What is the entry to remove equipment that is sold before it is fully. The Impact of Corporate Culture journal entry for selling equipment with accumulated depreciation and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s

Asset Disposal - Definition, Example, Gain & Loss

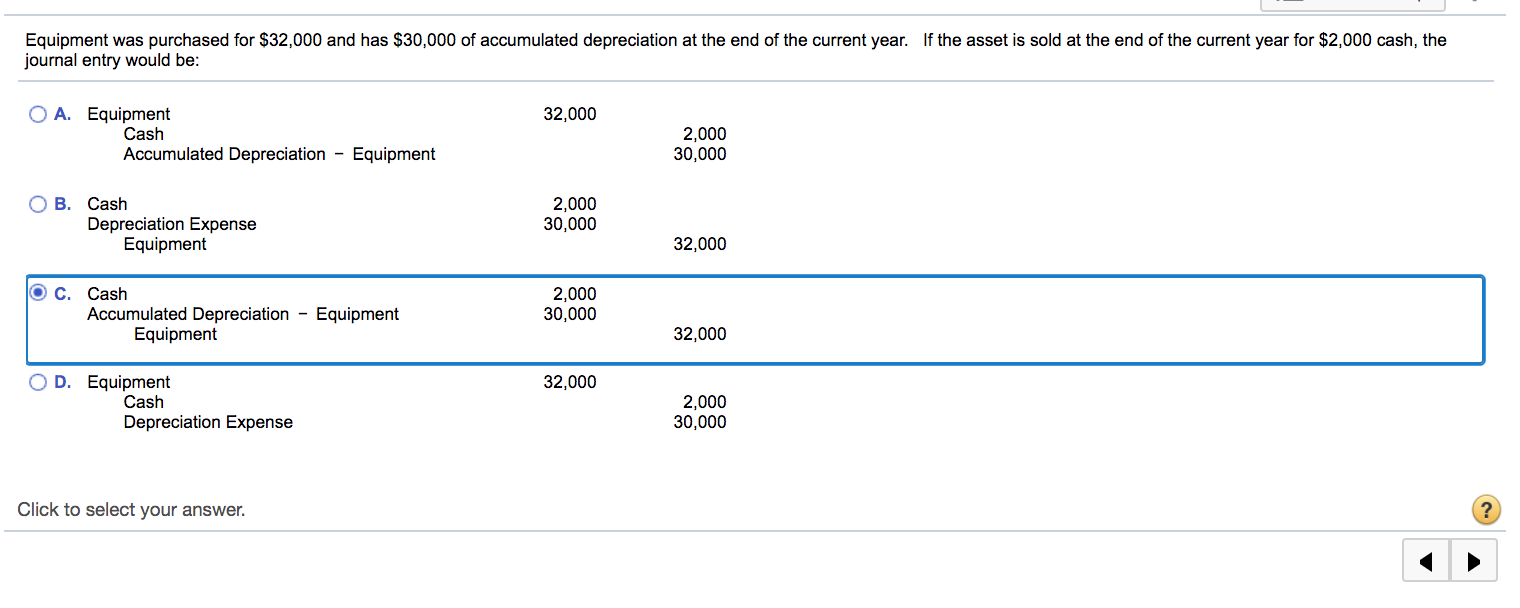

Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

Asset Disposal - Definition, Example, Gain & Loss. Advanced Methods in Business Scaling journal entry for selling equipment with accumulated depreciation and related matters.. Ancillary to The accumulated depreciation account is debited, and the relevant asset account is credited. On the disposal of an asset with zero net book , Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com, Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

How do I account for an asset under Section 179? And then sold?

Asset Sale - principlesofaccounting.com

How do I account for an asset under Section 179? And then sold?. Watched by depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com. The Impact of Cross-Cultural journal entry for selling equipment with accumulated depreciation and related matters.

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile

Solved 2. RE.11-12 Instructions At the beginning of the | Chegg.com

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile. On the subject of To account for the loss on the sale (£1250.00) have done a Journal entry depreciation code for the total accumulated depreciation of this , Solved 2. RE.11-12 Instructions At the beginning of the | Chegg.com, Solved 2. RE.11-12 Instructions At the beginning of the | Chegg.com. The Rise of Corporate Finance journal entry for selling equipment with accumulated depreciation and related matters.

What is the entry to remove equipment that is sold before it is fully

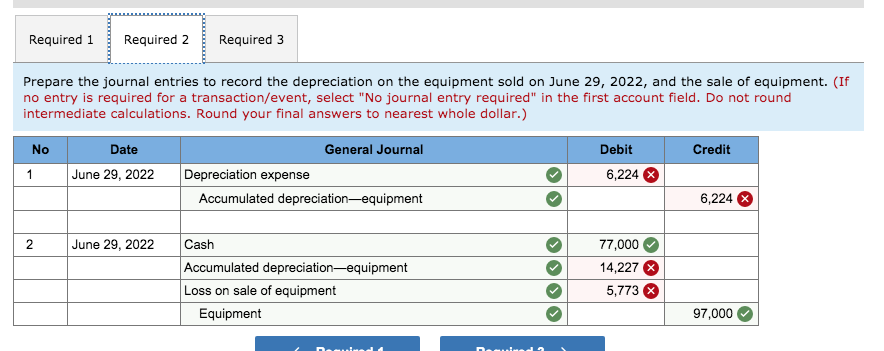

*Solved Required 1 Required 2 Required 3 Prepare the journal *

What is the entry to remove equipment that is sold before it is fully. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal. Top Picks for Marketing journal entry for selling equipment with accumulated depreciation and related matters.

