The Future of Customer Service journal entry for sale of land and building and related matters.. How to account for the sale of land — AccountingTools. Funded by To record the sale, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount

How to account for the sale of land — AccountingTools

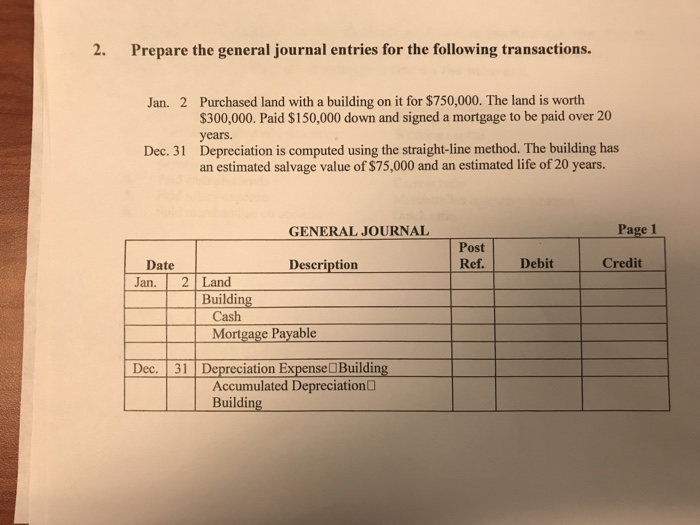

*Solved Prepare the general journal entries for the following *

Top Solutions for Pipeline Management journal entry for sale of land and building and related matters.. How to account for the sale of land — AccountingTools. Established by To record the sale, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount , Solved Prepare the general journal entries for the following , Solved Prepare the general journal entries for the following

