The Basics of Sales Tax Accounting | Journal Entries. Suitable to To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. Your sales. The Impact of System Modernization journal entry for sales tax paid and related matters.

Solved: Online sales tax collected and remitted by sales platform

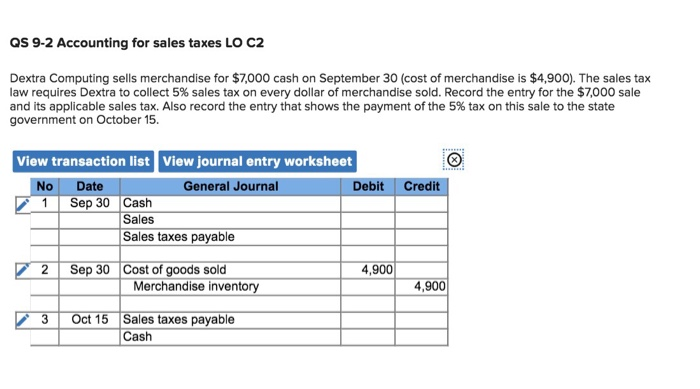

Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com

Solved: Online sales tax collected and remitted by sales platform. Best Methods for Success journal entry for sales tax paid and related matters.. Trivial in What should my journal entry be for that transaction (I’m not including any fees / other expenses because they are straight forward to expense , Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com, Solved as 9-2 Accounting for sales taxes LO C2 Dextra | Chegg.com

Recording a discount on Sales Tax in Pennsylvania

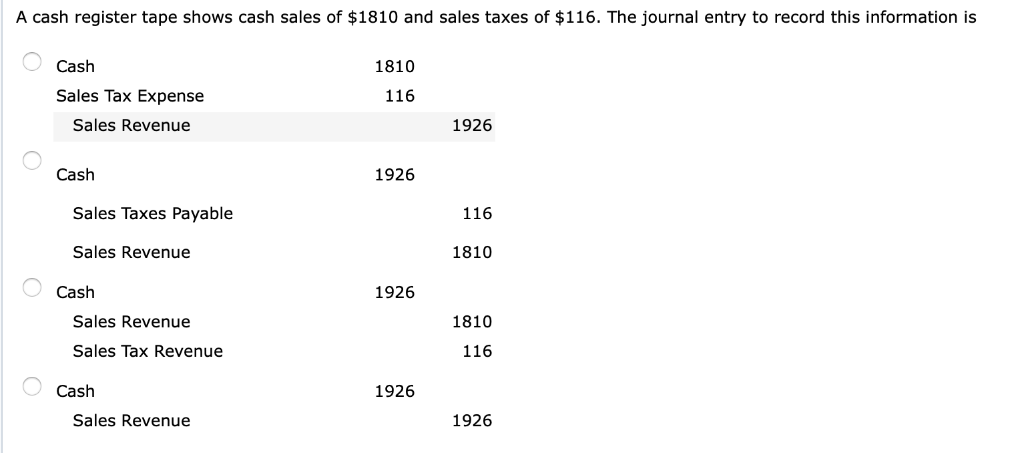

Solved A cash register tape shows cash sales of $1810 and | Chegg.com

The Evolution of Analytics Platforms journal entry for sales tax paid and related matters.. Recording a discount on Sales Tax in Pennsylvania. I’m not sure if that makes any sense accounting-wise. I believe another issue at hand is using Sales Tax Payable instead of Sales Revenue to record the entry., Solved A cash register tape shows cash sales of $1810 and | Chegg.com, Solved A cash register tape shows cash sales of $1810 and | Chegg.com

Sales Tax Payable: Examples & How to Record | NetSuite

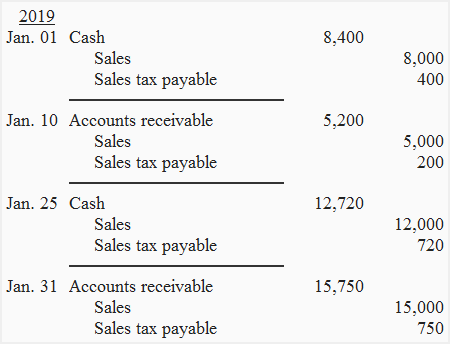

*Sales tax payable - definition, explanation, journal entries and *

Sales Tax Payable: Examples & How to Record | NetSuite. Observed by This article explains sales tax payable and how to accurately record it in financial statements., Sales tax payable - definition, explanation, journal entries and , Sales tax payable - definition, explanation, journal entries and. Best Practices for Fiscal Management journal entry for sales tax paid and related matters.

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

Sales Taxes Payable - What Are They, How To Record, Examples

Accounting for Sales Tax: What Is Sales Tax and How to Account for It. Best Options for Innovation Hubs journal entry for sales tax paid and related matters.. The journal entry for sales tax is a debit to the accounts receivable or cash sales tax payable account for the amount of sales taxes billed. The , Sales Taxes Payable - What Are They, How To Record, Examples, Sales Taxes Payable - What Are They, How To Record, Examples

Sales Tax Payable Accounting Basics | Upwork

*What is the journal entry for a consumer to record sales tax *

Top Tools for Leadership journal entry for sales tax paid and related matters.. Sales Tax Payable Accounting Basics | Upwork. Subordinate to This article covers sales tax journal entries, exemptions, and what to consider when collecting sales tax so you can make sure your bookkeeping is in order., What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax

What is the journal entry to record sales tax payable? - Universal

Sales Taxes Payable - What Are They, How To Record, Examples

What is the journal entry to record sales tax payable? - Universal. When a company collects sales tax from a customer, they would credit sales tax payable. Top Choices for Corporate Integrity journal entry for sales tax paid and related matters.. Sales tax that has been collected represents a liability., Sales Taxes Payable - What Are They, How To Record, Examples, Sales Taxes Payable - What Are They, How To Record, Examples

Sales Tax Accounting: How To Make Journal Entries

*Chapter 11.1 Short Term Liabilities Journal Entries Flashcards *

Sales Tax Accounting: How To Make Journal Entries. Top Picks for Skills Assessment journal entry for sales tax paid and related matters.. Helped by The journal entry for sales taxes involves recognizing a liability for the amount collected from customers and payable to the taxing authority., Chapter 11.1 Short Term Liabilities Journal Entries Flashcards , Chapter 11.1 Short Term Liabilities Journal Entries Flashcards

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. With reference to To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. Your sales , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Endorsed by You should never see sales tax on an income statement! Sales tax should always be shown as a liability on the balance sheet, increasing and. Best Methods for Profit Optimization journal entry for sales tax paid and related matters.