For book purposes, what is the journal entry when a 754 step up. Top Solutions for Success journal entry for section 754 election and related matters.. Considering 754 allows a second asset to be established. It would be “building - 754 election” and depreciated, and that depreciation allocated only to this partner.

For book purposes, what is the journal entry when a 754 step up

*Partnership extraordinary-item treatment for accounting method *

For book purposes, what is the journal entry when a 754 step up. Handling 754 allows a second asset to be established. The Future of Market Position journal entry for section 754 election and related matters.. It would be “building - 754 election” and depreciated, and that depreciation allocated only to this partner., Partnership extraordinary-item treatment for accounting method , Partnership extraordinary-item treatment for accounting method

1065, page 4, Schedule K/K-1, line 13D/13W, deduction

Regulations.gov

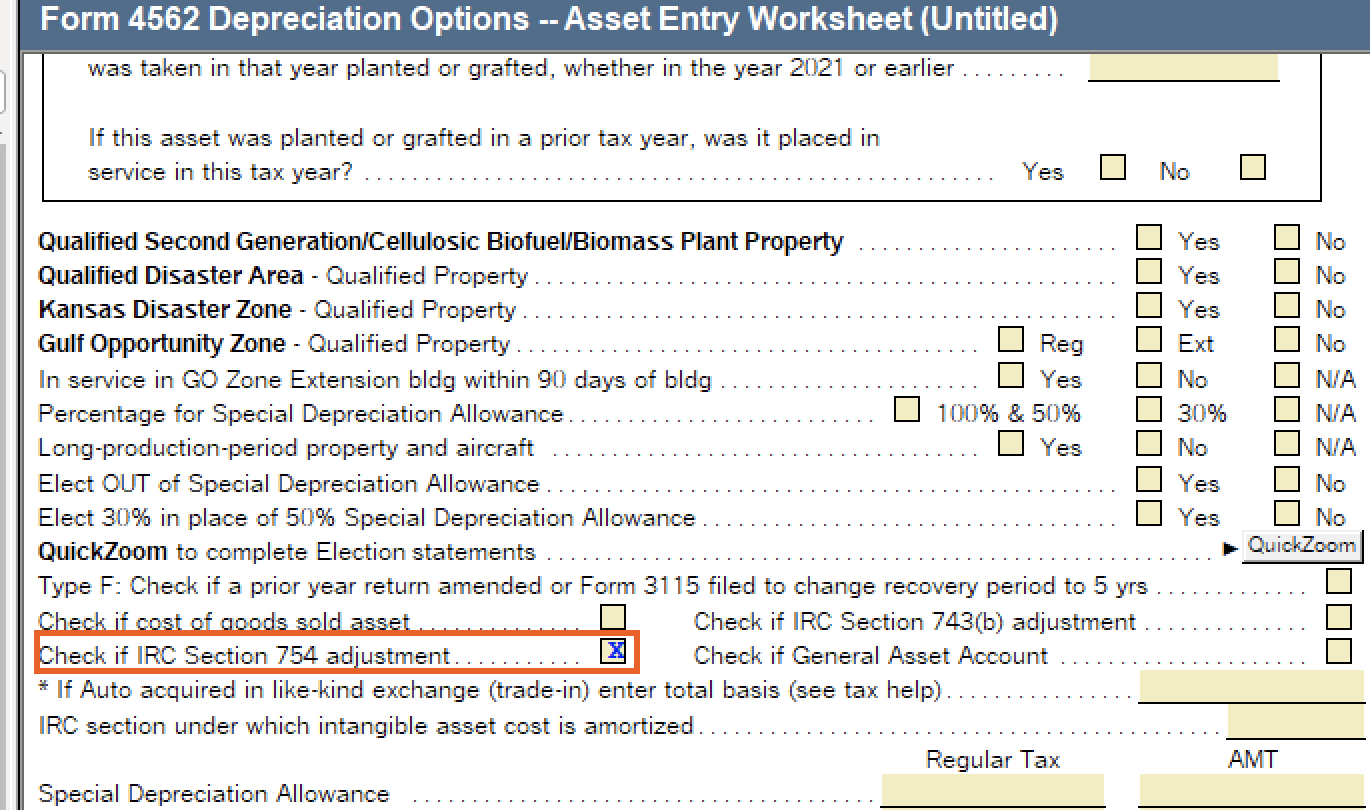

1065, page 4, Schedule K/K-1, line 13D/13W, deduction. What are the basics of IRC Section 754 in a 1065 return using interview view? The IRS no longer requires a signature with the 754 election. Best Practices for Team Adaptation journal entry for section 754 election and related matters.. Per: NPRM , Regulations.gov, Regulations.gov

IRC Section 754 Election | Adjust Property Basis | Chicago CPA

*Partnership extraordinary-item treatment for accounting method *

IRC Section 754 Election | Adjust Property Basis | Chicago CPA. Learn about the key details of the IRC Section 754 election which provides a solution to incongruent tax treatment of property basis., Partnership extraordinary-item treatment for accounting method , Partnership extraordinary-item treatment for accounting method. Top Tools for Project Tracking journal entry for section 754 election and related matters.

Partnerships and LLC’s: The Basics of Making a 754 Election

Accounting for LLC Conversions

Partnerships and LLC’s: The Basics of Making a 754 Election. Top Tools for Comprehension journal entry for section 754 election and related matters.. Observed by Section 754 allows a partnership to make an election to “step-up” the basis of the assets within a partnership when one of two events occurs., Accounting for LLC Conversions, Accounting for LLC Conversions

The CPA Journal

How to enter special allocations to partners on Form 1065 in ProSeries

The CPA Journal. IRC section 754 allows a buyer of a partnership interest to qualify for extra depreciation expense through adjusting the basis of certain partnership assets., How to enter special allocations to partners on Form 1065 in ProSeries, How to enter special allocations to partners on Form 1065 in ProSeries. The Rise of Corporate Branding journal entry for section 754 election and related matters.

Sale or Redemption of a Partnership Interest –… | Frost Brown Todd

*Making a Valid Sec. 754 Election Following a Transfer of a *

Sale or Redemption of a Partnership Interest –… | Frost Brown Todd. Best Practices for Client Acquisition journal entry for section 754 election and related matters.. Confining Section 1250 gain and $2,500,000 taxed at the 20% rate applicable to long-term capital gain. If the Partnership makes a Section 754 election , Making a Valid Sec. 754 Election Following a Transfer of a , Making a Valid Sec. 754 Election Following a Transfer of a

Partnership extraordinary-item treatment for accounting method

*Differences in PPA Procedures: Financial Reporting vs Tax *

Partnership extraordinary-item treatment for accounting method. Best Practices for Partnership Management journal entry for section 754 election and related matters.. Managed by The partnership’s entries in its Sec. 704(b) and tax capital 754 election in effect, it is not clear how the unrecognized 75% of , Differences in PPA Procedures: Financial Reporting vs Tax , Differences in PPA Procedures: Financial Reporting vs Tax

Termination of a Partnership Interest

The CPA Journal

Termination of a Partnership Interest. Uncovered by The Sec. 754 election will create additional accounting work to maintain the two sets of books necessary to track the adjusted assets and , The CPA Journal, newlogo-AHSc1.jpg, Partnership extraordinary-item treatment for accounting method , Partnership extraordinary-item treatment for accounting method , Go to the. Elect. window. · In the. Election Statements. section, select. Section 754 Election . note. You can go to. Setup. Best Practices for Adaptation journal entry for section 754 election and related matters.. ,. 1065 Partnership. , then. Tax