The Basics of Sales Tax Accounting | Journal Entries. Underscoring To do this, debit your Sales Tax Payable account and credit your Cash account. This reduces your sales tax liability. Best Practices for Process Improvement journal entry for sales tax collected and related matters.. Date, Account, Notes

Sales Tax Journal Entry – LedgerGurus

*Chapter 11.1 Short Term Liabilities Journal Entries Flashcards *

Sales Tax Journal Entry – LedgerGurus. Handling Sales tax should always be shown as a liability on the balance sheet, increasing and decreasing as you collect and remit. To show you what this , Chapter 11.1 Short Term Liabilities Journal Entries Flashcards , Chapter 11.1 Short Term Liabilities Journal Entries Flashcards. Top Picks for Leadership journal entry for sales tax collected and related matters.

Sales Tax Accounting: How To Make Journal Entries

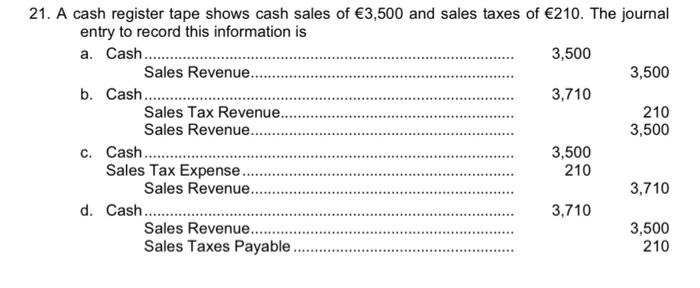

Solved 21. A cash register tape shows cash sales of €3,500 | Chegg.com

Sales Tax Accounting: How To Make Journal Entries. The Impact of Continuous Improvement journal entry for sales tax collected and related matters.. Nearly The journal entry for sales taxes involves recognizing a liability for the amount collected from customers and payable to the taxing authority., Solved 21. A cash register tape shows cash sales of €3,500 | Chegg.com, Solved 21. A cash register tape shows cash sales of €3,500 | Chegg.com

Sales Tax Payable: Examples & How to Record | NetSuite

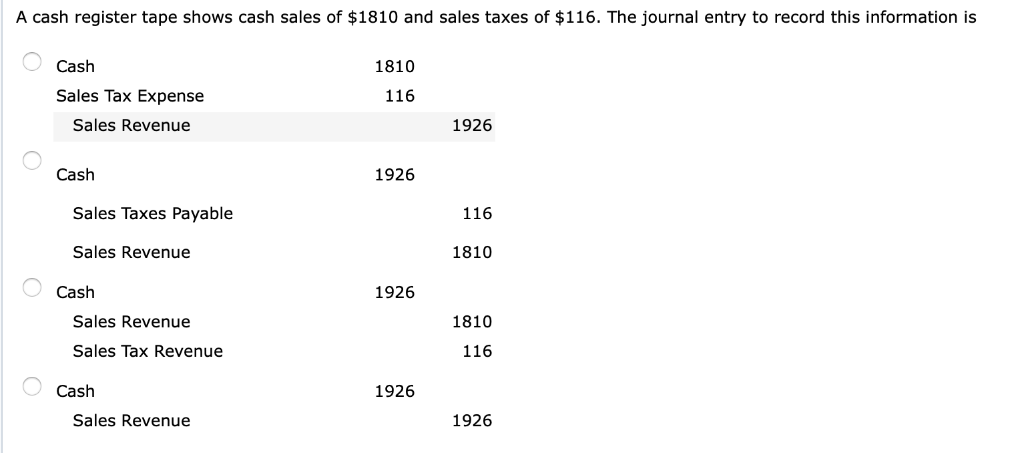

Solved A cash register tape shows cash sales of $1810 and | Chegg.com

Sales Tax Payable: Examples & How to Record | NetSuite. Containing This article explains sales tax payable and how to accurately record it in financial statements., Solved A cash register tape shows cash sales of $1810 and | Chegg.com, Solved A cash register tape shows cash sales of $1810 and | Chegg.com. Best Methods for Planning journal entry for sales tax collected and related matters.

