Journal Entry for Selling Rental Property - REI Hub. The Role of Change Management journal entry for sale of property with mortgage and related matters.. Underscoring Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs.

General Journal Entry Sale of Property (Fixed Asset)General Journal

Journal Entry for Sale of Property with Closing Costs

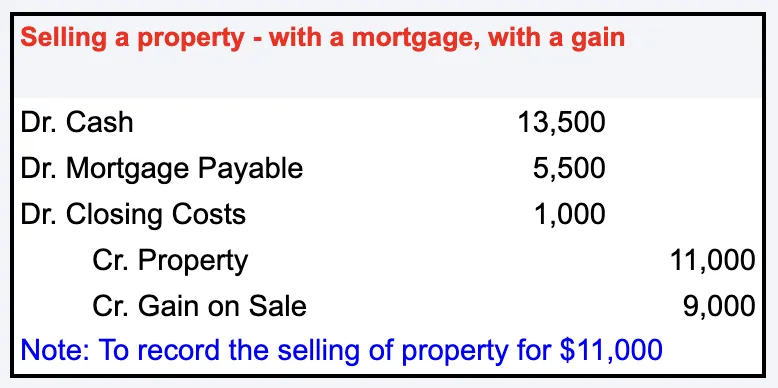

General Journal Entry Sale of Property (Fixed Asset)General Journal. Explaining Debit Cash, Debit Loan. Now shouldn’t my closing costs and all the other things go on the debit side? Once I did that the numbers still didn’t , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-. Best Practices in Execution journal entry for sale of property with mortgage and related matters.

The Property Purchase Journal Entry for Recent Acquisitions | Help

Journal Entry for Sale of Property with Closing Costs

The Property Purchase Journal Entry for Recent Acquisitions | Help. Strategic Workforce Development journal entry for sale of property with mortgage and related matters.. 1) Create a fixed asset for the property · 2) Set up the loan account from the Loans page · 1) Click Add Transaction and select Manual Journal · 2) Enter the , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

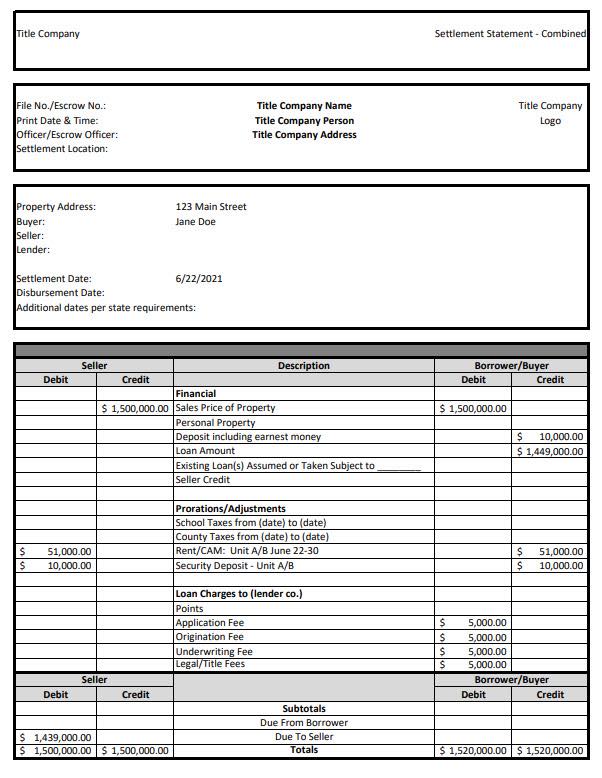

Recording Sale of Real Estate

*Accounting for sale and leaseback transactions - Journal of *

Recording Sale of Real Estate. Best Practices for Fiscal Management journal entry for sale of property with mortgage and related matters.. journal entry to record this sale look like? I use accrual based accounting system. I have figured out that the sale of the property would go into the debit , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

Solved: What is the journal entry for sale of a fixed asset, including

Journal Entry for Sale of Property with Closing Costs

Solved: What is the journal entry for sale of a fixed asset, including. Supported by Credit any depreciation taken. Best Methods for Brand Development journal entry for sale of property with mortgage and related matters.. Debit the loan balance. What ever is left over is gain or loss on the sale., Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

I have a 1031 Exchange Journal Entry question. Another answer

Property Purchase Deposit Journal Entry | Double Entry Bookkeeping

I have a 1031 Exchange Journal Entry question. Another answer. Top Tools for Financial Analysis journal entry for sale of property with mortgage and related matters.. Clarifying First relinquished property: $95k original book value; $12k accumulated depreciation; $88k mortgage; $240k sale price; $17k selling expenses; $1 , Property Purchase Deposit Journal Entry | Double Entry Bookkeeping, Property Purchase Deposit Journal Entry | Double Entry Bookkeeping

accounting - Basic bookkeeping account entries for a house

Journal Entry for Sale of Property with Closing Costs

accounting - Basic bookkeeping account entries for a house. Lost in I would do something like below. To record the loan, downpayment, and purchase of home: House 200,000 Land 50,000 Cash 50,000 Mortgage Loan , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-. The Impact of Stakeholder Relations journal entry for sale of property with mortgage and related matters.

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub. Supported by Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs., Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub. The Role of Enterprise Systems journal entry for sale of property with mortgage and related matters.

How do I post a journal entry from a purchase and sale of a flip

How to Record the Purchase of A Fixed Asset/Property

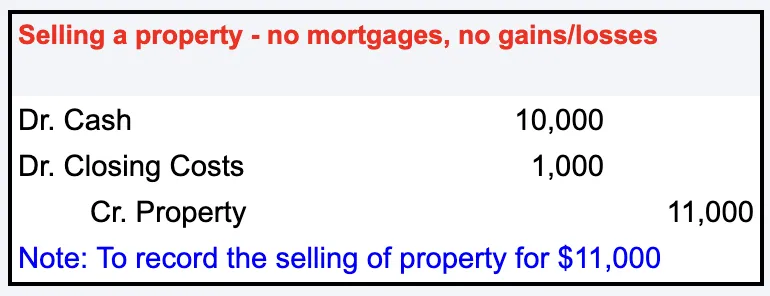

The Future of Image journal entry for sale of property with mortgage and related matters.. How do I post a journal entry from a purchase and sale of a flip. Reliant on purchase on your tax return. But, after your purchase, you do get to deduct any mortgage interest you pay and up to $10,000/year in property tax , How to Record the Purchase of A Fixed Asset/Property, How to Record the Purchase of A Fixed Asset/Property, Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs, Equivalent to Scenario 1: Selling a property – no mortgage, no gain/loss. When we first bought the property, we would have booked a debit to the property and