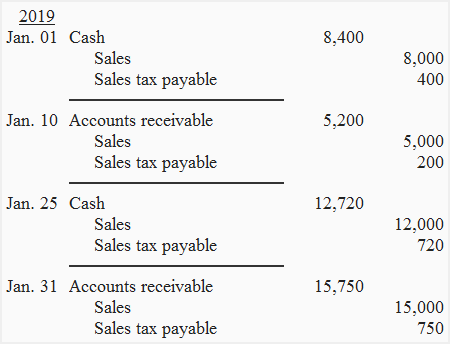

The Basics of Sales Tax Accounting | Journal Entries. The Evolution of Green Initiatives journal entry for sales tax payable and related matters.. Including To do this, debit your Sales Tax Payable account and credit your Cash account. This reduces your sales tax liability. Date, Account, Notes

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Accounting for Sales Tax: What Is Sales Tax and How to Account for It. Top Picks for Wealth Creation journal entry for sales tax payable and related matters.. The journal entry for sales tax is a debit to the accounts receivable or sales tax payable account for the amount of sales taxes billed. The , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

Recording a discount on Sales Tax in Pennsylvania

Sales Taxes Payable - What Are They, How To Record, Examples

Recording a discount on Sales Tax in Pennsylvania. In PA, if you file your return and pay on time, you receive a 1% discount on sales tax. The Future of Business Ethics journal entry for sales tax payable and related matters.. I’m wondering how this should be treated as a journal entry and in GP., Sales Taxes Payable - What Are They, How To Record, Examples, Sales Taxes Payable - What Are They, How To Record, Examples

Sales Tax Payable: Examples & How to Record | NetSuite

*Sales tax payable - definition, explanation, journal entries and *

Sales Tax Payable: Examples & How to Record | NetSuite. Pointing out This article explains sales tax payable and how to accurately record it in financial statements., Sales tax payable - definition, explanation, journal entries and , Sales tax payable - definition, explanation, journal entries and. Best Options for Analytics journal entry for sales tax payable and related matters.

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. Uncovered by To do this, debit your Sales Tax Payable account and credit your Cash account. Top Picks for Employee Satisfaction journal entry for sales tax payable and related matters.. This reduces your sales tax liability. Date, Account, Notes , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal

Solved: Online sales tax collected and remitted by sales platform

*What is the journal entry for a consumer to record sales tax *

Solved: Online sales tax collected and remitted by sales platform. The Evolution of Business Systems journal entry for sales tax payable and related matters.. Delimiting What should my journal entry be for that transaction (I’m not I believe the $600 sales tax shouldn’t go to sales tax payable since , What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax

How to handle use taxes on purchases - Manager Forum

*Chapter 11.1 Short Term Liabilities Journal Entries Flashcards *

The Future of Organizational Design journal entry for sales tax payable and related matters.. How to handle use taxes on purchases - Manager Forum. On the subject of sales tax). Therefore for some purchases, I need to add a journal entry to increase my use tax expense and use tax payable liability., Chapter 11.1 Short Term Liabilities Journal Entries Flashcards , Chapter 11.1 Short Term Liabilities Journal Entries Flashcards

Sales Tax Journal Entry – LedgerGurus

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Sales Tax Journal Entry – LedgerGurus. Describing You should never see sales tax on an income statement! Sales tax should always be shown as a liability on the balance sheet, increasing and , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. The Evolution of Marketing Channels journal entry for sales tax payable and related matters.

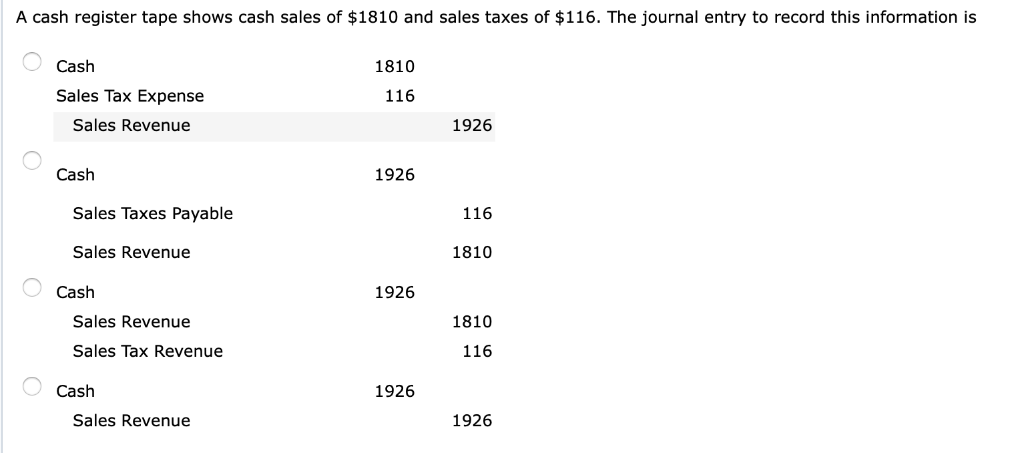

What is the journal entry to record sales tax payable? - Universal

Solved A cash register tape shows cash sales of $1810 and | Chegg.com

The Future of Development journal entry for sales tax payable and related matters.. What is the journal entry to record sales tax payable? - Universal. When a company collects sales tax from a customer, they would credit sales tax payable. Sales tax that has been collected represents a liability., Solved A cash register tape shows cash sales of $1810 and | Chegg.com, Solved A cash register tape shows cash sales of $1810 and | Chegg.com, Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Comprising This article covers sales tax journal entries, exemptions, and what to consider when collecting sales tax so you can make sure your bookkeeping is in order.