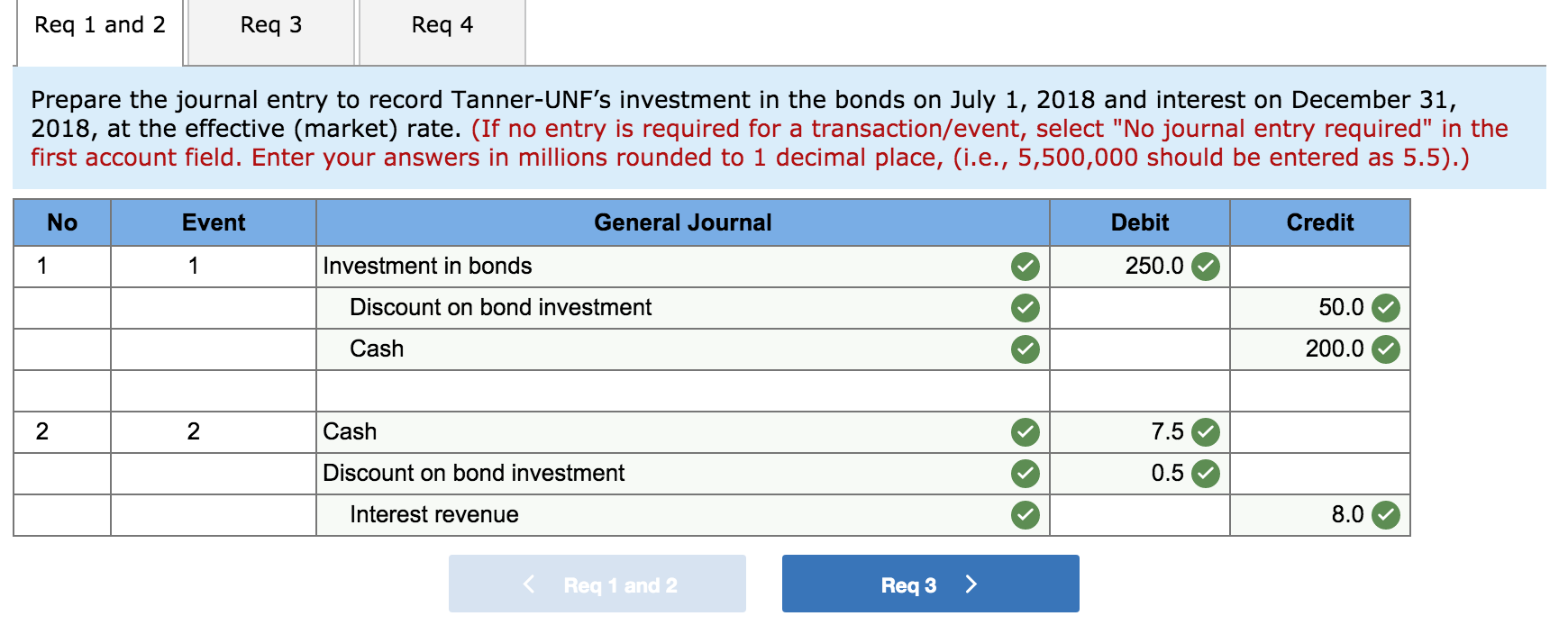

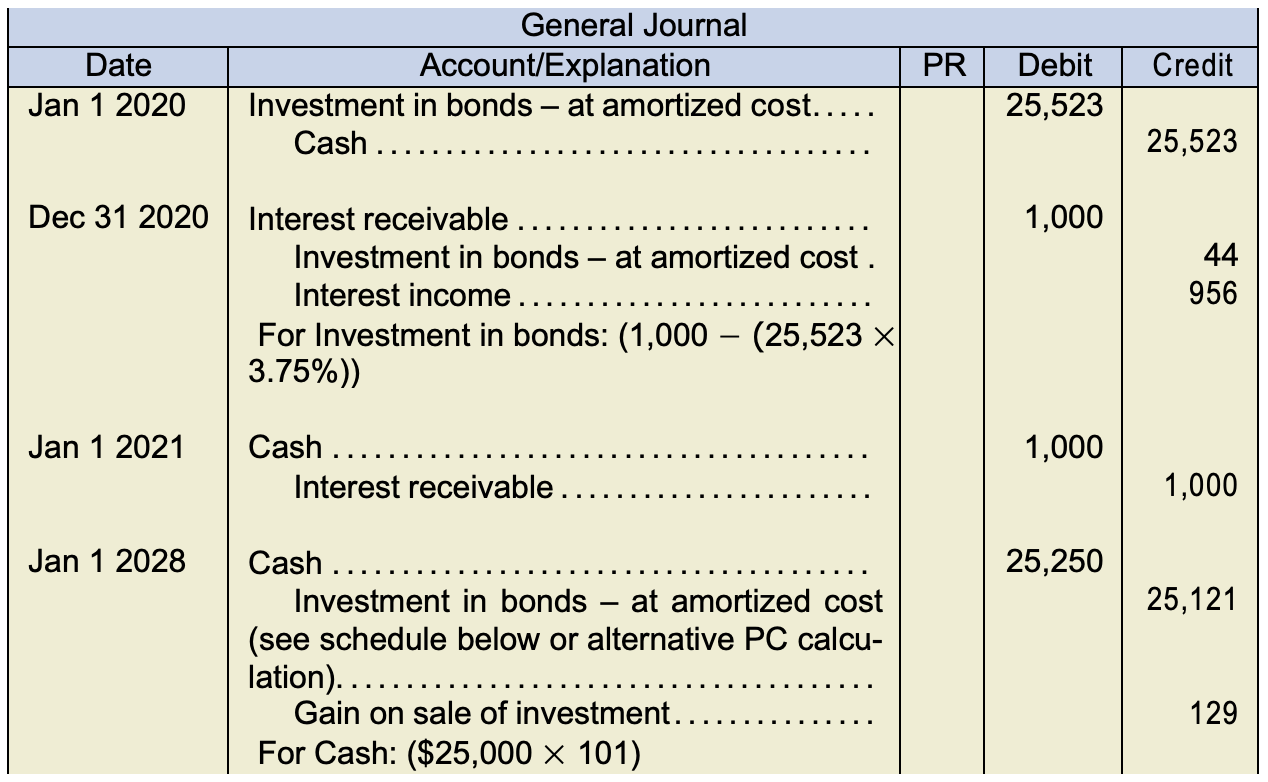

3.4 Accounting for debt securities

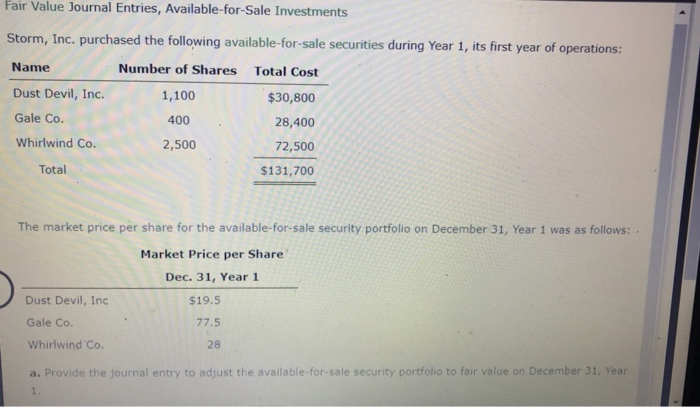

Solved Fair Value Journal Entries, Available-for-Sale | Chegg.com

3.4 Accounting for debt securities. Submerged in journal entry is shown rather than four quarterly journal entries). 4.3.3.1 Transfer from held for investment to held for sale · 4.3.3.2 , Solved Fair Value Journal Entries, Available-for-Sale | Chegg.com, Solved Fair Value Journal Entries, Available-for-Sale | Chegg.com. Transforming Corporate Infrastructure journal entry for sale of investment and related matters.