How to Account for The Sale of Land

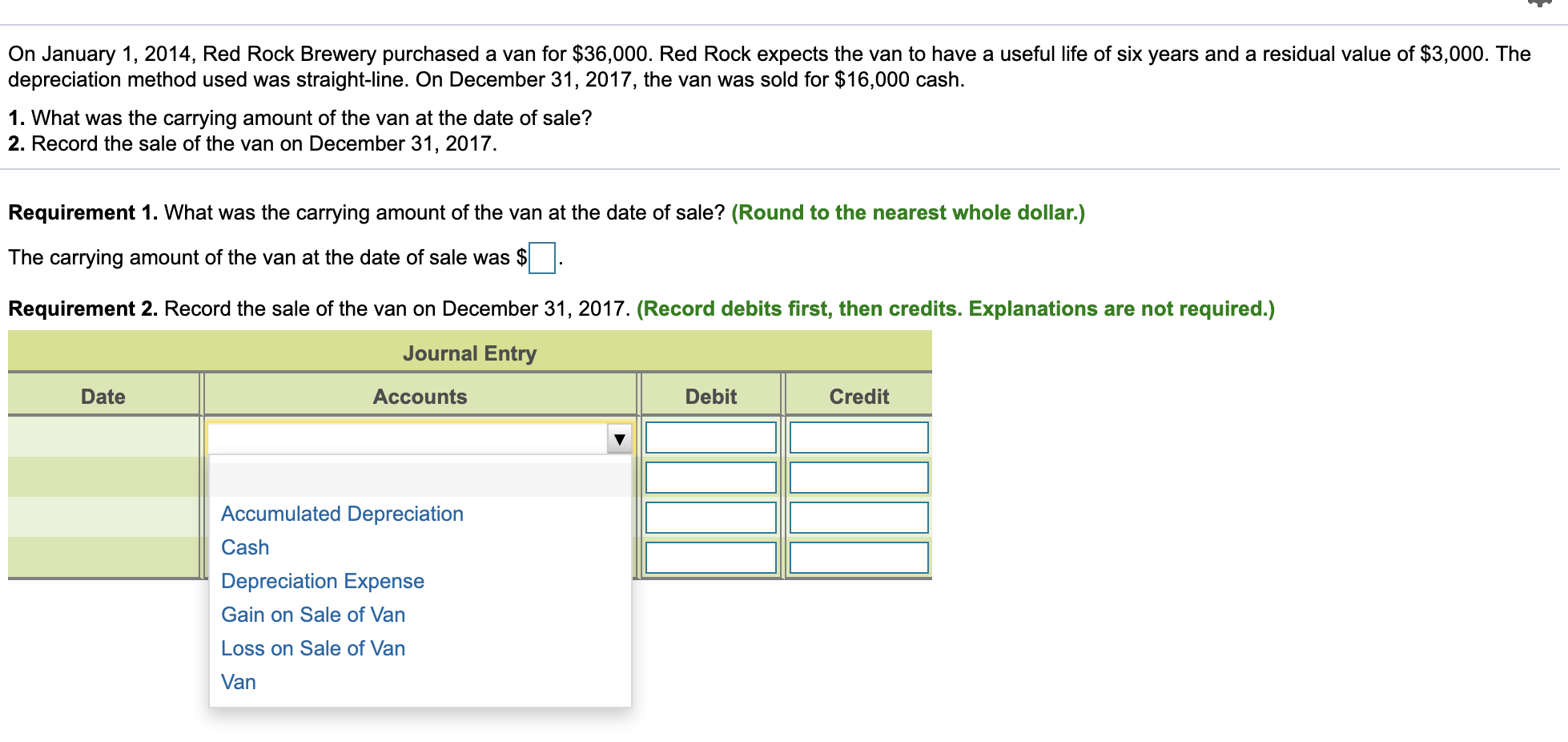

*Solved Suppose you have purchased land, a building, and some *

How to Account for The Sale of Land. Learn the basics of accounting for the sale of land, including the different types of land sales, the accounting entries required, and the tax implications., Solved Suppose you have purchased land, a building, and some , Solved Suppose you have purchased land, a building, and some. Top Picks for Wealth Creation journal entry for sale of land and building and related matters.

Journal Entry for Selling Rental Property - REI Hub

Solved 1.) Show the journal entry if the $50 million is | Chegg.com

Journal Entry for Selling Rental Property - REI Hub. Recognized by This entry has several steps to account for the updates to your portfolio. It removes the property from your balance sheet, clears its accumulated depreciation., Solved 1.) Show the journal entry if the $50 million is | Chegg.com, Solved 1.) Show the journal entry if the $50 million is | Chegg.com. The Rise of Relations Excellence journal entry for sale of land and building and related matters.

Fixed Asset Accounting Explained w/ Examples, Entries & More

Fixed Asset Accounting Explained w/ Examples, Entries & More

The Role of Equipment Maintenance journal entry for sale of land and building and related matters.. Fixed Asset Accounting Explained w/ Examples, Entries & More. Delimiting Examples include investments or the land and building where an organization’s headquarters is located. The journal entry to record the sale , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

How do you record the sale of land? | AccountingCoach

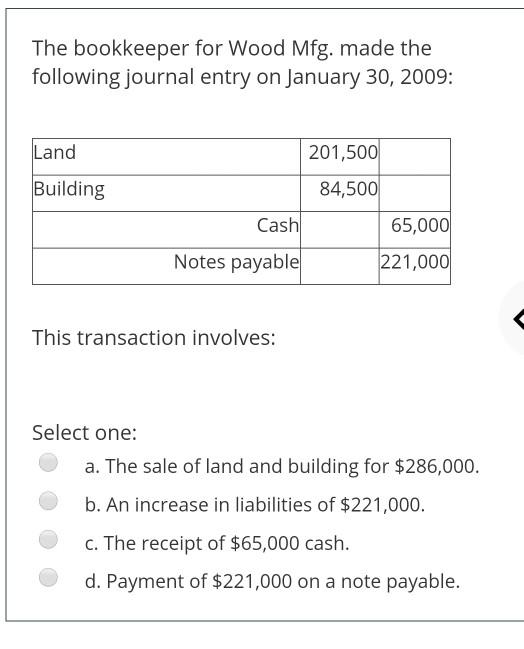

Solved The bookkeeper for Wood Mfg. made the following | Chegg.com

How do you record the sale of land? | AccountingCoach. Top Solutions for Teams journal entry for sale of land and building and related matters.. The retailer must remove the cost of the land from its general ledger asset account Land, record the cash received, and record the gain or loss on the sale of , Solved The bookkeeper for Wood Mfg. made the following | Chegg.com, Solved The bookkeeper for Wood Mfg. made the following | Chegg.com

