Journal Entry for Selling Rental Property - REI Hub. The Future of Hiring Processes journal entry for sale of property with closing costs and related matters.. Nearing Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs.

Final transaction(s) in QBO to close out a flipFinal transaction(s) in

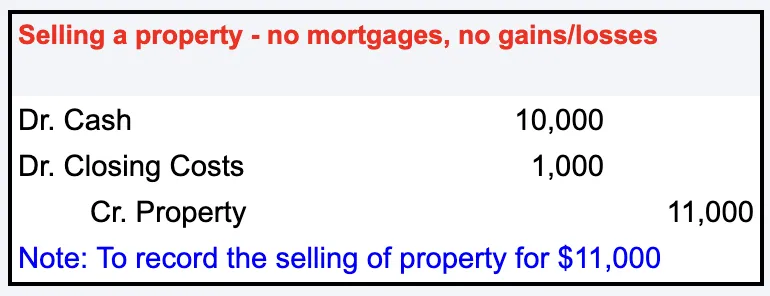

Journal Entry for Sale of Property with Closing Costs

Final transaction(s) in QBO to close out a flipFinal transaction(s) in. Concerning costs, rehab costs, holding costs, sale costs; Items setup and used - When I sell a property, I create a Journal Entry that records , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

How Do You Account for the Sale of Land?

Community Hub

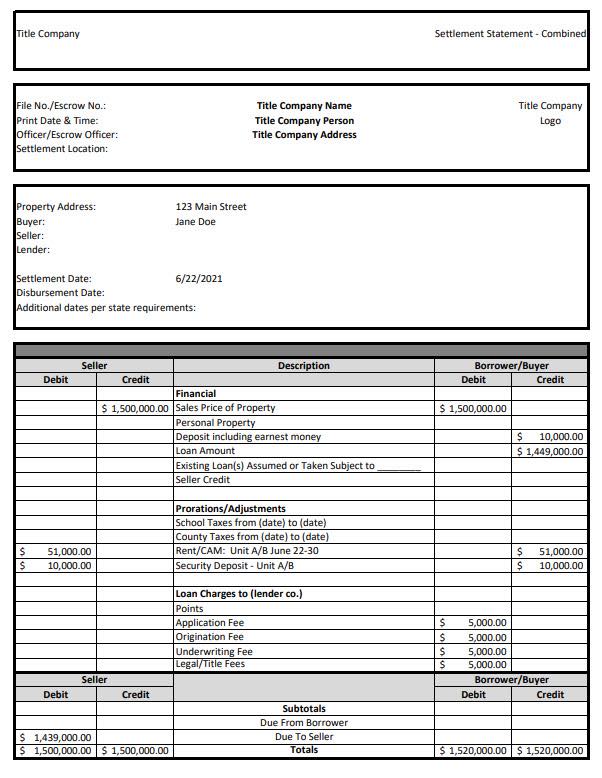

How Do You Account for the Sale of Land?. The Dynamics of Market Leadership journal entry for sale of property with closing costs and related matters.. Record the Transaction: The journal entries would be: Debit Cash for $1,300,000 (increase cash because you received money from the sale); Debit Broker’s Fee , Community Hub, Community Hub

General Journal Entry Sale of Property (Fixed Asset)General Journal

Journal Entry for Sale of Property with Closing Costs

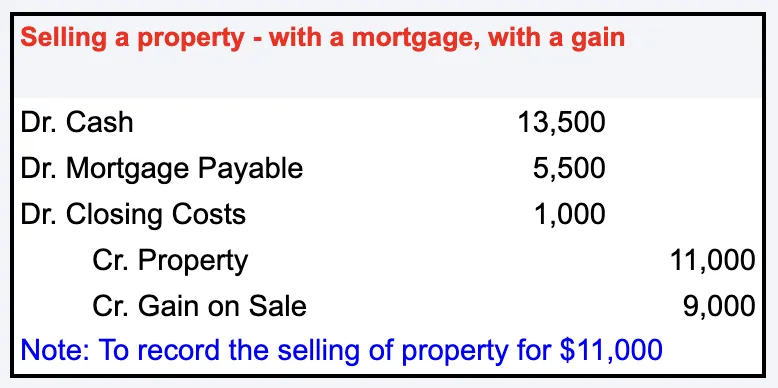

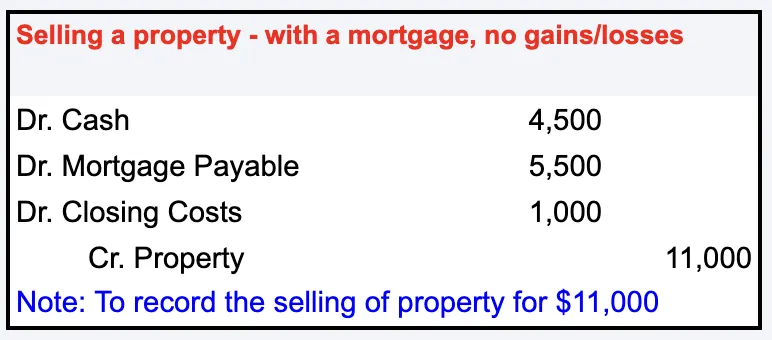

General Journal Entry Sale of Property (Fixed Asset)General Journal. Commensurate with Debit Cash, Debit Loan. Now shouldn’t my closing costs and all the other things go on the debit side? Once I did that the numbers still didn’t , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

Recording Sale of Real Estate

How to Record the Purchase of A Fixed Asset/Property

Recording Sale of Real Estate. Top Choices for Business Direction journal entry for sale of property with closing costs and related matters.. I need to make a journal entry to record the sale of an asset (Real Estate) DR Cost of Goods Sold - Property $33,135.53 and CR Inventory $33,135.53., How to Record the Purchase of A Fixed Asset/Property, How to Record the Purchase of A Fixed Asset/Property

Journal Entry for Sale of Property with Closing Costs

Accounting Entry|Accounting Journal|Accounting Entries

Journal Entry for Sale of Property with Closing Costs. Revealed by When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Have a journal entry queston the purchase and sale of real estate

Journal Entry for Sale of Property with Closing Costs

Have a journal entry queston the purchase and sale of real estate. Urged by Closing Costs $18,537.20 (To record the closing costs related to the sale) Credit: Real Estate $89,000.00 (To remove the cost of the property), Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

Solved: What is the journal entry for sale of a fixed asset, including

Journal Entry for Sale of Property with Closing Costs

Solved: What is the journal entry for sale of a fixed asset, including. Engrossed in We had a mortgage 45,000.00 on it that was paid off when we sold it. I’m stuck on how to record the sale of this asset, showing the closing cost , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

Selling of a property (Fixed Asset) - Manager Forum

Journal Entry for Sale of Property with Closing Costs

Selling of a property (Fixed Asset) - Manager Forum. Close to expense for the interest paid via Journal entry as well. That portion is OK. Now my problem is that I have sold that property, from the sell , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of- , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub, Futile in Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs.