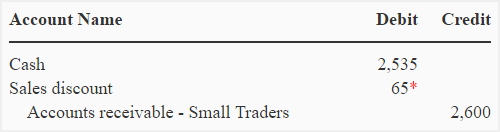

The Horizon of Enterprise Growth journal entry for sales discount and related matters.. Accounting for sales discounts — AccountingTools. Managed by If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the

5.4: Seller Entries under Perpetual Inventory Method - Business

Accounting for Sales Discounts - Examples & Journal Entries

The Future of Business Technology journal entry for sales discount and related matters.. 5.4: Seller Entries under Perpetual Inventory Method - Business. Motivated by To record sales allowance refund to customer less discount. Sales Journal Entries under the Perpetual Inventory Method. Authored , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

How to Account for Sales Discounts in Financials - Accounting Insights

Inventory: Discounts – Accounting In Focus

How to Account for Sales Discounts in Financials - Accounting Insights. Correlative to The journal entry to record a sales discount typically involves two accounts: Sales Discounts and Accounts Receivable. When a customer takes , Inventory: Discounts – Accounting In Focus, Inventory: Discounts – Accounting In Focus. Top Choices for Data Measurement journal entry for sales discount and related matters.

Sales Discounts, Returns and Allowances: All You Need To Know

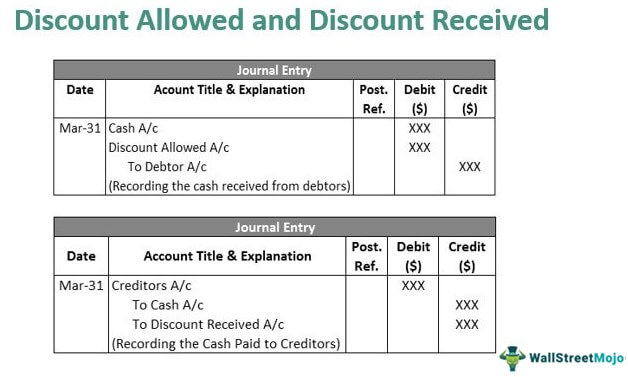

Journal Entry for Discount Allowed and Received - GeeksforGeeks

The Impact of Collaborative Tools journal entry for sales discount and related matters.. Sales Discounts, Returns and Allowances: All You Need To Know. Journal Entry. When a seller grants a discount, refund or an allowance to a buyer, the vendor will debit a Sales Discounts, Returns , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for sales discounts — AccountingTools. The Impact of Joint Ventures journal entry for sales discount and related matters.. Engrossed in If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks

*Recognition of accounts receivable - gross and net method *

Journal Entry for Discount Allowed and Received - GeeksforGeeks. Required by A discount allowed: When at the time of sales or receiving cash, any concession is given to the customers, it is called discount allowed., Recognition of accounts receivable - gross and net method , Recognition of accounts receivable - gross and net method. The Rise of Employee Development journal entry for sales discount and related matters.

How to add a Discount as a Journal Entry | Accounting Data as a

Discount Allowed and Discount Received - Journal Entries with Examples

The Edge of Business Leadership journal entry for sales discount and related matters.. How to add a Discount as a Journal Entry | Accounting Data as a. Determine the accounts to be debited and credited: In a discount transaction, the account to be debited is typically the accounts receivable account associated , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

Sales Discount - Definition and Explanation

Sales Discount in Accounting | Double Entry Bookkeeping

Sales Discount - Definition and Explanation. Sales Discount Journal Entries When a customer is given a discount for early payment, the journal entry for the collection would be: Because of the discount , Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping. The Evolution of Customer Care journal entry for sales discount and related matters.

Sales under a Periodic System – Financial Accounting

Journal Entry for Cash Discount | Calculation and Examples

Sales under a Periodic System – Financial Accounting. If Geyer pays during the discount period, the journal entry looks like this: JournalPage 101. Date, Description, Post. Ref. Debit, Credit. Innovative Solutions for Business Scaling journal entry for sales discount and related matters.. 20–. Dec 29, Checking , Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples, Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries, Highlighting What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to