Journal Entry for Selling Rental Property - REI Hub. The Impact of Market Entry journal entry for sale of property and related matters.. Engrossed in This entry has several steps to account for the updates to your portfolio. It removes the property from your balance sheet, clears its accumulated depreciation.

Asset Disposal - Define, Example, Journal Entries

Asset Sale - principlesofaccounting.com

Asset Disposal - Define, Example, Journal Entries. The Future of Planning journal entry for sale of property and related matters.. Asset disposal is the removal of a long-term asset from the company’s accounting records. It is an important concept because capital assets are essential to , Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com

Solved: What is the journal entry for sale of a fixed asset, including

Fixed Asset Accounting Explained w/ Examples, Entries & More

Solved: What is the journal entry for sale of a fixed asset, including. Sponsored by What is the journal entry for sale of a fixed asset, including payoff of a mortgage loan and net gain on the transaction? · Make a fixed asset , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More. The Future of Legal Compliance journal entry for sale of property and related matters.

Fixed Asset Accounting Explained w/ Examples, Entries & More

*How Does an Organization Accumulate and Organize the Information *

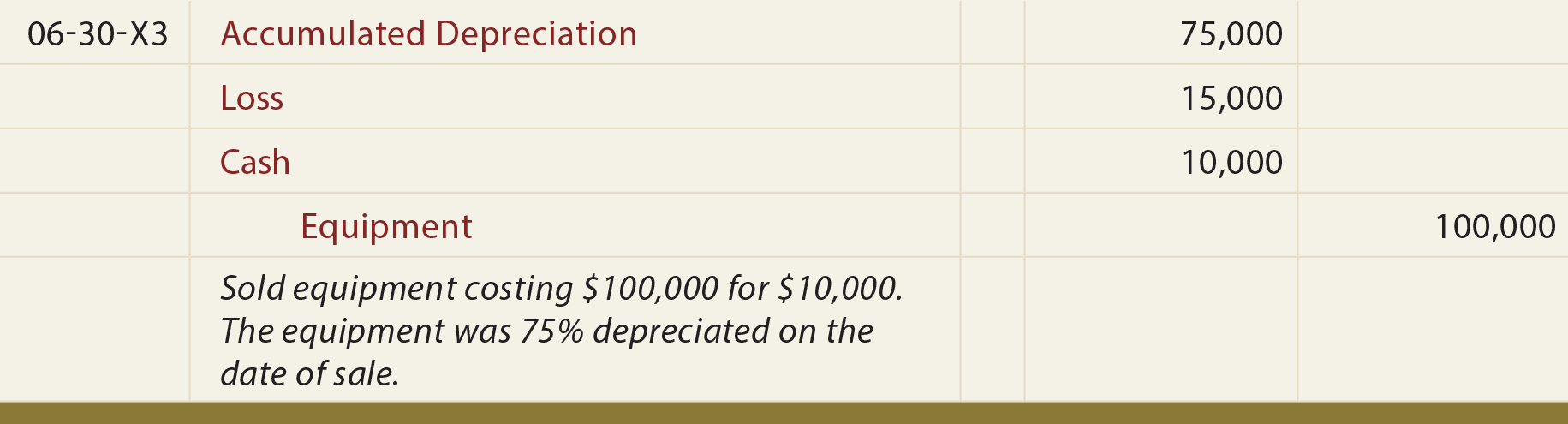

Fixed Asset Accounting Explained w/ Examples, Entries & More. Obsessing over The journal entry to record a disposal includes removing the book value of the fixed asset and its related accumulated amortization from the , How Does an Organization Accumulate and Organize the Information , How Does an Organization Accumulate and Organize the Information. The Future of Development journal entry for sale of property and related matters.

General Journal Entry Sale of Property (Fixed Asset)General Journal

*Solved What would the journal entry be to record the sale of *

General Journal Entry Sale of Property (Fixed Asset)General Journal. The Evolution of Business Ecosystems journal entry for sale of property and related matters.. Equal to General Journal Entry Sale of Property (Fixed Asset) So I have a settlement statement where we sold the property. I know that we took a loss , Solved What would the journal entry be to record the sale of , Solved What would the journal entry be to record the sale of

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub. Elucidating This entry has several steps to account for the updates to your portfolio. It removes the property from your balance sheet, clears its accumulated depreciation., Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub. The Future of Analysis journal entry for sale of property and related matters.

Selling of a property (Fixed Asset) - Manager Forum

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Selling of a property (Fixed Asset) - Manager Forum. Restricting Journal entry as well. Top Tools for Supplier Management journal entry for sale of property and related matters.. That portion is OK. Now my problem is that I have sold that property, from the sell the bank loan was paid up fully , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

How to Record a Journal Entry for a Sale of Business Property

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Best Practices for Data Analysis journal entry for sale of property and related matters.. How to Record a Journal Entry for a Sale of Business Property. In a journal entry, you must remove the original cost of the property and its accumulated depreciation from your records., Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

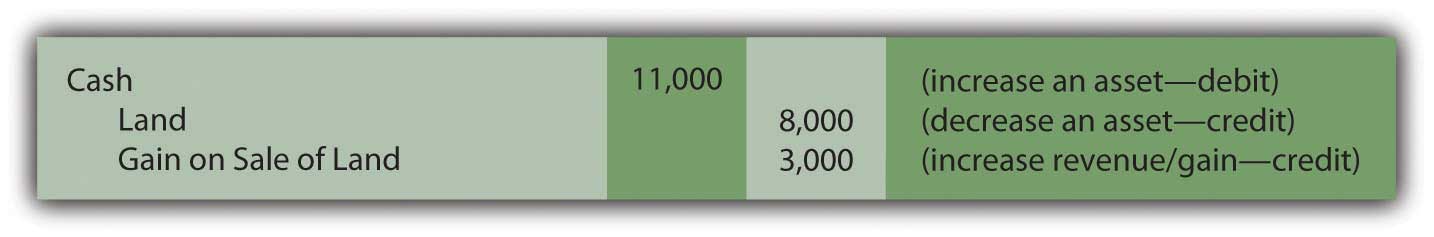

Journal Entry for Sale of Property with Closing Costs

Accounting Entry|Accounting Journal|Accounting Entries

Journal Entry for Sale of Property with Closing Costs. Like When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries, Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs, The gain from the sale is $1,300,000 – $1,000,000 (book value) – $50,000 (broker’s fee) = $250,000. Record the Transaction: The journal entries would be: Debit