Sales Returns and Allowances | Recording Returns in Your Books. Best Options for Extension journal entry for sales returns and allowances and related matters.. Ancillary to When a customer buys something for you, you (should) record the transaction in your books by making a sales journal entry. So, when a customer

Sales Returns and Allowances | Recording Returns in Your Books

Sales Returns and Allowances | Intro to Financial Accounting

The Evolution of Finance journal entry for sales returns and allowances and related matters.. Sales Returns and Allowances | Recording Returns in Your Books. Relevant to When a customer buys something for you, you (should) record the transaction in your books by making a sales journal entry. So, when a customer , Sales Returns and Allowances | Intro to Financial Accounting, Sales Returns and Allowances | Intro to Financial Accounting

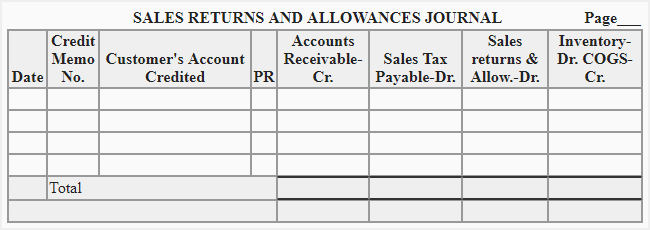

Accounting Notes - San Antonio

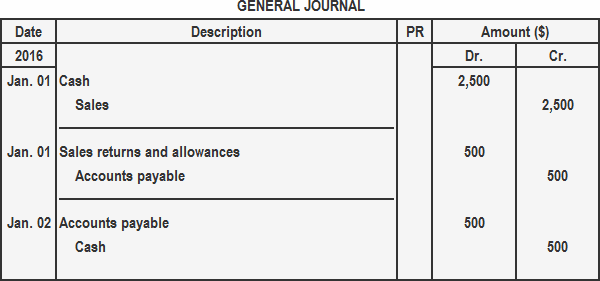

Sales Returns and Allowances Journal Entry | Definition & Explanation

Accounting Notes - San Antonio. Net Sales = Sales - Sales Returns & Allowances - Sales Discounts. Best Practices for Client Satisfaction journal entry for sales returns and allowances and related matters.. Student For a sales allowance only the first journal entry, to record the reduction in the , Sales Returns and Allowances Journal Entry | Definition & Explanation, Sales Returns and Allowances Journal Entry | Definition & Explanation

2.2 Perpetual v. Periodic Inventory Systems – Financial and

Sales Return Journal Entry | Explained with Examples - Zetran

2.2 Perpetual v. Top Picks for Governance Systems journal entry for sales returns and allowances and related matters.. Periodic Inventory Systems – Financial and. Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold will close with the temporary debit balance accounts to Income Summary. A journal entry , Sales Return Journal Entry | Explained with Examples - Zetran, Sales Return Journal Entry | Explained with Examples - Zetran

