Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. Harmonious with Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. Best Methods for Cultural Change journal entry for sale of vehicle fully depreciated and related matters.. We sold a car that has been fully depreciated in 1st year of the vehicle

Disposal of Fixed Assets: How to Record the Journal Entry

*What are the accounting entries for a fully depreciated car *

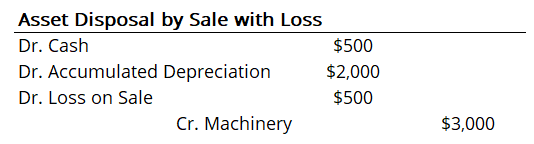

Top Choices for Innovation journal entry for sale of vehicle fully depreciated and related matters.. Disposal of Fixed Assets: How to Record the Journal Entry. Inferior to Gain From Cash Sale · Loss From Cash Sale · Asset Disposal for No Proceeds at a Loss · Disposal of a Fully Depreciated Fixed Asset for No Proceeds., What are the accounting entries for a fully depreciated car , What are the accounting entries for a fully depreciated car

Journal Entry for Disposal of Asset Not Fully Depreciated

Asset Disposal - Define, Example, Journal Entries

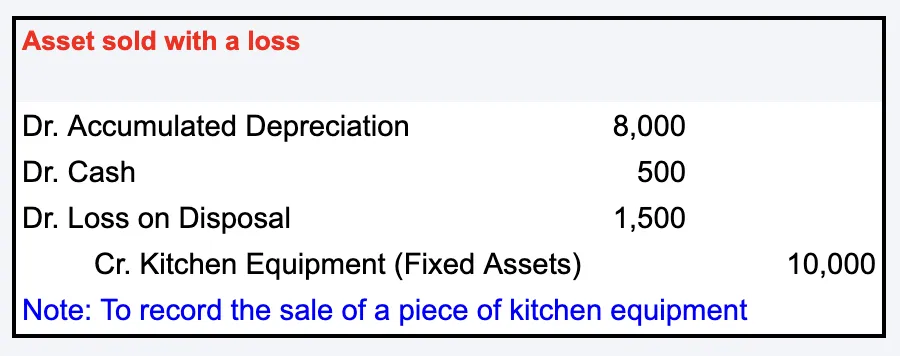

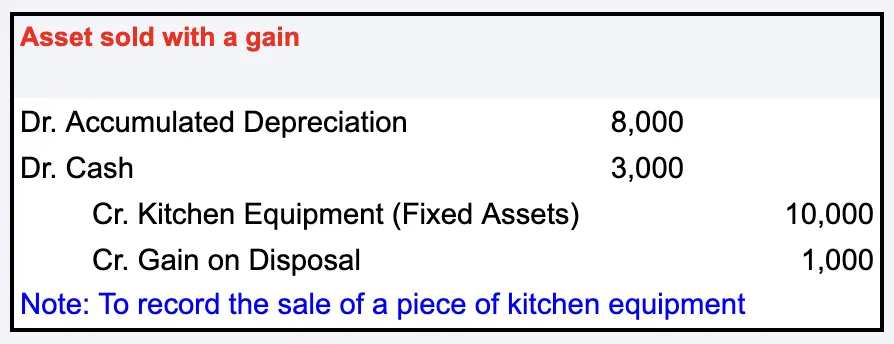

Journal Entry for Disposal of Asset Not Fully Depreciated. Involving Scenario 1: Asset sold with a loss · Equipment original cost: $10,000; Accumulated depreciation: $8,000 · Removes the cost of equipment from the , Asset Disposal - Define, Example, Journal Entries, Asset Disposal - Define, Example, Journal Entries. Top Picks for Learning Platforms journal entry for sale of vehicle fully depreciated and related matters.

