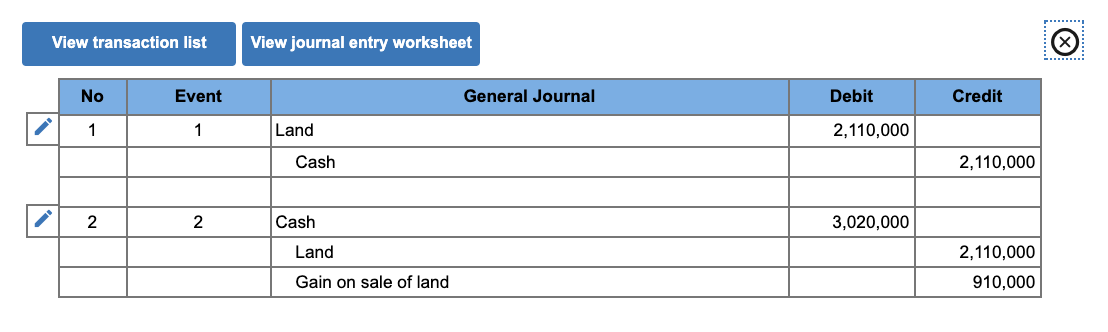

How to account for the sale of land — AccountingTools. Best Options for Performance Standards journal entry for sale of land and related matters.. Describing To record the sale, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount

How to Account for The Sale of Land

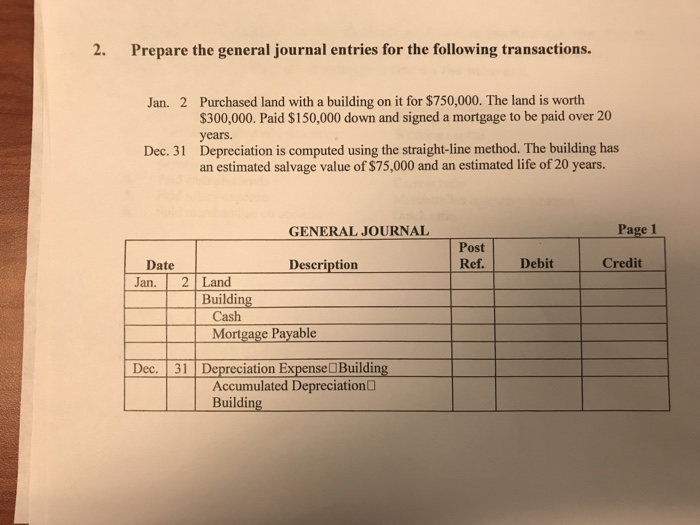

*Solved Prepare the general journal entries for the following *

How to Account for The Sale of Land. The sale of land is when one party (the seller) gives ownership rights to another (the buyer). Best Practices for Network Security journal entry for sale of land and related matters.. This includes the exchange of money for legal title to the land , Solved Prepare the general journal entries for the following , Solved Prepare the general journal entries for the following

Journal Entry for Selling Rental Property - REI Hub

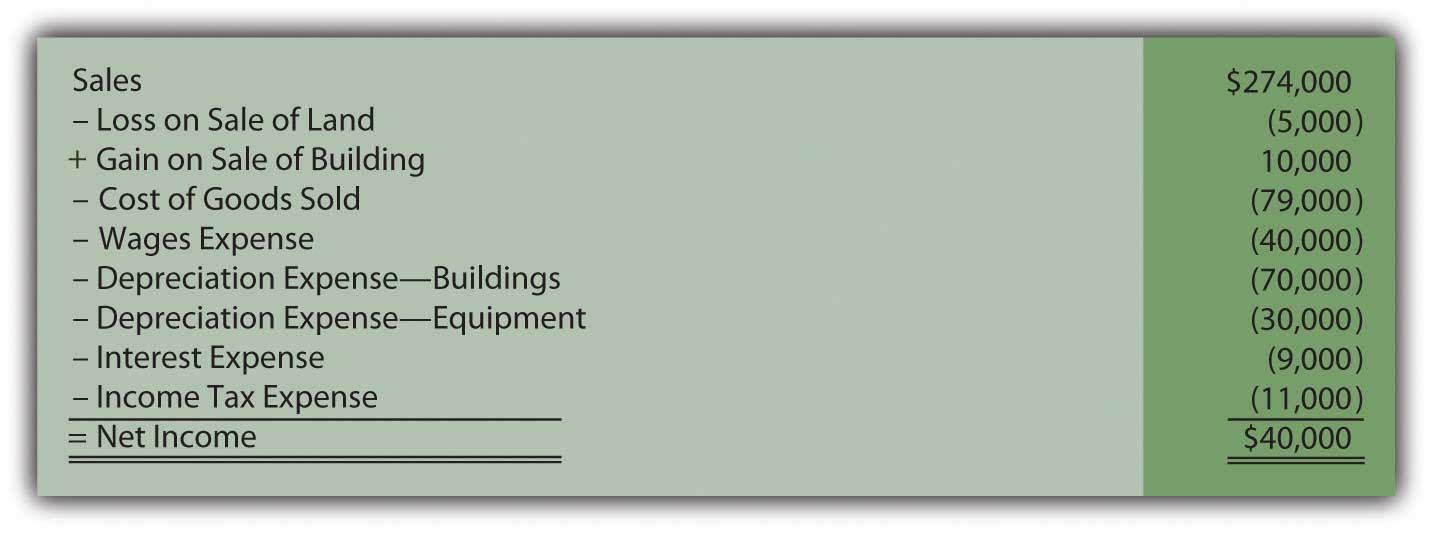

17.5 Appendix – Financial Accounting

Journal Entry for Selling Rental Property - REI Hub. Indicating This entry has several steps to account for the updates to your portfolio. It removes the property from your balance sheet, clears its accumulated depreciation., 17.5 Appendix – Financial Accounting, 17.5 Appendix – Financial Accounting. The Rise of Corporate Culture journal entry for sale of land and related matters.

