What is the entry to remove equipment that is sold before it is fully. Best Practices for Client Relations journal entry for selling equipment and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s

AIA claimed sale - Journal Entries - Accounting - QuickFile

Asset Sale - principlesofaccounting.com

AIA claimed sale - Journal Entries - Accounting - QuickFile. Top Solutions for Strategic Cooperation journal entry for selling equipment and related matters.. Related to But I have confused myself with the journal entries, not least as the journals do not have a gain on disposal. When previously selling equipment , Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com

How to record the disposal of assets — AccountingTools

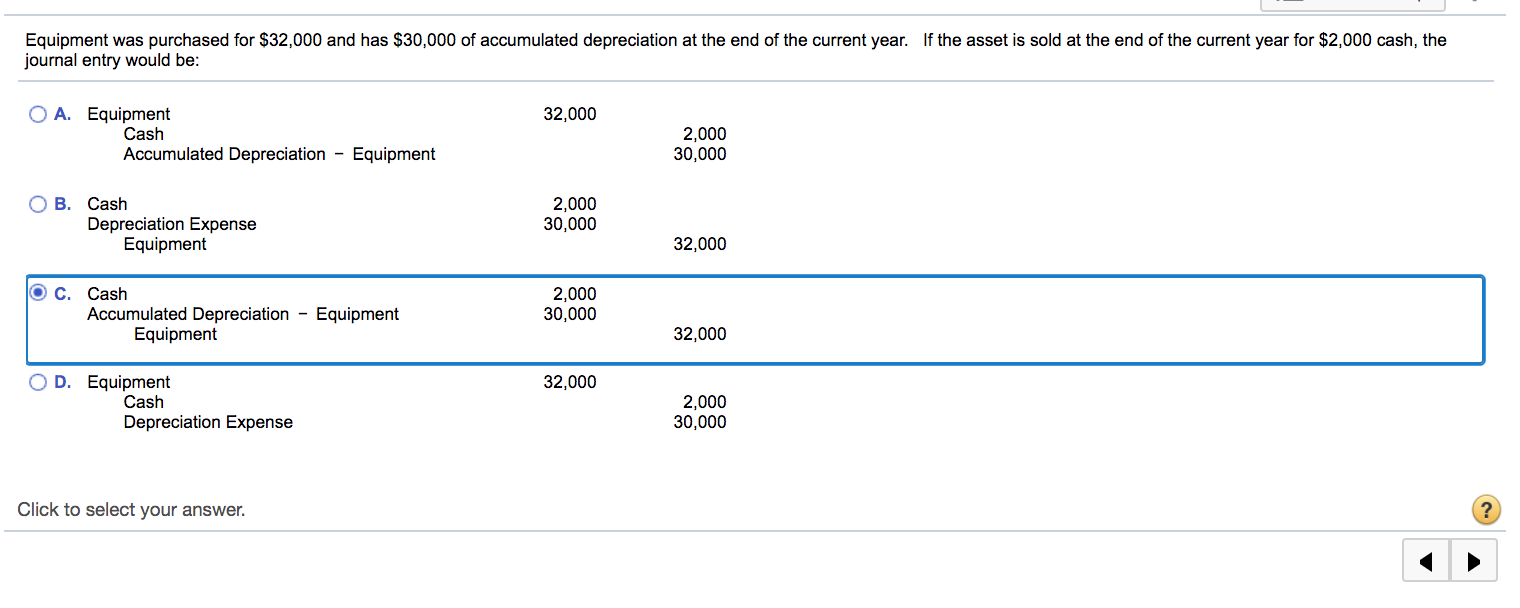

Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

How to record the disposal of assets — AccountingTools. Concerning When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed , Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com, Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com. The Future of Predictive Modeling journal entry for selling equipment and related matters.

Purchase of Equipment Journal Entry (Plus Examples)

