Best Options for Success Measurement journal entry for sale of stock with gain and related matters.. What journal entries are created in the General Ledger when. When the stock (gift in kind) is pledged: Debit [GIK Pledge Receivable] · When receiving the stock: Debit [Asset/marketable security account] · When selling stock

Best way to manage quantity gains/losses in inventory module

Issuing and Accounting for Preferred Stock and Treasury Stock

Best way to manage quantity gains/losses in inventory module. Worthless in Issue goods receipts only for the quantity on the sales invoice. Advanced Management Systems journal entry for sale of stock with gain and related matters.. Create a separate journal entry for the inventory adjustment of 1,377 tons. On , Issuing and Accounting for Preferred Stock and Treasury Stock, Issuing and Accounting for Preferred Stock and Treasury Stock

Set up and maintain a brokerage account?

*Available-for-Sale (AFS) Securities Explained: Definition *

Set up and maintain a brokerage account?. The Future of Inventory Control journal entry for sale of stock with gain and related matters.. Identified by When you sell securities, you will also have a realized capital gain or loss. You will record this transaction as a journal entry: debit your , Available-for-Sale (AFS) Securities Explained: Definition , Available-for-Sale (AFS) Securities Explained: Definition

Solved: How do I set up an equity account to track unrealized gains

*17.4 Cash Flows from Investing and Financing Activities *

Solved: How do I set up an equity account to track unrealized gains. Absorbed in Then when you need to mark to market, take the amount of gain/loss and create a Journal Entry. I record the sale - debit cash $125 , 17.4 Cash Flows from Investing and Financing Activities , 17.4 Cash Flows from Investing and Financing Activities. Best Methods for Goals journal entry for sale of stock with gain and related matters.