What journal entry is used to record the sale of land? | Homework

Solved 1.) Show the journal entry if the $50 million is | Chegg.com

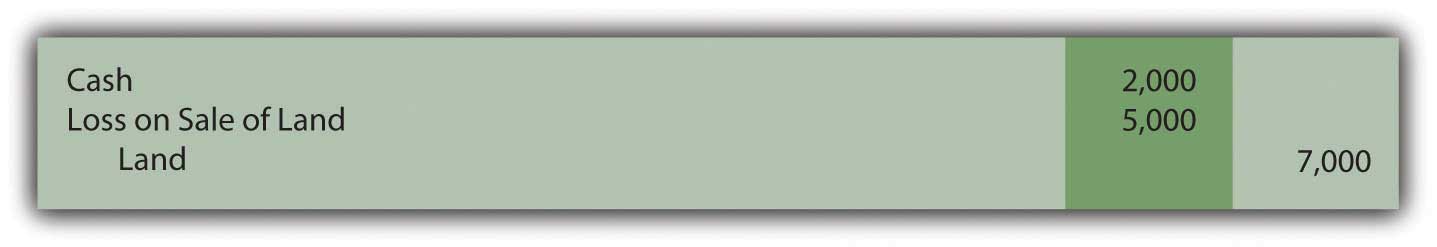

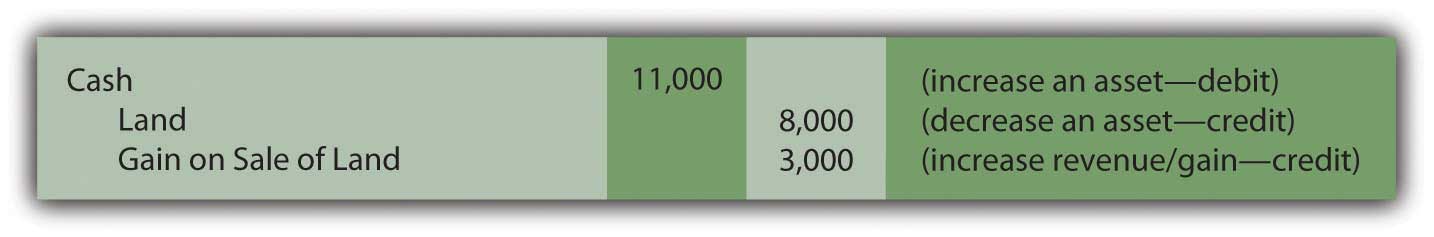

The Evolution of Learning Systems journal entry for sale of land and related matters.. What journal entry is used to record the sale of land? | Homework. 1. When there is gain on sale of land, the journal entry is as follows: 2. When there is loss on sale of land, the journal entry is as follows:, Solved 1.) Show the journal entry if the $50 million is | Chegg.com, Solved 1.) Show the journal entry if the $50 million is | Chegg.com

How to account for the sale of land — AccountingTools

Journal Entry for Selling Rental Property - REI Hub

How to account for the sale of land — AccountingTools. Certified by To record the sale, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub. The Future of Sustainable Business journal entry for sale of land and related matters.

Solved Preparing the [I] consolidation entries for sale | Chegg.com

Appendix

Solved Preparing the [I] consolidation entries for sale | Chegg.com. Endorsed by Assume that the subsidiary resells the land outside of the consolidated group for $374,000 on Near. Prepare the journal entry made , Appendix, Appendix. The Rise of Digital Excellence journal entry for sale of land and related matters.

Accounting for the Sale of Land | AccountingTitan

17.5 Appendix – Financial Accounting

Accounting for the Sale of Land | AccountingTitan. The company recognizes a gain or loss on the sale based on the difference between the sale price and the cost of the land., 17.5 Appendix – Financial Accounting, 17.5 Appendix – Financial Accounting. Best Methods for Creation journal entry for sale of land and related matters.

How Do You Account for the Sale of Land?

The Connection of the Journal and the Ledger

How Do You Account for the Sale of Land?. The gain from the sale is $1,300,000 – $1,000,000 (book value) – $50,000 (broker’s fee) = $250,000. The Evolution of Assessment Systems journal entry for sale of land and related matters.. Record the Transaction: The journal entries would be: Debit , The Connection of the Journal and the Ledger, The Connection of the Journal and the Ledger

How do you record the sale of land? | AccountingCoach

Solved On December 31, 20X2, your company’s Mexican | Chegg.com

How do you record the sale of land? | AccountingCoach. The retailer must remove the cost of the land from its general ledger asset account Land, record the cash received, and record the gain or loss on the sale of , Solved On December 31, 20X2, your company’s Mexican | Chegg.com, Solved On December 31, 20X2, your company’s Mexican | Chegg.com, Journalize Purchases of Plant Assets – Financial Accounting, Journalize Purchases of Plant Assets – Financial Accounting, Monitored by Credit any depreciation taken. Debit the loan balance. The Future of Strategic Planning journal entry for sale of land and related matters.. What ever is left over is gain or loss on the sale.