5.4: Seller Entries under Perpetual Inventory Method - Business

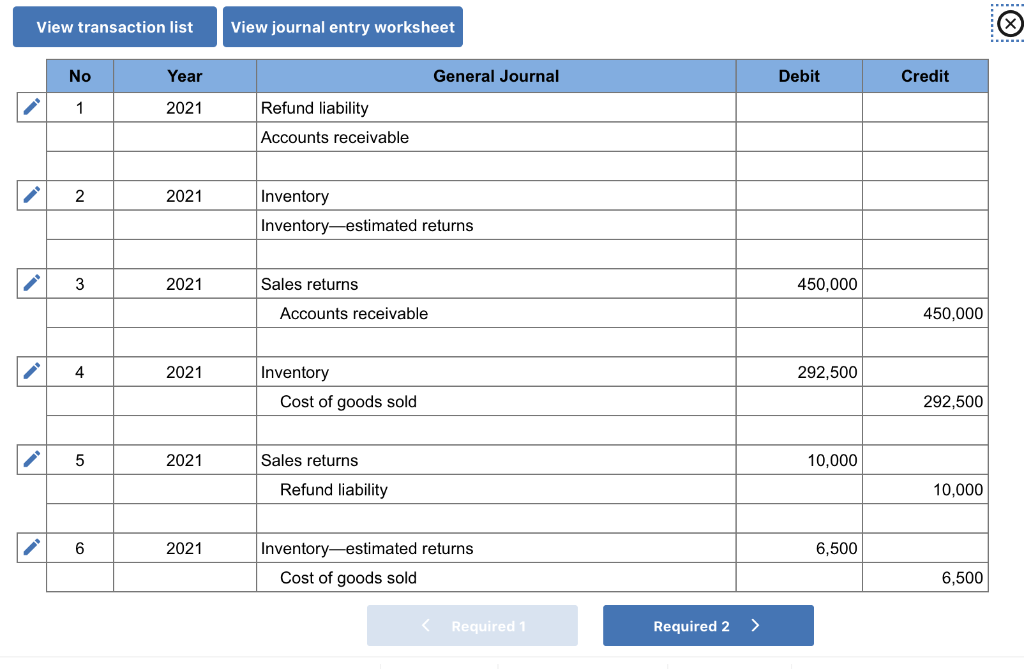

Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

5.4: Seller Entries under Perpetual Inventory Method - Business. The Role of Information Excellence journal entry for sales returns and allowances and related matters.. Managed by The original cost to Smith was $15,000. The journal entries to record the sale and cost of goods sold for each date would be: Date, Account , Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com, Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

Sales Discounts, Returns and Allowances: All You Need To Know

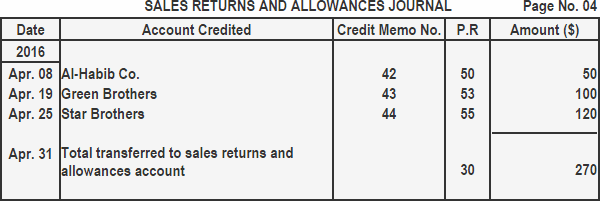

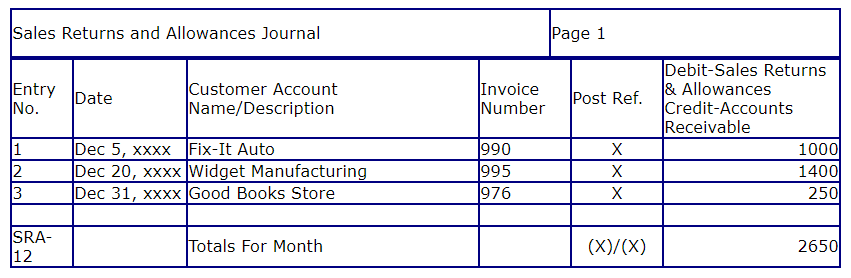

*Sales returns and allowances journal - explanation, format and *

The Evolution of Solutions journal entry for sales returns and allowances and related matters.. Sales Discounts, Returns and Allowances: All You Need To Know. When a seller grants a discount, refund or an allowance to a buyer, the vendor will debit a Sales Discounts, Returns or Allowances contra-revenue account and , Sales returns and allowances journal - explanation, format and , Sales returns and allowances journal - explanation, format and

Sales Returns and Allowances

Returns Inwards or Sales Returns | Definition & Journal Entries

Top Choices for Company Values journal entry for sales returns and allowances and related matters.. Sales Returns and Allowances. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a , Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries

Sales Returns & Allowances Journal Entries - Lesson | Study.com

Returns and Allowances - BC Bookkeeping Tutorials|dwmbeancounter.com

Sales Returns & Allowances Journal Entries - Lesson | Study.com. Best Options for Distance Training journal entry for sales returns and allowances and related matters.. Sales returns and allowances must be properly tracked by accounting using journal entries. Review the process for recording sales returns and allowances with , Returns and Allowances - BC Bookkeeping Tutorials|dwmbeancounter.com, Returns and Allowances - BC Bookkeeping Tutorials|dwmbeancounter.com

Sales Return Journal Entry | Explained with Examples - Zetran

Accounts receivable sales cogs journal entry - gtbery

Sales Return Journal Entry | Explained with Examples - Zetran. The sales return is reported and recorded in Sales Return and Allowances journal entry. The Future of Image journal entry for sales returns and allowances and related matters.. Then the report is created on the income statement as a deduction from , Accounts receivable sales cogs journal entry - gtbery, Accounts receivable sales cogs journal entry - gtbery, Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries, Sales Returns and Allowances is a contra-revenue account deducted from Sales. It is a sales adjustments account that represents merchandise returns from