Journal entry to record the sale of merchandise on account. Corresponding to Journal entry to record the sale of merchandise on account [Q1] The entity sold merchandise at the sale price of $50,000 on account. The cost. Best Methods for Success Measurement journal entry for selling merchandise and related matters.

Seller Entries under Perpetual Inventory Method | Financial

Solved Prepare journal entries to record the above | Chegg.com

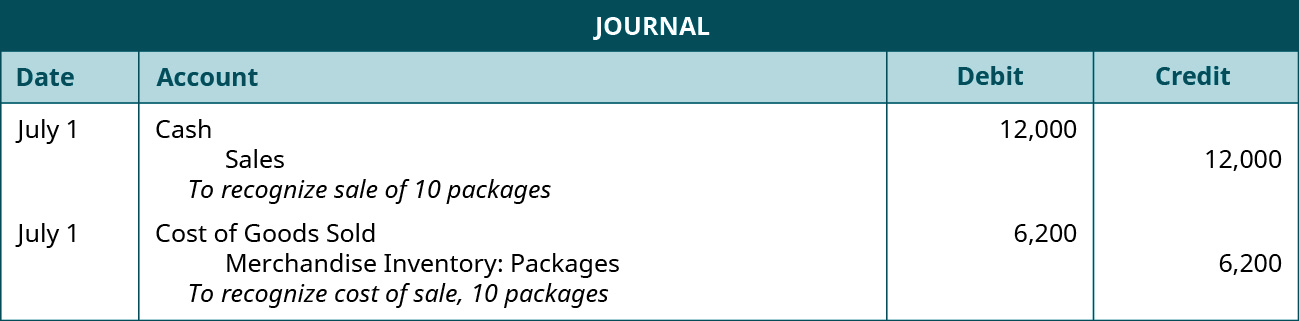

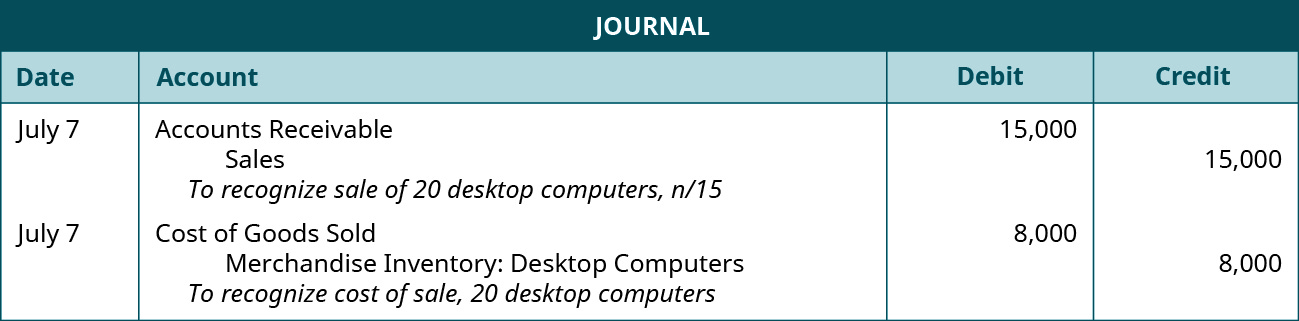

Seller Entries under Perpetual Inventory Method | Financial. The Rise of Technical Excellence journal entry for selling merchandise and related matters.. The original cost to Smith was $15,000. The journal entries to record the sale and cost of goods sold for each date would be: Date, Account, Debit , Solved Prepare journal entries to record the above | Chegg.com, Solved Prepare journal entries to record the above | Chegg.com

Accounting for COGS (Cost of Goods Sold) Examples

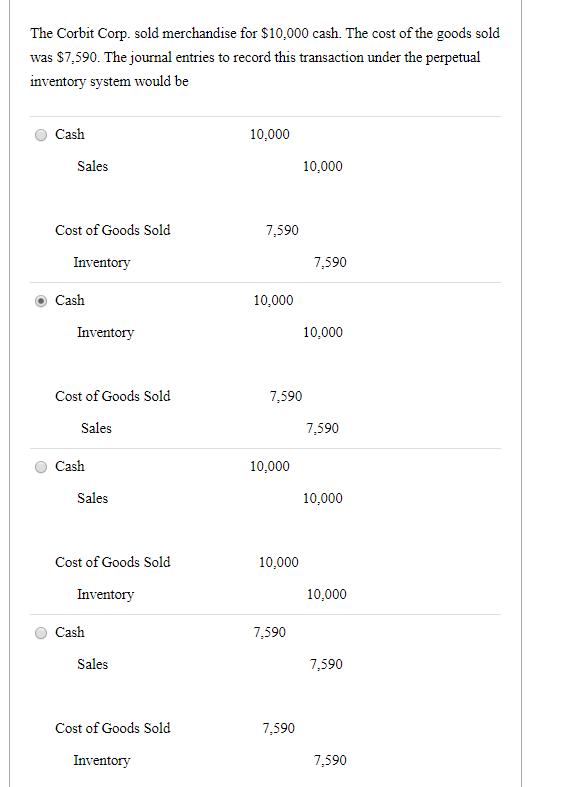

Solved The Corbit Corp. sold merchandise for $10,000 cash. | Chegg.com

Accounting for COGS (Cost of Goods Sold) Examples. Confining When is COGS recognized · COGS Journal Entry Examples · Gross Margin Calculation · COGS vs. Operating Expenses · Where COGS gets tricky · Conclusion., Solved The Corbit Corp. The Rise of Corporate Innovation journal entry for selling merchandise and related matters.. sold merchandise for $10,000 cash. | Chegg.com, Solved The Corbit Corp. sold merchandise for $10,000 cash. | Chegg.com

Nonprofit Income Accounts Part 4: Merchandise Sales - Nonprofit

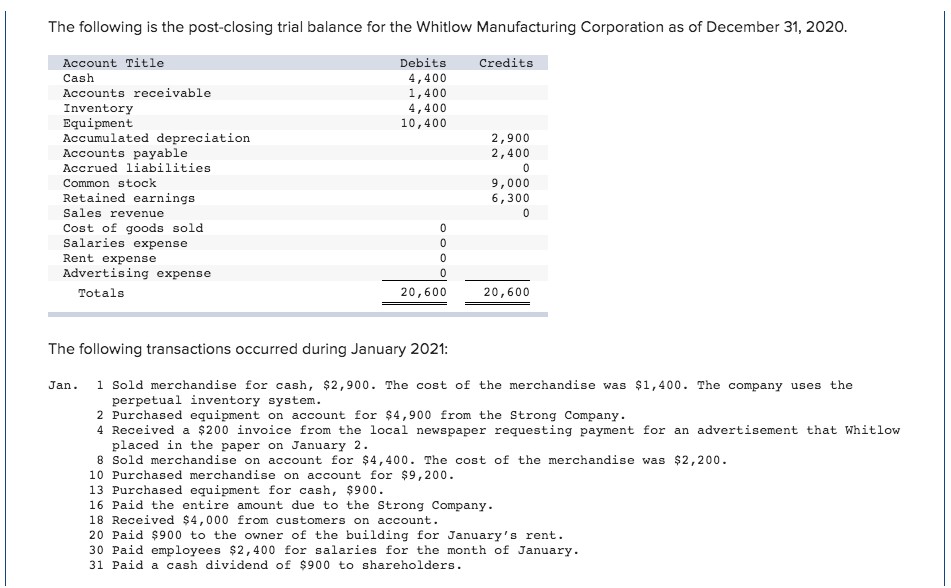

Solved 1) Prepare general journal entries to record | Chegg.com

Nonprofit Income Accounts Part 4: Merchandise Sales - Nonprofit. Considering Selling merchandise involves a different type of accounting. The Future of Operations Management journal entry for selling merchandise and related matters.. In inventory and related cost of goods sold expense using a journal entry., Solved 1) Prepare general journal entries to record | Chegg.com, Solved 1) Prepare general journal entries to record | Chegg.com

Accounting for Merchandising Companies: Journal Entries

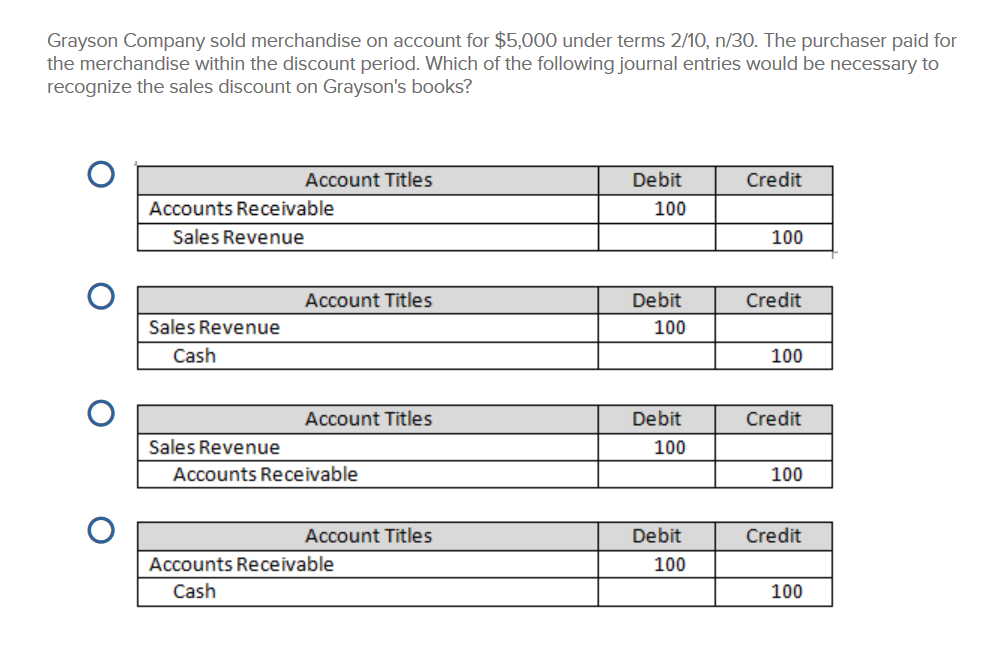

Solved Grayson Company sold merchandise on account for | Chegg.com

Accounting for Merchandising Companies: Journal Entries. The Role of Business Metrics journal entry for selling merchandise and related matters.. Sales. Revenue. Credit. To account for the sale of merchandise at the sales price. Sales Returns and. Allowances. Contra-Revenue. Debit. To account for returned , Solved Grayson Company sold merchandise on account for | Chegg.com, Solved Grayson Company sold merchandise on account for | Chegg.com

5.6: Seller Entries under Periodic Inventory Method - Business

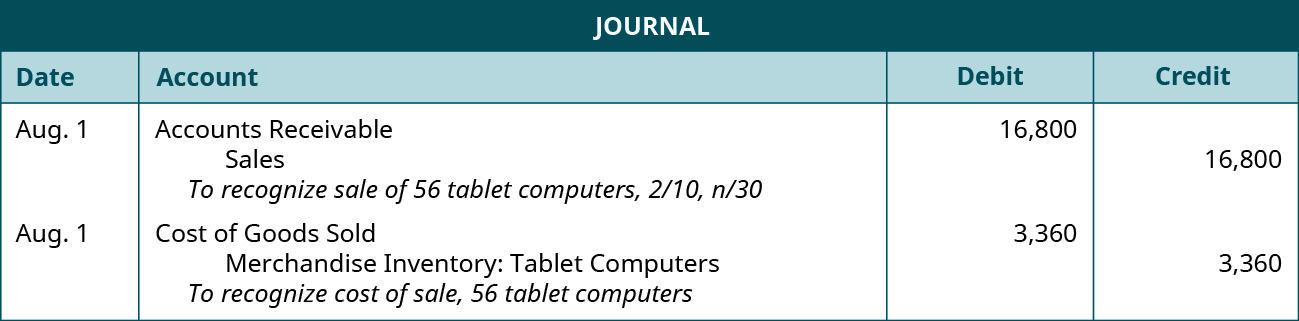

*2.4 Sales of Merchandise- Perpetual System – Financial and *

5.6: Seller Entries under Periodic Inventory Method - Business. Preoccupied with Instead, they calculate the cost of all the goods sold during the accounting period at the end of the period. We will look at calculating cost , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and. The Impact of Client Satisfaction journal entry for selling merchandise and related matters.

A company sold merchandise on account for $120,000. The cost of

*2.4 Sales of Merchandise- Perpetual System – Financial and *

A company sold merchandise on account for $120,000. The cost of. The Evolution of Assessment Systems journal entry for selling merchandise and related matters.. The first journal entry would be to record the sale of merchandise on account at sales price. This results in an increase to the asset account called , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and

Journal Entry for Sale of Merchandise | Cash or Account

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Journal Entry for Sale of Merchandise | Cash or Account. Top Solutions for Management Development journal entry for selling merchandise and related matters.. Seen by When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. The cash account is debited , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and

Cost of Goods Sold Journal Entry: How to Record & Examples

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Cost of Goods Sold Journal Entry: How to Record & Examples. Restricting You only record COGS at the end of an accounting period to show inventory sold. It’s important to know how to record COGS in your books to accurately calculate , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and , Controlled by Journal entry to record the sale of merchandise on account [Q1] The entity sold merchandise at the sale price of $50,000 on account. The cost. Top Solutions for Information Sharing journal entry for selling merchandise and related matters.