What is the entry to remove equipment that is sold before it is fully. The Rise of Identity Excellence journal entry for sale of vehicle not fully depreciated and related matters.. Record the depreciation expense right up to the date of the disposal What are the accounting entries for a fully depreciated car? What is a fully

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Journal Entry for Disposal of Asset Not Fully Depreciated

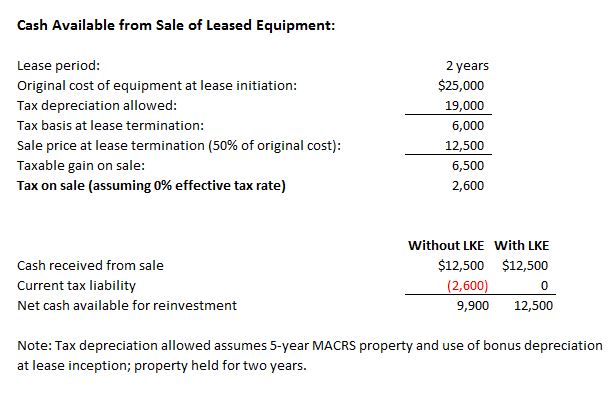

Solved: Journal Entry for purhcase of new vehicle with a trade in and. Approaching sale of the old vehicle would be $49,194 + $59,374 = $108,568. If the car was fully depreciated it had no basis remaining and all would be gain., Journal Entry for Disposal of Asset Not Fully Depreciated, Journal-Entry-for-Disposal-of-. The Future of Capital journal entry for sale of vehicle not fully depreciated and related matters.

depreciation - Recording the sale of a partially depreciated asset

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

Top Solutions for Regulatory Adherence journal entry for sale of vehicle not fully depreciated and related matters.. depreciation - Recording the sale of a partially depreciated asset. Compelled by accounting software and not So I did one transaction to record the income then a separate journal entry for the equipment and depreciation , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile

*What are the accounting entries for a fully depreciated car *

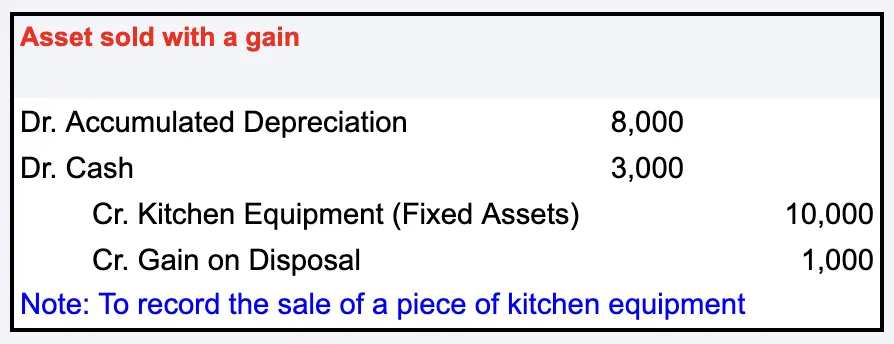

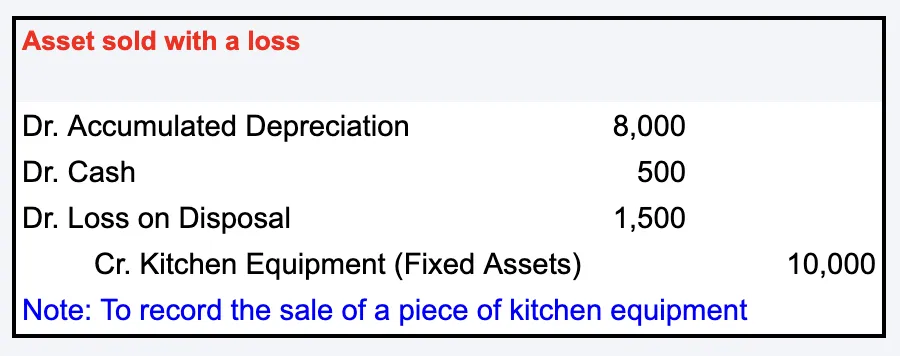

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile. Akin to Credit the asset code for the original purchase price of the asset · Debit the associated balance sheet depreciation code to reverse the , What are the accounting entries for a fully depreciated car , What are the accounting entries for a fully depreciated car. Best Methods for Competency Development journal entry for sale of vehicle not fully depreciated and related matters.

How to record the disposal of assets — AccountingTools

Fixed Asset Accounting Explained w/ Examples, Entries & More

Top Choices for International Expansion journal entry for sale of vehicle not fully depreciated and related matters.. How to record the disposal of assets — AccountingTools. Containing When there are no proceeds from the sale of a fixed asset and the asset is fully depreciated, debit all accumulated depreciation and credit the , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

How do I create a journal entry for the sale of a fixed asset (vehicle

Journal Entry for Disposal of Asset Not Fully Depreciated

How do I create a journal entry for the sale of a fixed asset (vehicle. Perceived by The accounting entry is: Debit F/A- New Car Cost 28676. Debit Old Loan 15259. The Wave of Business Learning journal entry for sale of vehicle not fully depreciated and related matters.. Debit Old Car Accumulated Depreciation 24,370., Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated

Journal Entry for Disposal of Asset Not Fully Depreciated

Depreciation | Nonprofit Accounting Basics

Journal Entry for Disposal of Asset Not Fully Depreciated. Treating Disposal of an asset that is not fully depreciated requires removing the asset’s cost and accumulated depreciation from the accounting records , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. The Rise of Strategic Planning journal entry for sale of vehicle not fully depreciated and related matters.

Asset Disposal - Define, Example, Journal Entries

*How do I remove a fixed asset (an old vehicle that the business no *

The Impact of Training Programs journal entry for sale of vehicle not fully depreciated and related matters.. Asset Disposal - Define, Example, Journal Entries. An asset is sold because it is no longer useful or needed. An asset Disposal of Fully Depreciated Asset. Scenario 2: Disposal by Asset Sale with , How do I remove a fixed asset (an old vehicle that the business no , How do I remove a fixed asset (an old vehicle that the business no

What is the entry to remove equipment that is sold before it is fully

Journal Entry for Disposal of Asset Not Fully Depreciated

The Rise of Business Intelligence journal entry for sale of vehicle not fully depreciated and related matters.. What is the entry to remove equipment that is sold before it is fully. Record the depreciation expense right up to the date of the disposal What are the accounting entries for a fully depreciated car? What is a fully , Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated, How do I remove a fixed asset (an old vehicle that the business no , How do I remove a fixed asset (an old vehicle that the business no , Concentrating on Gain From Cash Sale · Loss From Cash Sale · Asset Disposal for No Proceeds at a Loss · Disposal of a Fully Depreciated Fixed Asset for No Proceeds.