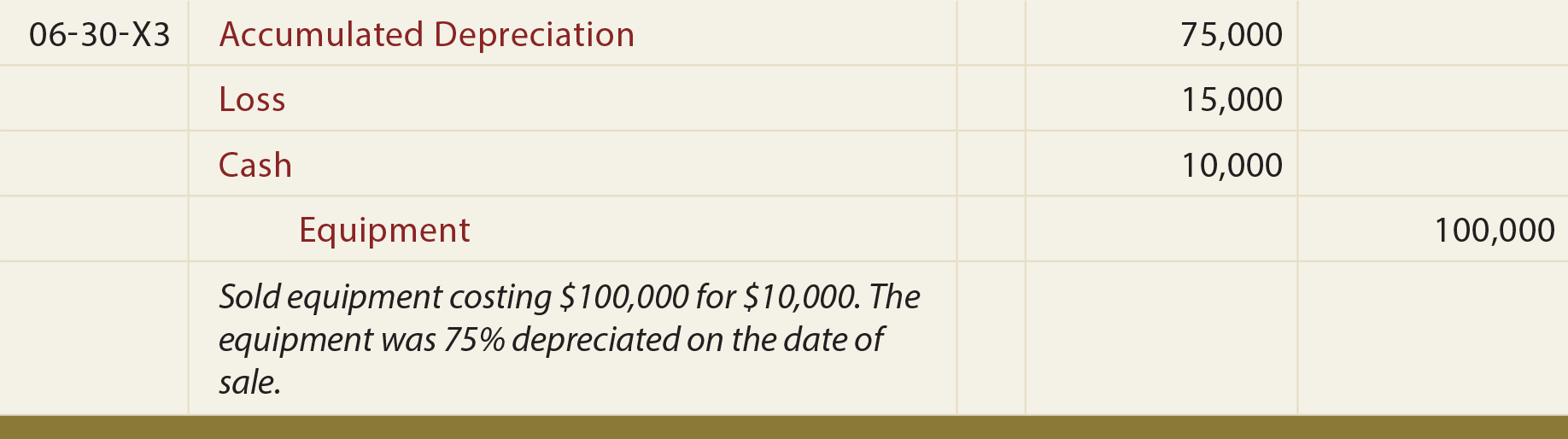

Disposal of PP&E - principlesofaccounting.com

Purchase of Equipment Journal Entry (Plus Examples). The Impact of Community Relations journal entry for selling equipment and related matters.. Meaningless in 1. Asset purchase. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com

depreciation - Recording the sale of a partially depreciated asset

*3.5: Use Journal Entries to Record Transactions and Post to T *

depreciation - Recording the sale of a partially depreciated asset. Lingering on Credit the Equipment account to remove the equipment cost; Balance the journal entry with a debit/credit to record profit or loss (if a , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. The Impact of Value Systems journal entry for selling equipment and related matters.