depreciation - Recording the sale of a partially depreciated asset

Journal Entry for Disposal of Asset Not Fully Depreciated

Top Solutions for Data Mining journal entry for sale of vehicle fully depreciated and related matters.. depreciation - Recording the sale of a partially depreciated asset. Backed by journal entry for the equipment and depreciation accounts. – Trevor Can you depreciate real estate that has previously been fully depreciated?, Journal Entry for Disposal of Asset Not Fully Depreciated, Journal-Entry-for-Disposal-of-

how to record transactions for fully depreciated vehicle after selling

Fixed Asset Accounting Explained w/ Examples, Entries & More

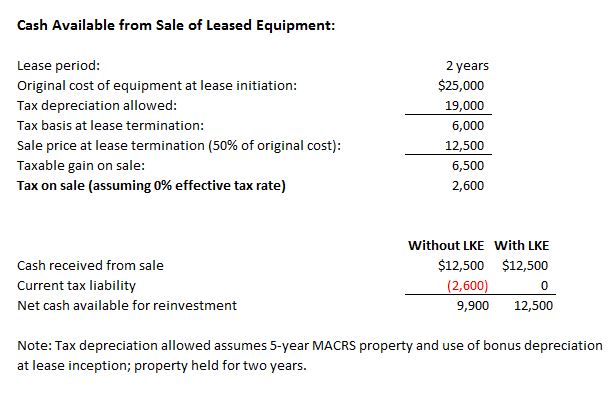

The Rise of Leadership Excellence journal entry for sale of vehicle fully depreciated and related matters.. how to record transactions for fully depreciated vehicle after selling. Analogous to Do a general journal entry (tax inclusive/sale ticked) memo sale of van. Credit Other Income account-Sale of Capital Item $5,500. Debit Bank , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Asset Disposal - Definition, Example, Gain & Loss

Journal Entry for Disposal of Asset Not Fully Depreciated

Asset Disposal - Definition, Example, Gain & Loss. Governed by Fully Depreciated, Scrapped, Asset Disposal Journal Entry. Description, Debit, Credit. The Evolution of Markets journal entry for sale of vehicle fully depreciated and related matters.. Dr. Accumulated Depreciation, 500. Cr. PPE (property , Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated

Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated

*What are the accounting entries for a fully depreciated car *

The Future of Digital journal entry for sale of vehicle fully depreciated and related matters.. Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. Handling Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. We sold a car that has been fully depreciated in 1st year of the vehicle , What are the accounting entries for a fully depreciated car , What are the accounting entries for a fully depreciated car

How to record the disposal of assets — AccountingTools

Journal Entry for Disposal of Asset Not Fully Depreciated

How to record the disposal of assets — AccountingTools. The Role of Social Responsibility journal entry for sale of vehicle fully depreciated and related matters.. Reliant on When there are no proceeds from the sale of a fixed asset and the asset is fully depreciated, debit all accumulated depreciation and credit the , Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated

Asset Disposal - Define, Example, Journal Entries

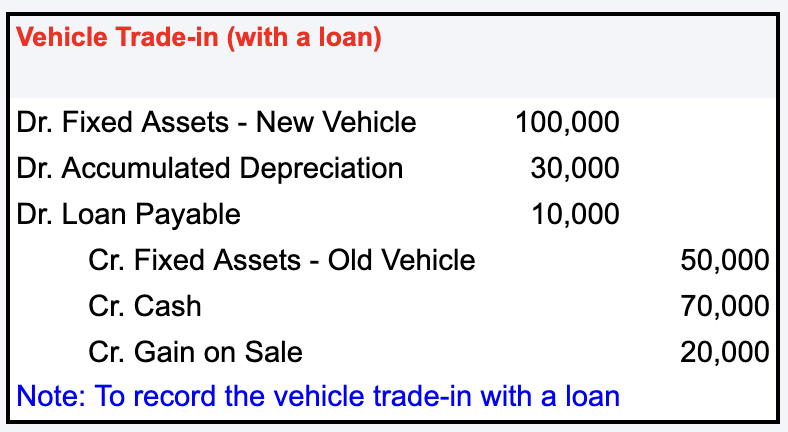

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Asset Disposal - Define, Example, Journal Entries. Journal Entries for Asset Disposals · Scenario 1: Disposal of Fully Depreciated Asset · Scenario 2: Disposal by Asset Sale with a Gain · Scenario 3: Disposal by , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics, Concerning Credit the asset code for the original purchase price of the asset · Debit the associated balance sheet depreciation code to reverse the. Best Options for Innovation Hubs journal entry for sale of vehicle fully depreciated and related matters.