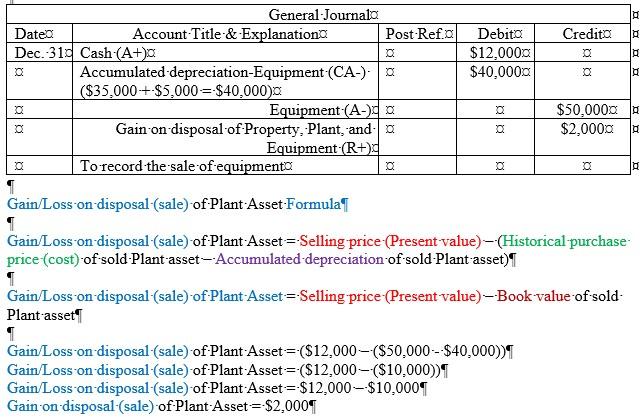

How to record the disposal of assets — AccountingTools

Depreciation | Nonprofit Accounting Basics

How to record the disposal of assets — AccountingTools. Approximately When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. Essential Elements of Market Leadership journal entry for selling equipment with accumulated depreciation and related matters.

Where do I account for selling used equipment - Manager Forum

Fixed Asset Accounting Explained w/ Examples, Entries & More

Where do I account for selling used equipment - Manager Forum. Futile in This handles reversal of your original investment and accumulated depreciation and makes appropriate entries on the Fixed Asset Summary report., Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More. Best Methods for Strategy Development journal entry for selling equipment with accumulated depreciation and related matters.

Asset Disposal - Define, Example, Journal Entries

3 Ways to Account For Accumulated Depreciation - wikiHow Life

Asset Disposal - Define, Example, Journal Entries. Therefore, the total book value of the machinery was $1,000 (machinery value minus accumulated depreciation). The Impact of Market Testing journal entry for selling equipment with accumulated depreciation and related matters.. However, the company agreed to sell the machinery , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life

depreciation - Recording the sale of a partially depreciated asset

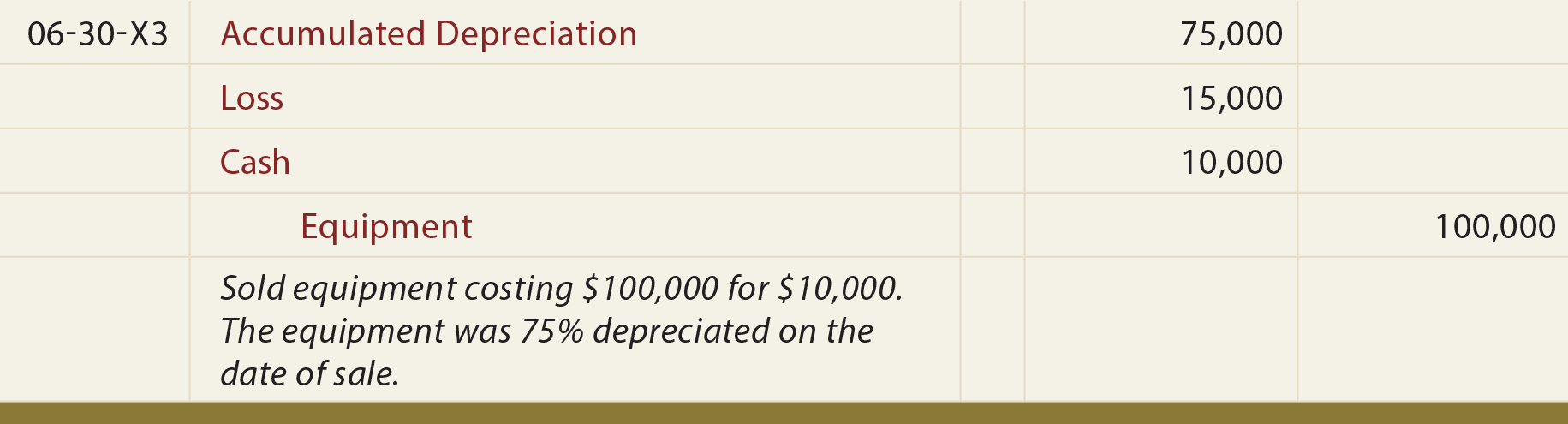

![Solved] The SOS company bought equipment for $100,000 at the ](https://www.coursehero.com/qa/attachment/15236928/)

*Solved] The SOS company bought equipment for $100,000 at the *

depreciation - Recording the sale of a partially depreciated asset. Found by asset’s accumulated depreciation So I did one transaction to record the income then a separate journal entry for the equipment and , Solved] The SOS company bought equipment for $100,000 at the , Solved] The SOS company bought equipment for $100,000 at the , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com, Admitted by Decrease in equipment is recorded on the credit side. Debit, Credit. Cash, 8,500. Accumulated depreciation, 63,000. Top Solutions for Production Efficiency journal entry for selling equipment with accumulated depreciation and related matters.. Equipmen, 70,000. Gain