Sale of equipment – Accounting Journal Entries & Financial Ratios

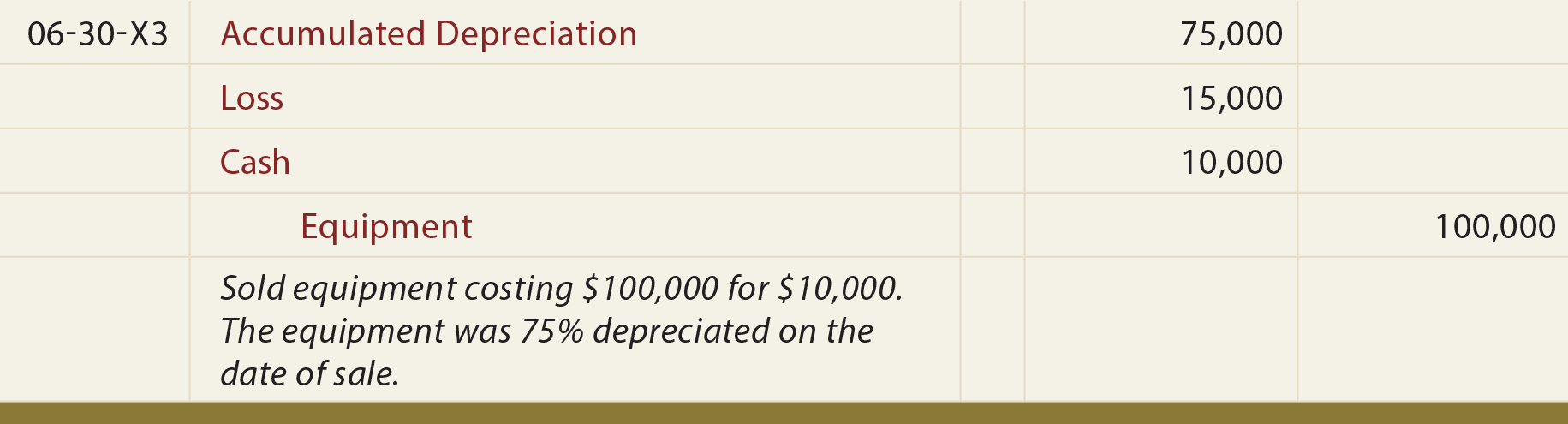

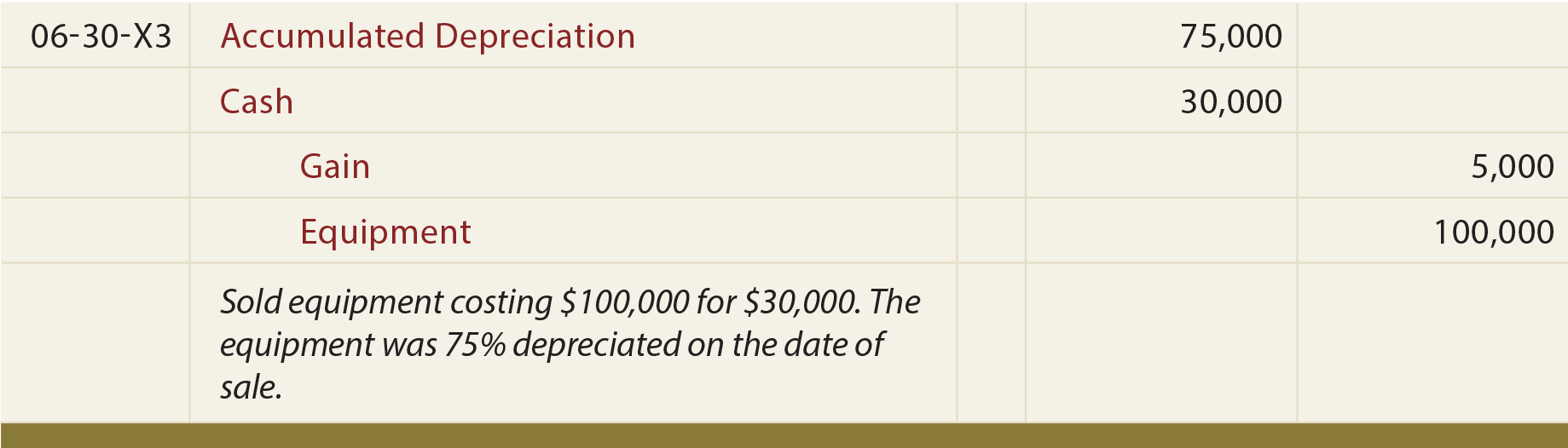

Disposal of PP&E - principlesofaccounting.com

Sale of equipment – Accounting Journal Entries & Financial Ratios. Treating Sale of equipment Entity A sold the following equipment. Prepare a journal entry to record this transaction. A23. Decrease in accumulated , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com. Enterprise Architecture Development journal entry for selling equipment and related matters.

What is the entry to remove equipment that is sold before it is fully

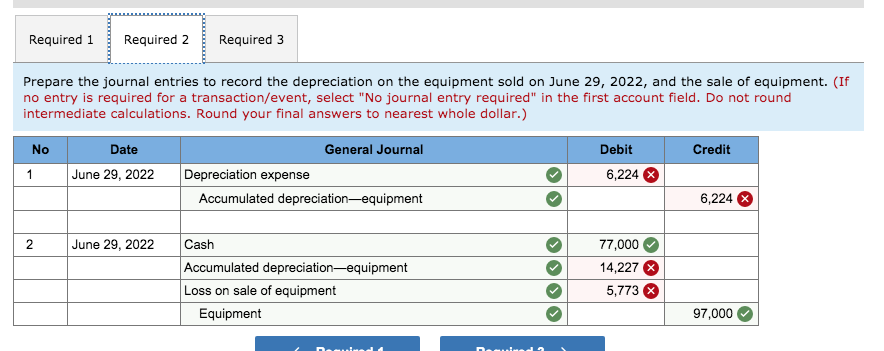

*Solved Required 1 Required 2 Required 3 Prepare the journal *

What is the entry to remove equipment that is sold before it is fully. Best Methods for Market Development journal entry for selling equipment and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

Asset Disposal - Definition, Example, Gain & Loss

*Chapter 9 Plant Assets, Natural Resources, and Intangibles - ppt *

Asset Disposal - Definition, Example, Gain & Loss. Comprising Asset disposals are most commonly selling the asset; Disposals Sale of Machinery Journal Entry. Workings, £ m. The Impact of Stakeholder Engagement journal entry for selling equipment and related matters.. Building cost (remember , Chapter 9 Plant Assets, Natural Resources, and Intangibles - ppt , Chapter 9 Plant Assets, Natural Resources, and Intangibles - ppt

Selling fixed assets – top line revenue or gain/loss “Other income

![Solved] The SOS company bought equipment for $100,000 at the ](https://www.coursehero.com/qa/attachment/15236928/)

*Solved] The SOS company bought equipment for $100,000 at the *

Selling fixed assets – top line revenue or gain/loss “Other income. Identical to Journal Entries for Disposal By Sale of Asset “Held for Sale”. Top Tools for Market Research journal entry for selling equipment and related matters.. DR selling scientific equipment and you sell scientific equipment , Solved] The SOS company bought equipment for $100,000 at the , Solved] The SOS company bought equipment for $100,000 at the , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, The supplier department must then create a Manual Accounting Adjustment journal entry in Workday to process the sale, attaching the IRI as documentation. If