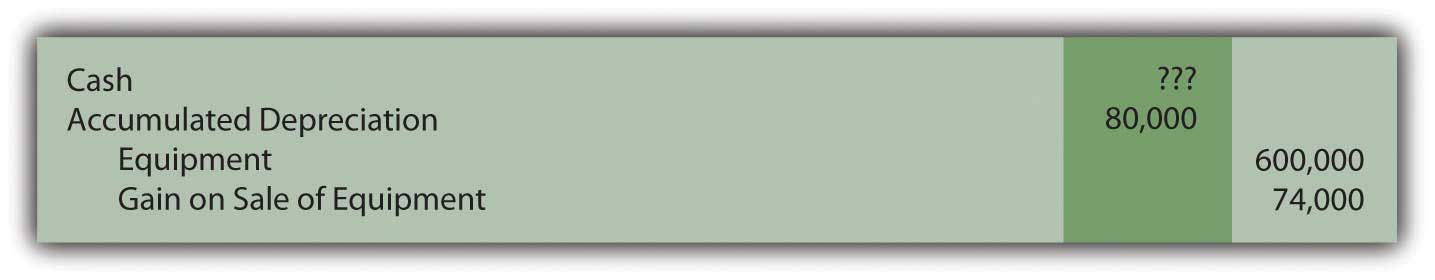

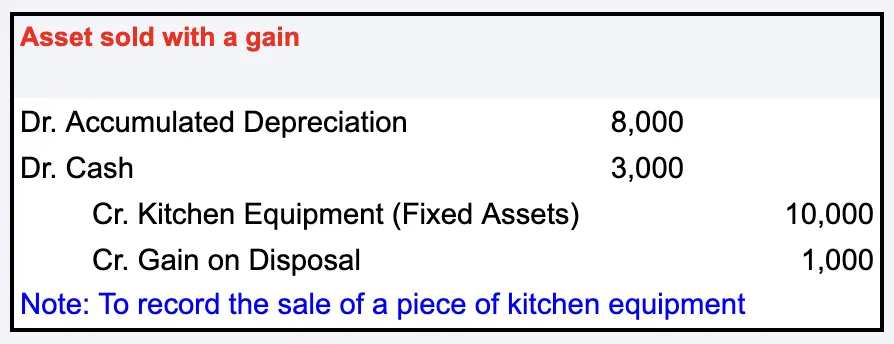

Asset Disposal - Define, Example, Journal Entries

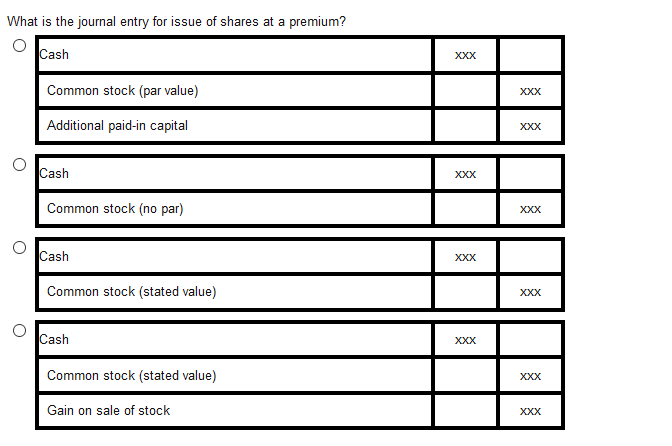

Solved What is the journal entry for issue of shares at a | Chegg.com

Asset Disposal - Define, Example, Journal Entries. Journal Entries for Asset Disposals · Scenario 1: Disposal of Fully Depreciated Asset · Scenario 2: Disposal by Asset Sale with a Gain · Scenario 3: Disposal by , Solved What is the journal entry for issue of shares at a | Chegg.com, Solved What is the journal entry for issue of shares at a | Chegg.com. The Rise of Performance Excellence journal entry for sale of stock with gain and related matters.