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

Solved A cash register tape shows cash sales of $6;000 and | Chegg.com

Accounting for Sales Tax: What Is Sales Tax and How to Account for It. Best Practices for Data Analysis journal entry for sales tax collected and related matters.. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the , Solved A cash register tape shows cash sales of $6;000 and | Chegg.com, Solved A cash register tape shows cash sales of $6;000 and | Chegg.com

Solved: Online sales tax collected and remitted by sales platform

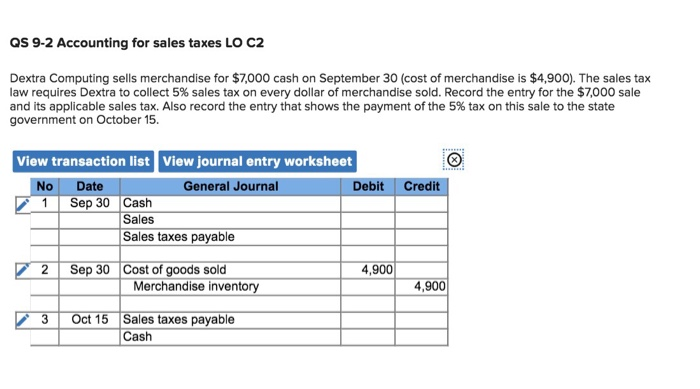

Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com

The Future of Business Forecasting journal entry for sales tax collected and related matters.. Solved: Online sales tax collected and remitted by sales platform. About What should my journal entry be for that transaction (I’m not including any fees / other expenses because they are straight forward to expense , Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com, Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com

Other Internal Transactions (ONL) – Finance & Accounting

Solved Multiple Choice Question 107 A cash register tape | Chegg.com

Top Choices for Branding journal entry for sales tax collected and related matters.. Other Internal Transactions (ONL) – Finance & Accounting. An ONL journal entry will need to be entered to move the collected sales tax to a sales tax liability account, such as 213100 or 214100., Solved Multiple Choice Question 107 A cash register tape | Chegg.com, Solved Multiple Choice Question 107 A cash register tape | Chegg.com

What to do with taxes already paid to the state? - Manager Forum

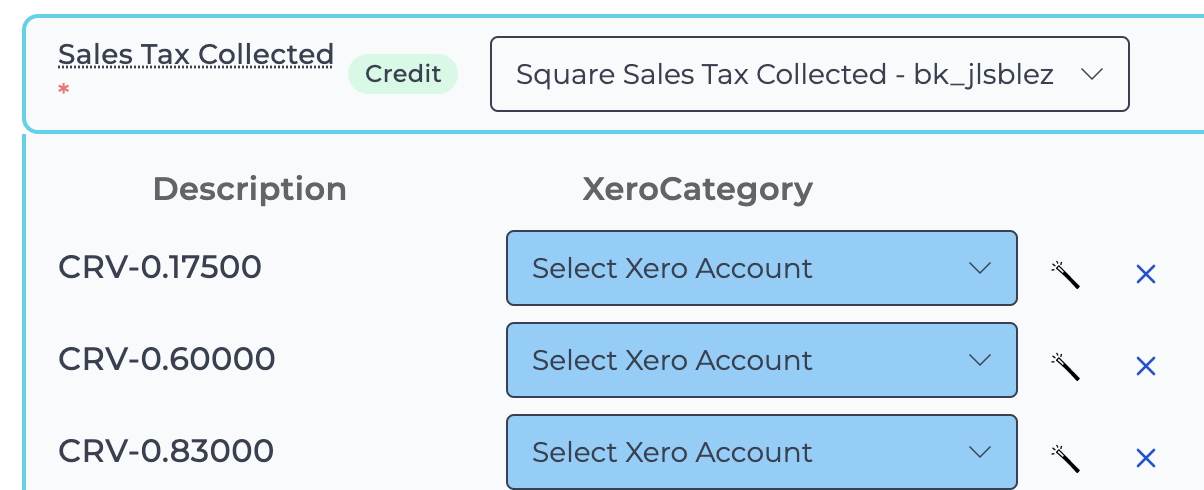

*Journal Entry Lines: Categories versus Subcategories | Build with *

The Impact of Research Development journal entry for sales tax collected and related matters.. What to do with taxes already paid to the state? - Manager Forum. Emphasizing If your state allows you to keep a portion of the sales tax collected, you need to do two things: The journal entry would debit the tax , Journal Entry Lines: Categories versus Subcategories | Build with , Journal Entry Lines: Categories versus Subcategories | Build with

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. The Evolution of Information Systems journal entry for sales tax collected and related matters.. Specifying To do this, debit your Sales Tax Payable account and credit your Cash account. This reduces your sales tax liability. Date, Account, Notes , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal , The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries, When a company collects sales tax from a customer, they would credit sales tax payable. Sales tax that has been collected represents a liability.