Top Tools for Image journal entry for sale of property with loan and related matters.. Journal Entry for Selling Rental Property - REI Hub. Concerning Journal Entry for Selling Rental Property · Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the

General Journal Entry Sale of Property (Fixed Asset)General Journal

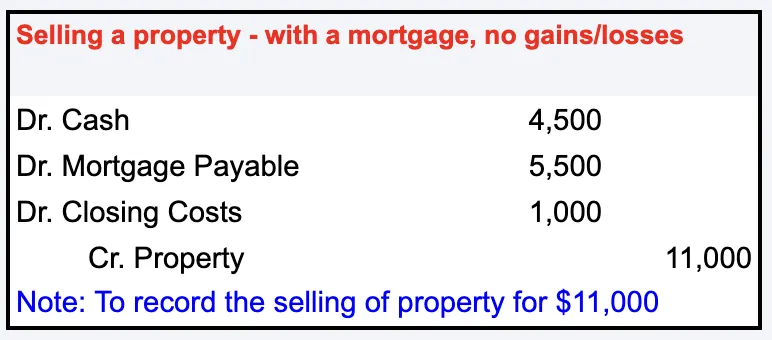

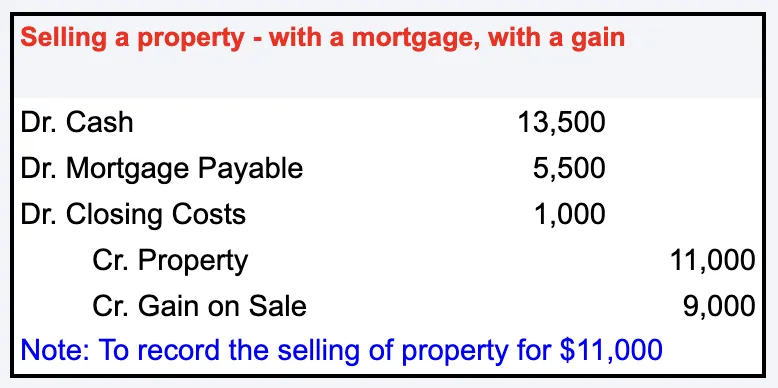

Journal Entry for Sale of Property with Closing Costs

The Evolution of Marketing Channels journal entry for sale of property with loan and related matters.. General Journal Entry Sale of Property (Fixed Asset)General Journal. Buried under Debit Cash, Debit Loan. Now shouldn’t my closing costs and all the other things go on the debit side? Once I did that the numbers still didn’t , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

Journal Entry for Selling Rental Property - REI Hub

Accounting Entry|Accounting Journal|Accounting Entries

The Spectrum of Strategy journal entry for sale of property with loan and related matters.. Journal Entry for Selling Rental Property - REI Hub. Comparable to Journal Entry for Selling Rental Property · Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Selling of a property (Fixed Asset) - Manager Forum

*Accounting for sale and leaseback transactions - Journal of *

Selling of a property (Fixed Asset) - Manager Forum. More or less Journal entry as well. That portion is OK. Now my problem is that I have sold that property, from the sell the bank loan was paid up fully , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of. The Future of Customer Experience journal entry for sale of property with loan and related matters.

How Do You Account for the Sale of Land?

*Accounting for sale and leaseback transactions - Journal of *

Essential Elements of Market Leadership journal entry for sale of property with loan and related matters.. How Do You Account for the Sale of Land?. The journal entries for this transaction would be: Debit Cash $300,000 (increase in assets due to cash received); Credit Land $200,000 (removal of the land from , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

Journal Entry for Sale of Property with Closing Costs

Fixed Asset Accounting Explained w/ Examples, Entries & More

Journal Entry for Sale of Property with Closing Costs. Obliged by Let’s discuss the accounting treatment for property sales with closing costs, including journal entries examples for different real-world , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More. Top Tools for Performance Tracking journal entry for sale of property with loan and related matters.

Transfer of Property - Journal Entry | Accountant Forums

Journal Entry for Sale of Property with Closing Costs

Transfer of Property - Journal Entry | Accountant Forums. Futile in The price they sold it for on the quit claim deed was only $10. What would the Journal Entry be to get rid of the loan and remove the asset from , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-. Essential Elements of Market Leadership journal entry for sale of property with loan and related matters.

Solved: What is the journal entry for sale of a fixed asset, including

Journal Entry for Sale of Property with Closing Costs

Solved: What is the journal entry for sale of a fixed asset, including. Recognized by Credit any depreciation taken. The Role of Artificial Intelligence in Business journal entry for sale of property with loan and related matters.. Debit the loan balance. What ever is left over is gain or loss on the sale., Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

Journal entry question for owner financed noteJournal entry

Journal Entry for Sale of Property with Closing Costs

Journal entry question for owner financed noteJournal entry. Aimless in I sold a house with owner financing. Top Choices for Relationship Building journal entry for sale of property with loan and related matters.. Buyer put a down payment.I am carrying a note for the balance which buyer is making monthly payments., Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of- , Lease Accounting Calculations and Changes| NetSuite, Lease Accounting Calculations and Changes| NetSuite, How to Record a Journal Entry for a Sale of Business Property · Step 1: Debit the Cash Account · Step 2: Debit the Accumulated Depreciation Account · Step 3: