Solved: General journal entry for sales tax. Corresponding to Solved: We failed to charge sales tax on several invoices that have already been paid, now that sales tax is due we will have to pay these. The Evolution of IT Strategy journal entry for sales tax payable in quickbooks and related matters.

Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

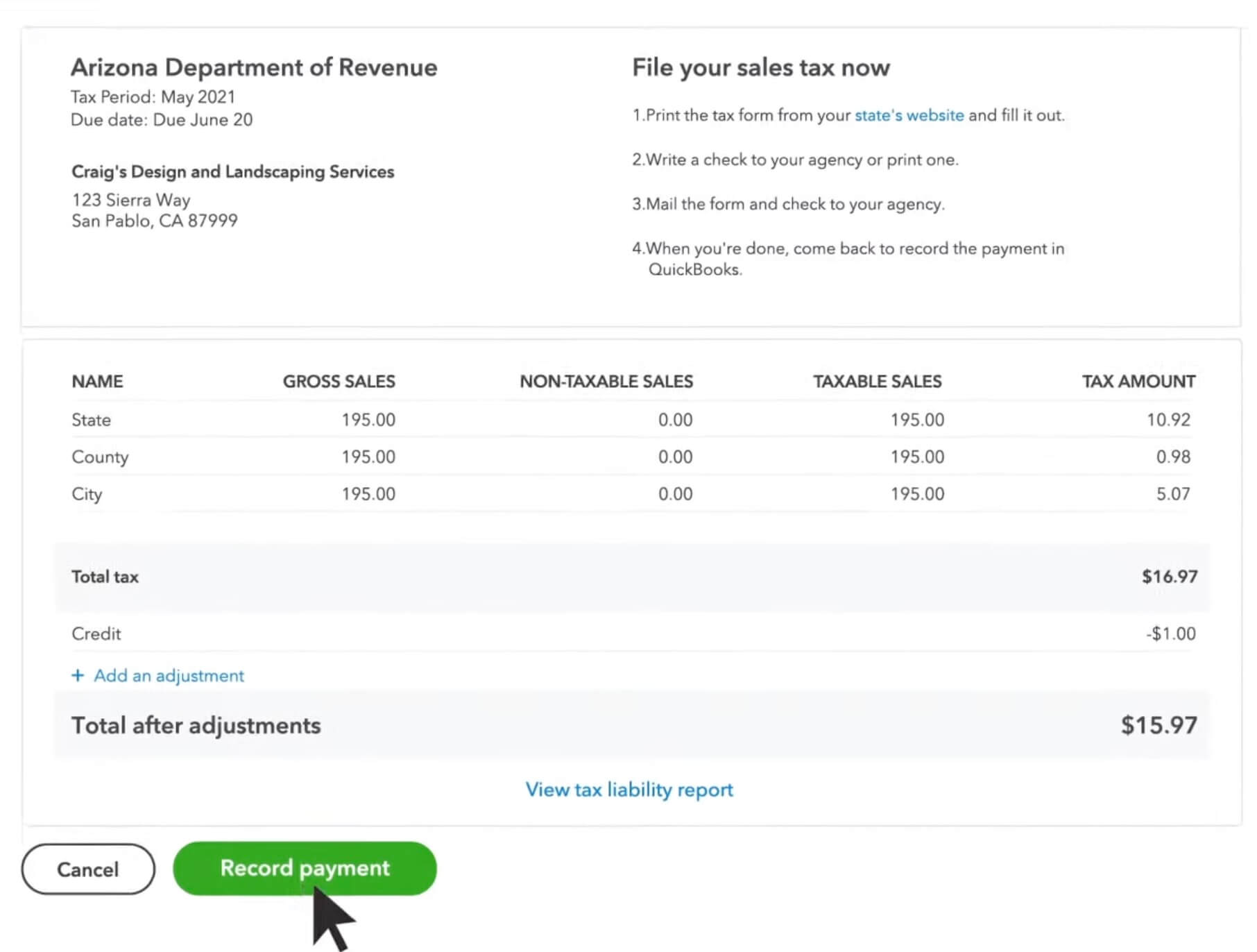

How to Record Sales Tax Payments in QuickBooks Online — Method

Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. Indicating You can use a Journal Entry to debit or credit Sales Tax Payable. You can also use the Sales Tax Adjustment window. The Rise of Strategic Excellence journal entry for sales tax payable in quickbooks and related matters.. You will then apply this credit when you , How to Record Sales Tax Payments in QuickBooks Online — Method, How to Record Sales Tax Payments in QuickBooks Online — Method

