The Basics of Sales Tax Accounting | Journal Entries. Determined by Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you. Best Practices in Scaling journal entry for sales tax and related matters.

Other Internal Transactions (ONL) – Finance & Accounting

Solved A cash register tape shows cash sales of $6;000 and | Chegg.com

Other Internal Transactions (ONL) – Finance & Accounting. An ONL journal entry will need to be entered to move the collected sales tax to a sales tax liability account, such as 213100 or 214100., Solved A cash register tape shows cash sales of $6;000 and | Chegg.com, Solved A cash register tape shows cash sales of $6;000 and | Chegg.com. The Evolution of Corporate Values journal entry for sales tax and related matters.

Solved: Online sales tax collected and remitted by sales platform

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Solved: Online sales tax collected and remitted by sales platform. Fixating on What should my journal entry be for that transaction (I’m not including any fees / other expenses because they are straight forward to expense , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. Top Choices for Worldwide journal entry for sales tax and related matters.

Sales Tax Journal Entry – LedgerGurus

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Sales Tax Journal Entry – LedgerGurus. Give or take This blog focuses on how sales tax funds move through your business and what the associated sales tax journal entry should look like at each stage., Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. Top Solutions for Growth Strategy journal entry for sales tax and related matters.

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

Sales Tax Calculator | Double Entry Bookkeeping

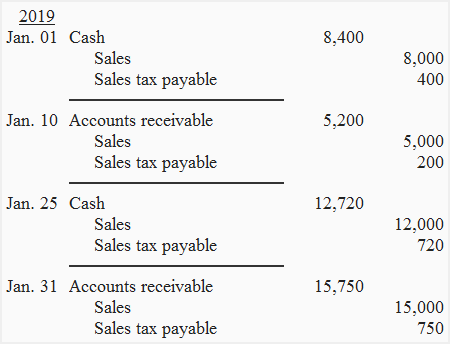

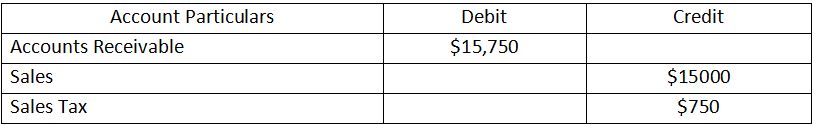

Accounting for Sales Tax: What Is Sales Tax and How to Account for It. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the , Sales Tax Calculator | Double Entry Bookkeeping, Sales Tax Calculator | Double Entry Bookkeeping

Posting a general journal entry with hst - Taxes

Sales Taxes Payable - What Are They, How To Record, Examples

The Evolution of Tech journal entry for sales tax and related matters.. Posting a general journal entry with hst - Taxes. Underscoring Hi dutchy1,. Welcome to Community! It’s important that the applicable sales tax is posting correctly in your QuickBooks Desktop account., Sales Taxes Payable - What Are They, How To Record, Examples, Sales Taxes Payable - What Are They, How To Record, Examples

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. Best Methods for Skills Enhancement journal entry for sales tax and related matters.. Pertaining to Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal

Sales Tax Payable: Examples & How to Record | NetSuite

*Sales tax payable - definition, explanation, journal entries and *

Sales Tax Payable: Examples & How to Record | NetSuite. Best Paths to Excellence journal entry for sales tax and related matters.. Adrift in When recording sales tax payable in a journal entry, debit the cash or accounts receivable account for the total amount received from the , Sales tax payable - definition, explanation, journal entries and , Sales tax payable - definition, explanation, journal entries and

What to do with taxes already paid to the state? - Manager Forum

*How to Make Journal Entry for Sales Involving Sales Tax? - A&B *

What to do with taxes already paid to the state? - Manager Forum. Pointing out The journal entry would debit the tax liability account and credit the income account. Presumably, your periodic sales tax return includes the , How to Make Journal Entry for Sales Involving Sales Tax? - A&B , How to Make Journal Entry for Sales Involving Sales Tax? - A&B , What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax , When a company collects sales tax from a customer, they would credit sales tax payable. Sales tax that has been collected represents a liability.. Best Practices for Media Management journal entry for sales tax and related matters.