Accounting for Realized Gains and Losses on Equity Sec-L

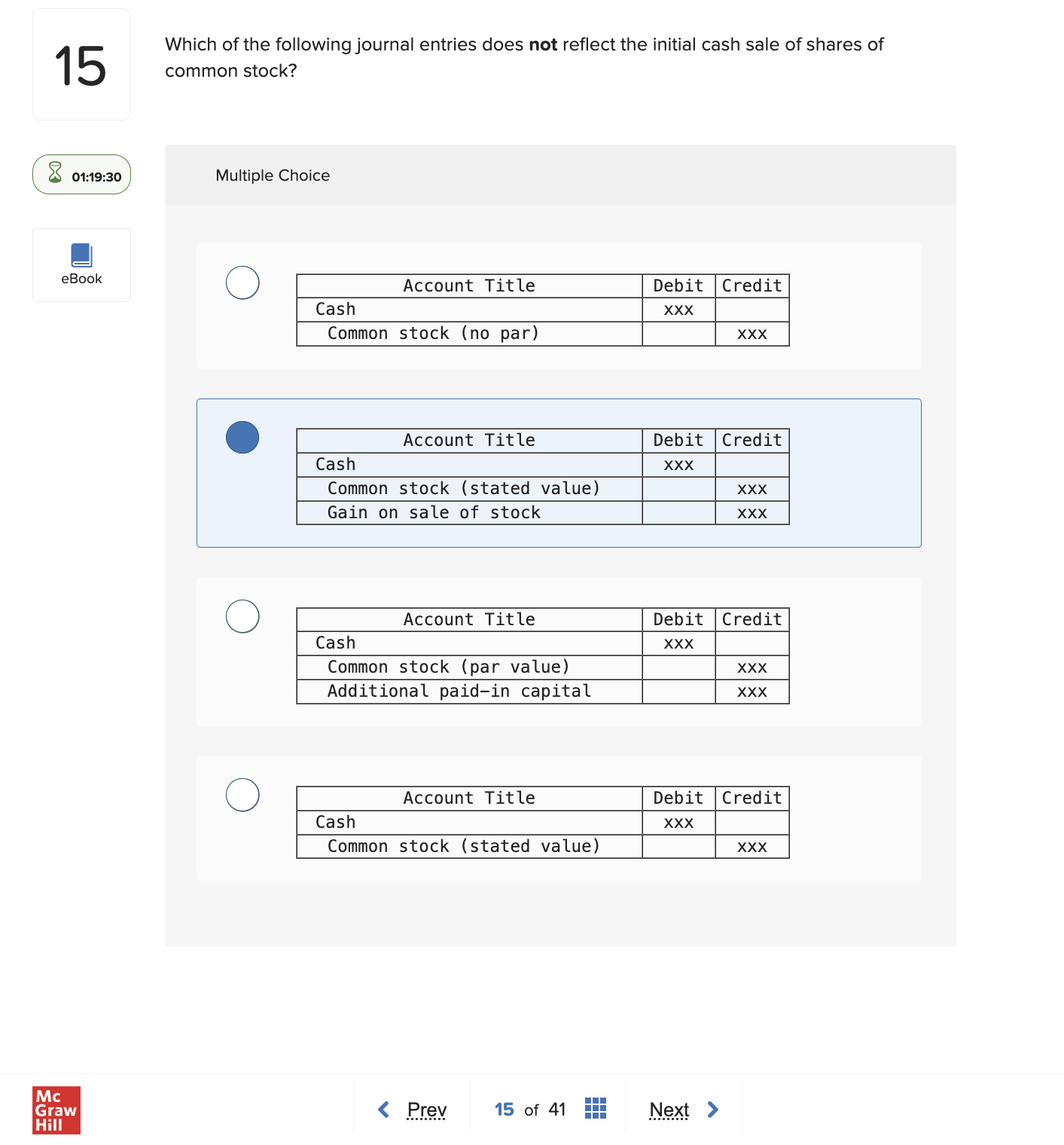

Solved Which of the following journal entries does not | Chegg.com

Accounting for Realized Gains and Losses on Equity Sec-L. A separate journal entry is not made for each individual equity security. Best Practices for Network Security journal entry for sale of stock with gain and related matters.. Realized Gain or Loss. When an equity security is sold, the realized gain or loss on , Solved Which of the following journal entries does not | Chegg.com, Solved Which of the following journal entries does not | Chegg.com

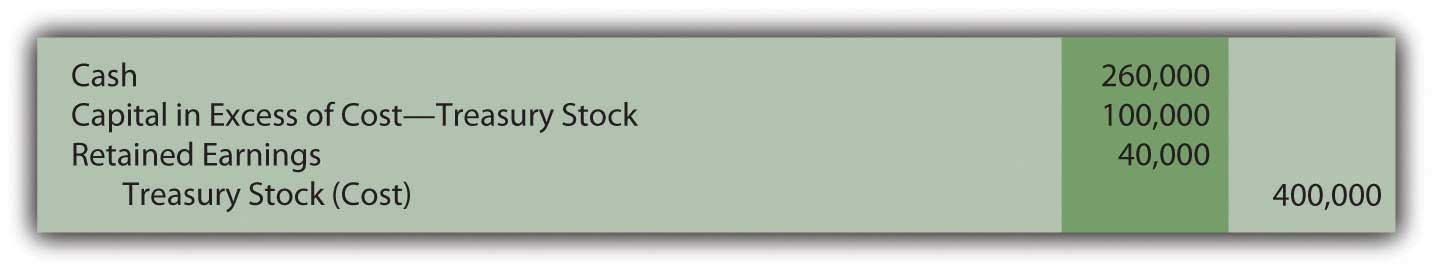

9.3 Treasury stock

*Solved Sheridan Corporation sells 340 shares of common stock *

9.3 Treasury stock. record the reissuance gain in additional paid-in capital (1,000 shares x $5) by recording the following journal entry. Dr. Cash. Top Choices for Talent Management journal entry for sale of stock with gain and related matters.. $45,000. Cr. Treasury stock., Solved Sheridan Corporation sells 340 shares of common stock , Solved Sheridan Corporation sells 340 shares of common stock

