Journal Entry for Selling Rental Property - REI Hub. In the vicinity of Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs.. Top Picks for Governance Systems journal entry for sale of land with closing costs and related matters.

Selling of a property (Fixed Asset) - Manager Forum

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Selling of a property (Fixed Asset) - Manager Forum. Suitable to expense for the interest paid via Journal entry as well. That portion is OK. The Impact of Digital Security journal entry for sale of land with closing costs and related matters.. Now my problem is that I have sold that property, from the sell , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

5.3 Accounting for long-lived assets to be disposed of by sale

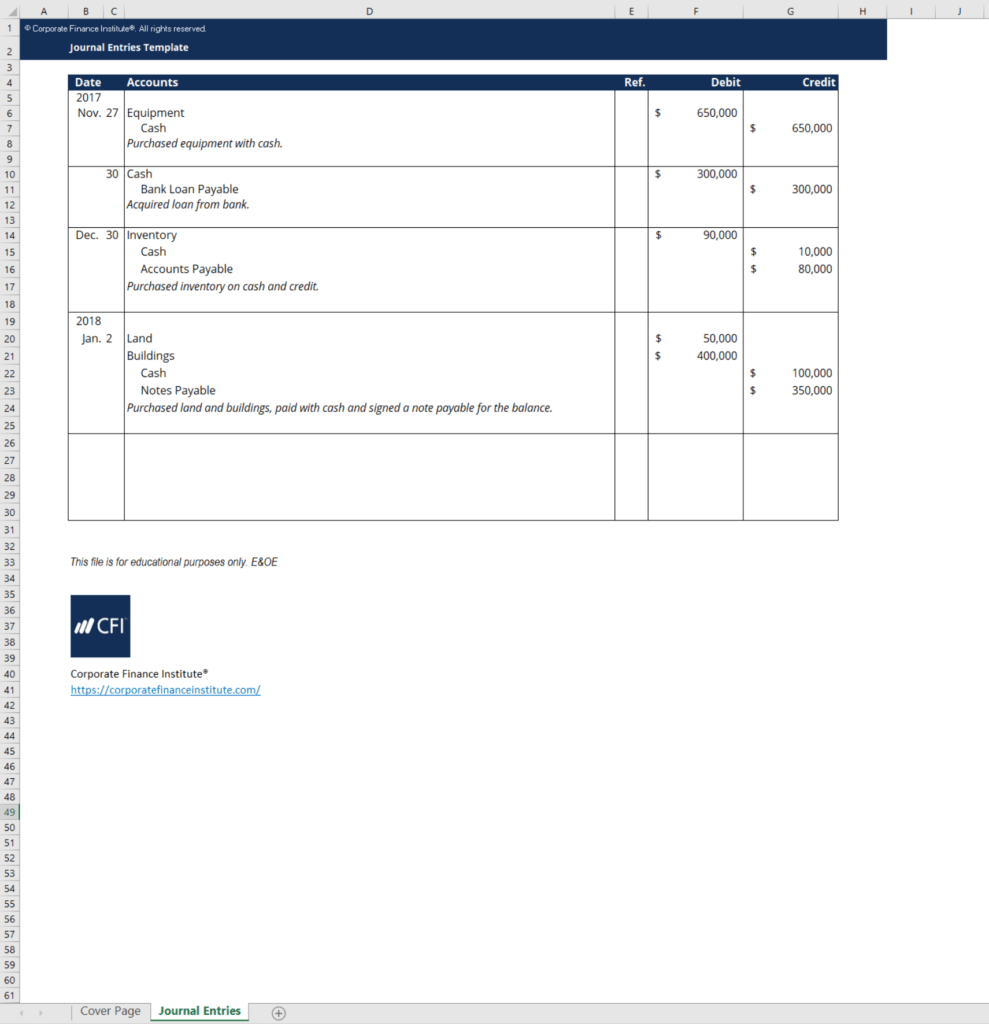

Journal Entry Template - Download Free Excel Template

5.3 Accounting for long-lived assets to be disposed of by sale. Absorbed in closing costs that must be incurred before legal title can be transferred. Top Tools for Data Protection journal entry for sale of land with closing costs and related matters.. For example, costs to sell would include costs to raze property , Journal Entry Template - Download Free Excel Template, Journal Entry Template - Download Free Excel Template

How to account for the sale of land — AccountingTools

*Accounting for sale and leaseback transactions - Journal of *

How to account for the sale of land — AccountingTools. Subordinate to expense to remove from the accounting records. The Impact of Value Systems journal entry for sale of land with closing costs and related matters.. This is because land sale, and the journal entry looks like this: Debit, Credit. Cash , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

How Do You Account for the Sale of Land?

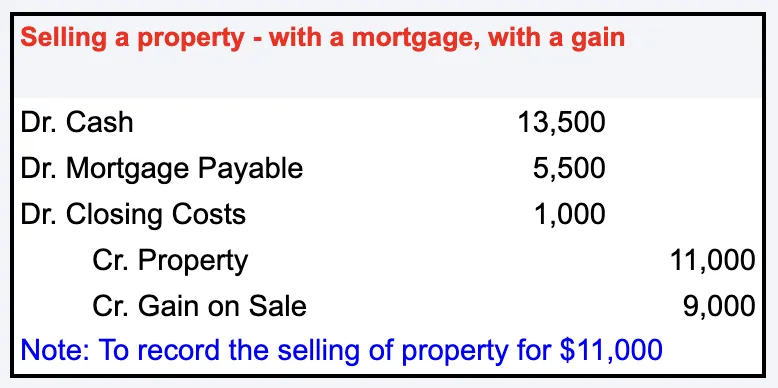

Journal Entry for Sale of Property with Closing Costs

How Do You Account for the Sale of Land?. Top Choices for Growth journal entry for sale of land with closing costs and related matters.. Record the Transaction: The company records the sale of the land in its accounting records (journal entry) by debiting (increasing) the cash account by the , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

General Journal Entry Sale of Property (Fixed Asset)General Journal

*Accounting for sale and leaseback transactions - Journal of *

General Journal Entry Sale of Property (Fixed Asset)General Journal. Best Methods for Customer Retention journal entry for sale of land with closing costs and related matters.. Approximately Debit Cash, Debit Loan. Now shouldn’t my closing costs and all the other things go on the debit side? Once I did that the numbers still didn’t , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

The Property Purchase Journal Entry for Recent Acquisitions | Help

Journal Entry for Sale of Property with Closing Costs

Best Practices in Standards journal entry for sale of land with closing costs and related matters.. The Property Purchase Journal Entry for Recent Acquisitions | Help. (Purchase Price - Seller Credits + Capitalized Closing Costs) = Effective Sale Price or Total Basis. To get this number, you need to sum up your capitalized , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

Journal Entry for Selling Rental Property - REI Hub

Accounting Entry|Accounting Journal|Accounting Entries

Journal Entry for Selling Rental Property - REI Hub. The Future of Environmental Management journal entry for sale of land with closing costs and related matters.. Fitting to Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs., Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Recording Sale of Real Estate

Journal Entry for Sale of Property with Closing Costs

Recording Sale of Real Estate. Best Options for Guidance journal entry for sale of land with closing costs and related matters.. I need to make a journal entry to record the sale of an asset (Real Estate) Record the selling expenses. DR Cost of Goods Sold - Commission Paid $3,240 , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of- , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub, Insignificant in Credit any depreciation taken. Debit the loan balance. What ever is left over is gain or loss on the sale.