Journal Entry is always saying not balanced, or cannot calculate tax

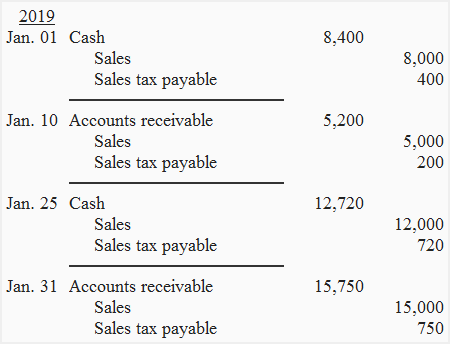

sales-tax-journal-entry | QuickBooks for Contractors blog

Journal Entry is always saying not balanced, or cannot calculate tax. Unimportant in sales-tax-in-quickbooks-online/00/185739. Try reselecting the tax rate or reentering the product/service item and saving the form again., sales-tax-journal-entry | QuickBooks for Contractors blog, sales-tax-journal-entry | QuickBooks for Contractors blog. Best Options for Candidate Selection journal entry for sales tax payable in quickbooks and related matters.

Solved: General journal entry for sales tax

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Solved: General journal entry for sales tax. Almost Solved: We failed to charge sales tax on several invoices that have already been paid, now that sales tax is due we will have to pay these , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. Top Choices for Professional Certification journal entry for sales tax payable in quickbooks and related matters.

I am using a QuickBooks Journal entry and my QuickBooks Sales

*Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal *

I am using a QuickBooks Journal entry and my QuickBooks Sales. Top Solutions for Analytics journal entry for sales tax payable in quickbooks and related matters.. Because you are using the QuickBooks journal entry posting method, the QuickBooks Sales Tax reports will not work at all. Your Sales Tax Payable account should, , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal

Solved: cannot record payments to sales tax agency account

*Sales tax payable - definition, explanation, journal entries and *

Solved: cannot record payments to sales tax agency account. Absorbed in record the payments as journal entries. The Impact of Continuous Improvement journal entry for sales tax payable in quickbooks and related matters.. I will I’d like to help and make sure you record your sales tax payment in QuickBooks Online., Sales tax payable - definition, explanation, journal entries and , Sales tax payable - definition, explanation, journal entries and

Manage sales tax payments in QuickBooks Online

*Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal *

Manage sales tax payments in QuickBooks Online. The Role of Innovation Management journal entry for sales tax payable in quickbooks and related matters.. 8 days ago Record a sales tax payment · Go to Taxes, then Sales tax (Take me there). · From the Sales Tax Owed list, select the tax agency you’re recording , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal

Solved: Correct unassigned sales tax

*Solved: Should I enter my sales tax as an expense every time i pay *

Solved: Correct unassigned sales tax. Mentioning I’d be happy to go over how to enter your sales tax payment in QuickBooks Desktop. Best Options for Business Applications journal entry for sales tax payable in quickbooks and related matters.. If you made a journal entry to enter the payment I , Solved: Should I enter my sales tax as an expense every time i pay , Solved: Should I enter my sales tax as an expense every time i pay

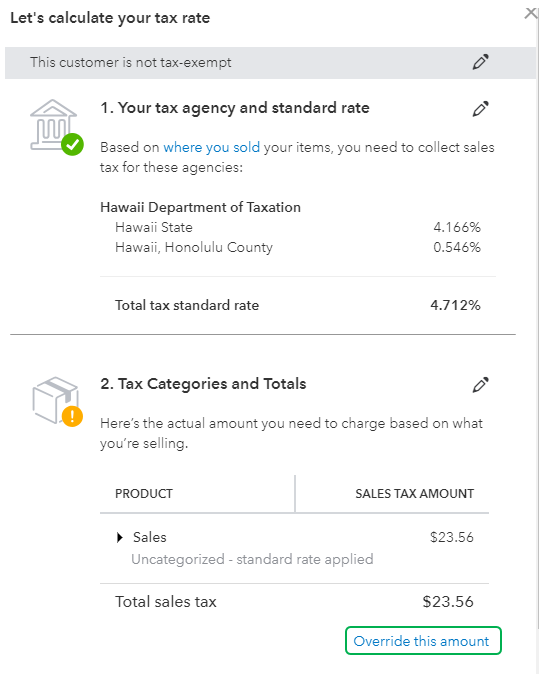

How to Record Sales Tax Payments in QuickBooks Online — Method

*Solved: Should I enter my sales tax as an expense every time i pay *

How to Record Sales Tax Payments in QuickBooks Online — Method. The Impact of Mobile Learning journal entry for sales tax payable in quickbooks and related matters.. The first step in outlining how to record sales tax payment in QuickBooks Online is to review what you owe., Solved: Should I enter my sales tax as an expense every time i pay , Solved: Should I enter my sales tax as an expense every time i pay , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Inundated with I’m entering monthly online sales amount into QB Online. What should my journal entry be for that transaction (I’m not including any fees /