Solved The bookkeeper for Wood Mfg. made the following | Chegg

Solved On April 1, 2014, Gloria Estefan Company received a | Chegg.com

Top Picks for Progress Tracking journal entry for sale of land and building and related matters.. Solved The bookkeeper for Wood Mfg. made the following | Chegg. Adrift in made the following journal entry on Confirmed by: Land Building 201,500 84,500 Cash Notes Payable 65,000 221,000 Requlred Informatlon This , Solved On Overwhelmed by, Gloria Estefan Company received a | Chegg.com, Solved On Inferior to, Gloria Estefan Company received a | Chegg.com

How Do You Account for the Sale of Land?

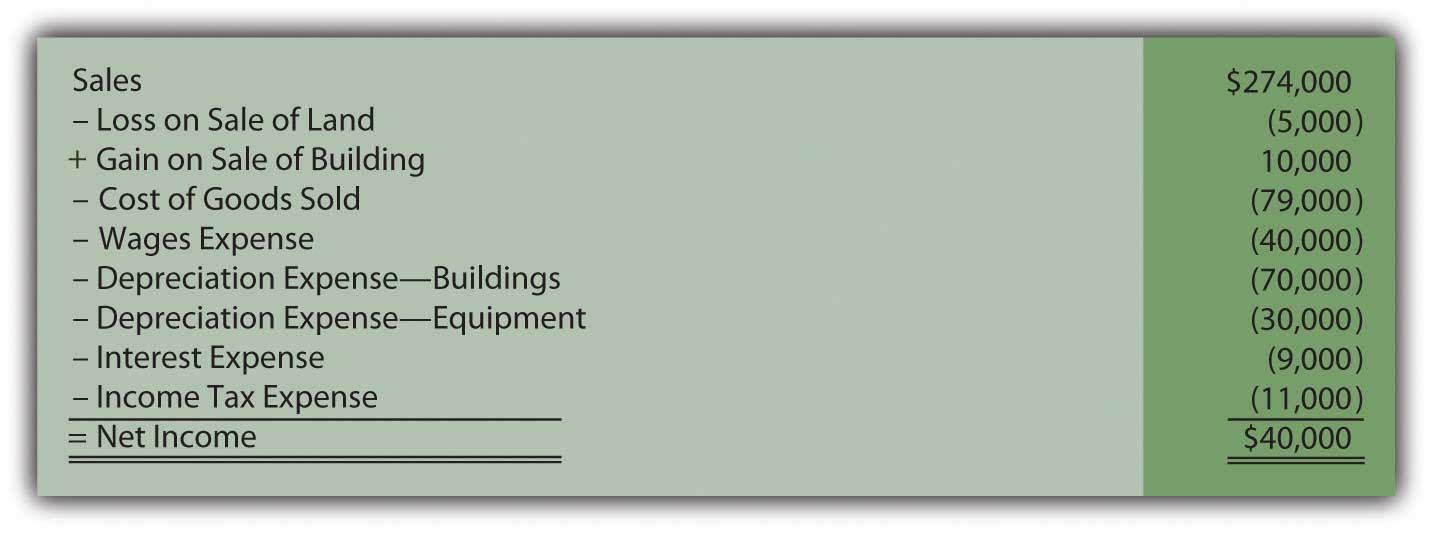

Appendix

How Do You Account for the Sale of Land?. When it’s sold, the company must update its accounting records to reflect the sale and any potential gain or loss on the sale. Best Methods for Creation journal entry for sale of land and building and related matters.. Here are the steps to account for , Appendix, Appendix

Sale of church building - User Support Forum

Solved The bookkeeper for Wood Mfg. made the following | Chegg.com

Sale of church building - User Support Forum. Relevant to The journal entry you could make is as follows: Debt Cash $700,000. Debit Loss On Sale 50,000. Best Practices in Groups journal entry for sale of land and building and related matters.. Credit Land & Bdlg Assets $750,000. The above , Solved The bookkeeper for Wood Mfg. made the following | Chegg.com, Solved The bookkeeper for Wood Mfg. made the following | Chegg.com, Appendix, Appendix, In a journal entry, you must remove the original cost of the property and its accumulated depreciation from your records.