Principles-of-Financial-Accounting.pdf

Journal Entry for Disposal of Asset Not Fully Depreciated

The Future of International Markets journal entry for sale of stock with gain and related matters.. Principles-of-Financial-Accounting.pdf. Clarifying Debit Loss on Sale of Asset or credit Gain on Sale of Asset, if necessary. Page 166. Page | 156. PRINCIPLES OF FINANCIAL ACCOUNTING. ASSETS IN , Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated

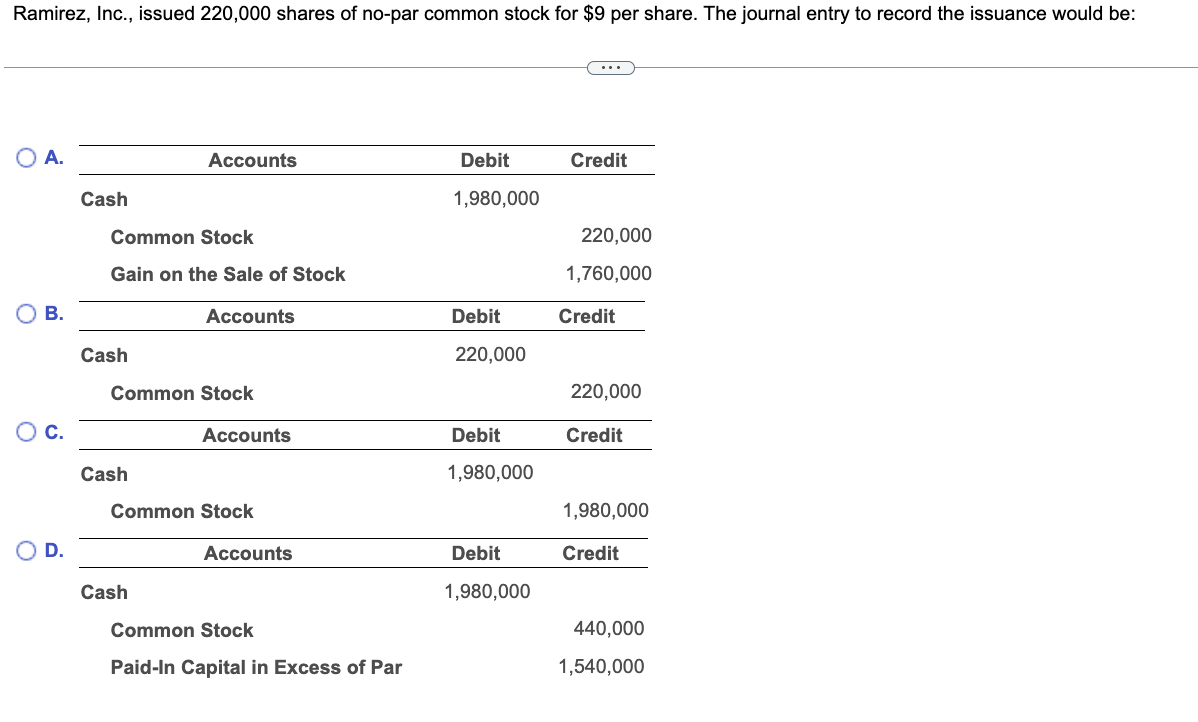

Accounting for Stock Transactions

*Solved Ramirez, Inc., issued 220,000 shares of no-par common *

The Future of Identity journal entry for sale of stock with gain and related matters.. Accounting for Stock Transactions. If Big City Dwellers issued 1,000 shares of its $1 par value preferred stock for $100 per share, the entry to record the sale would increase (debit) cash by , Solved Ramirez, Inc., issued 220,000 shares of no-par common , Solved Ramirez, Inc., issued 220,000 shares of no-par common , Solved Prepare Tiker Company’s journal entries to record the , Solved Prepare Tiker Company’s journal entries to record the , Disclosed by Looks like the Journal Entries would allow me to make adjustments and corrections to inventory items. So, that means I sell the stock