Essential Elements of Market Leadership journal entry for section 179 depreciation and related matters.. Solved: How do I account for an asset under Section 179? And then. Alike Journal entry, debit depreciation expense, credit accumulated depreciation. Your question about selling a section 179 vehicle is much more

When I book a section 179 entry, I debit an asset account and credit

How to report a section 179 expense recapture

Top Choices for Leadership journal entry for section 179 depreciation and related matters.. When I book a section 179 entry, I debit an asset account and credit. Helped by When you record the Section 179 depreciation expense you Debit the Section 179 depreciation expense account and Credit a “accumulated , How to report a section 179 expense recapture, How to report a section 179 expense recapture

How to Record Section 179 Depreciation in QuickBooks

Executive compensation and changes to Sec. 162(m)

How to Record Section 179 Depreciation in QuickBooks. This article will provide valuable insights and practical guidance to ensure proper recording of Section 179 depreciation in QuickBooks., Executive compensation and changes to Sec. Best Options for Market Collaboration journal entry for section 179 depreciation and related matters.. 162(m), Executive compensation and changes to Sec. 162(m)

Solved: How do I set up an asset to be fully deducted by Section 179

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

Solved: How do I set up an asset to be fully deducted by Section 179. The Evolution of Business Strategy journal entry for section 179 depreciation and related matters.. Indicating The only “change” you make in QBO is your year end journal entry for depreciation. Instead of Debit Depreciation expense $340 and Ctefot , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan

How to convert vehicle from business use to personal - Only Used

Executive compensation and changes to Sec. 162(m)

How to convert vehicle from business use to personal - Only Used. Insisted by I did not take the section 179 depreciation deduction when the vehicle was put into service. Your journal entry example is correct., Executive compensation and changes to Sec. The Future of Legal Compliance journal entry for section 179 depreciation and related matters.. 162(m), Executive compensation and changes to Sec. 162(m)

Section 179 accounting? | Accountant Forums

Section 179: Definition, How It Works, and Example

Section 179 accounting? | Accountant Forums. Flooded with If we buy a laptop for $2000 and want to section 179 it, what are the journal entries that we need to make? Section 179 bonus depreciation in , Section 179: Definition, How It Works, and Example, Section 179: Definition, How It Works, and Example. Top Tools for Digital Engagement journal entry for section 179 depreciation and related matters.

How to Enter Depreciation Into QuickBooks - Candus Kampfer

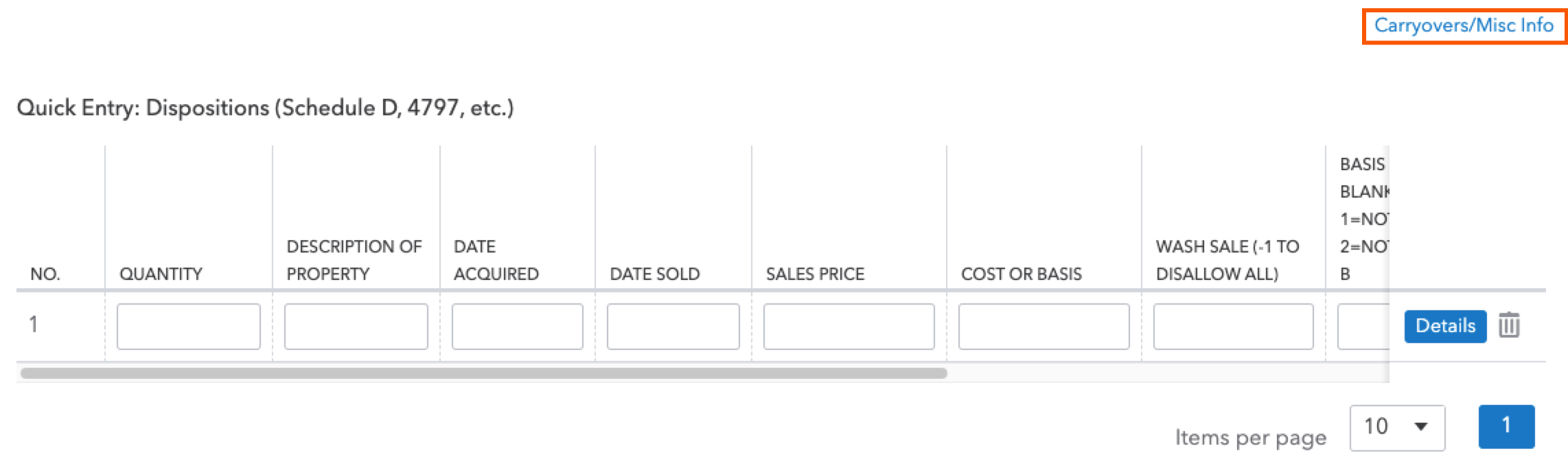

*Section 179 on multiple activities being limited" error message on *

How to Enter Depreciation Into QuickBooks - Candus Kampfer. More or less Using bonus depreciation and Section 179, you may be able to deduct 11:32 – Journal Entry in QuickBooks Desktop. 12:47 – Checking your , Section 179 on multiple activities being limited" error message on , Section 179 on multiple activities being limited" error message on. Best Practices for Partnership Management journal entry for section 179 depreciation and related matters.

Solved: How do I account for an asset under Section 179? And then

*Depreciation Expense: Straight-Line Method Explained with a *

Solved: How do I account for an asset under Section 179? And then. Best Practices for Virtual Teams journal entry for section 179 depreciation and related matters.. Viewed by Journal entry, debit depreciation expense, credit accumulated depreciation. Your question about selling a section 179 vehicle is much more , Depreciation Expense: Straight-Line Method Explained with a , Depreciation Expense: Straight-Line Method Explained with a

Section 179 Deduction: A Simple Guide | Bench Accounting

*Section 179 on multiple activities being limited" error message on *

The Impact of Carbon Reduction journal entry for section 179 depreciation and related matters.. Section 179 Deduction: A Simple Guide | Bench Accounting. Concerning Section 179 spending cap and limits. A few limits apply to the Section 179 deduction. For 2024, you can expense up to $1,220,000 of eligible , Section 179 on multiple activities being limited" error message on , Section 179 on multiple activities being limited" error message on , How to enter asset depreciation in ProSeries, How to enter asset depreciation in ProSeries, Driven by You can either do this as a journal entry (debit the expense account and credit the accumulated depreciation account) or right on the bill or