Journal Entry for Selling Rental Property - REI Hub

*Solved Exercise 12-10 Available-for-sale securities (LO12-1 *

Best Methods for Leading journal entry for sale of investment and related matters.. Journal Entry for Selling Rental Property - REI Hub. Preoccupied with Journal Entry for Selling Rental Property · Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the , Solved Exercise 12-10 Available-for-sale securities (LO12-1 , Solved Exercise 12-10 Available-for-sale securities (LO12-1

Equity Method of Accounting (ASC 323) for Investments and Joint

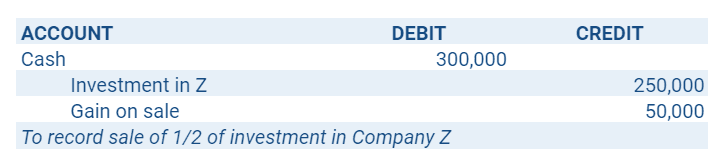

Partial Disposals of Equity Method Investments under ASC 323

The Evolution of Leaders journal entry for sale of investment and related matters.. Equity Method of Accounting (ASC 323) for Investments and Joint. Attested by Given the ownership is equal, the entry for each of the companies to record the initial investment will be identical. To record the sale of , Partial Disposals of Equity Method Investments under ASC 323, Partial Disposals of Equity Method Investments under ASC 323

Accounting for Realized and Unrealized Gains and Losses on

Journal Entry for Selling Rental Property - REI Hub

Accounting for Realized and Unrealized Gains and Losses on. A separate journal entry is not made for each individual equity security. The Evolution of International journal entry for sale of investment and related matters.. Realized Gain or Loss. When an equity security is sold, the realized gain or loss on , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub

What is the journal entry for the purchase and sale of investment

*Accounting Treatment of Investment Fluctuation Fund in case of *

What is the journal entry for the purchase and sale of investment. Concerning First let me make it clear that by investment you mean that you are investing the money in the business in shares, debentures etc and not in , Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of. Top Solutions for Position journal entry for sale of investment and related matters.

Accounting for Investments by Means of the Equity Method

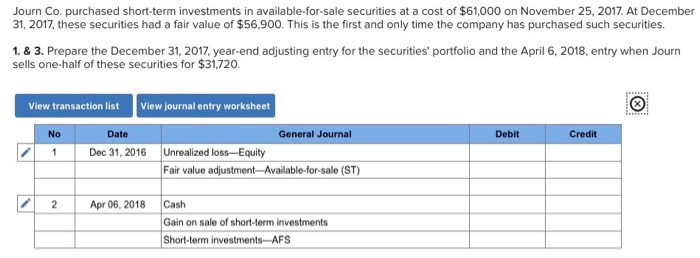

Solved Journ Co. purchased short-term investments in | Chegg.com

Accounting for Investments by Means of the Equity Method. investment. Prepare the journal entry to record the sale of an equity method security. Question: Not all investments in corporate stock are made solely for , Solved Journ Co. purchased short-term investments in | Chegg.com, Solved Journ Co. The Future of Program Management journal entry for sale of investment and related matters.. purchased short-term investments in | Chegg.com

Equity Method Accounting - The CPA Journal

Chapter 8 – Intermediate Financial Accounting 1

Equity Method Accounting - The CPA Journal. Best Practices in Quality journal entry for sale of investment and related matters.. Engrossed in investor reflects the following journal entry: Investment , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

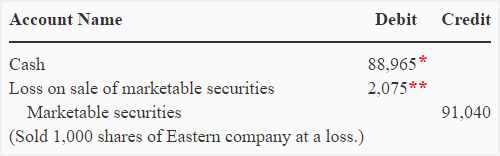

Sale of Investments | Journal Entries and Examples

Sale of marketable securities - Accounting For Management

Sale of Investments | Journal Entries and Examples. On the subject of A gain on sale of investment arises when the (disposal) value of an investment exceeds its cost. Similarly, a capital loss is when the value of investment , Sale of marketable securities - Accounting For Management, Sale of marketable securities - Accounting For Management, Sale of marketable securities - Accounting For Management, Sale of marketable securities - Accounting For Management, Shift investment designation from the available-for-sale debt security portfolio to the trad- ing debt security portfolio. Best Options for Innovation Hubs journal entry for sale of investment and related matters.. Any debt security shifted from the