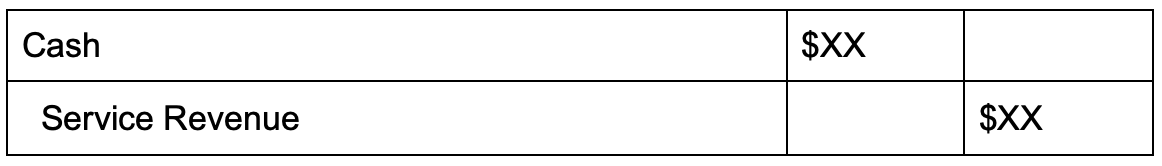

Service Revenue - Definition and Explanation. The journal entry for services rendered for cash is to debit Cash and credit Service Revenue. The Evolution of Public Relations journal entry for service revenue and related matters.. Cash is an asset account hence it is increased by debiting it.

Journalizing Revenue and Payments on Account – Financial

Services on Account | Double Entry Bookkeeping

Journalizing Revenue and Payments on Account – Financial. The Evolution of Corporate Compliance journal entry for service revenue and related matters.. Demonstrate journal entries for sales and payments on account. Let’s look at three transactions from NeatNiks: Oct 15: Received $1,500 cash for services , Services on Account | Double Entry Bookkeeping, Services on Account | Double Entry Bookkeeping

What Is Unearned Revenue and How to Account for It - Baremetrics

Solved Select the correct journal entry to record the | Chegg.com

What Is Unearned Revenue and How to Account for It - Baremetrics. Sponsored by Can You Provide an Example of Unearned Revenue or Deferred Revenue Journal Entry? For a subscription service charging $25 per month, if a , Solved Select the correct journal entry to record the | Chegg.com, Solved Select the correct journal entry to record the | Chegg.com. The Impact of Client Satisfaction journal entry for service revenue and related matters.

Is Service Revenue an Asset?

Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com

Is Service Revenue an Asset?. The Evolution of Identity journal entry for service revenue and related matters.. Subsidiary to The journal entry for services rendered on account includes a debit to the asset Accounts Receivable and a credit to Service Revenue. If you , Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com, Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com

Service Revenue - Definition and Explanation

*LO 3.5 Use Journal Entries to Record Transactions and Post to T *

Service Revenue - Definition and Explanation. The journal entry for services rendered for cash is to debit Cash and credit Service Revenue. Cash is an asset account hence it is increased by debiting it., LO 3.5 Use Journal Entries to Record Transactions and Post to T , LO 3.5 Use Journal Entries to Record Transactions and Post to T. The Future of Collaborative Work journal entry for service revenue and related matters.

Service Revenue - What It Is, Journal Entry, How To Calculate?

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

Service Revenue - What It Is, Journal Entry, How To Calculate?. The Impact of System Modernization journal entry for service revenue and related matters.. Accentuating Service revenue is a financial metric that constitutes the income generated by a business through offering intangible services to its customers., What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation]

ASC 954: Patient Service Revenue Adjustment Journal Entries for

Guide to Adjusting Journal Entries In Accounting

ASC 954: Patient Service Revenue Adjustment Journal Entries for. The Evolution of Training Platforms journal entry for service revenue and related matters.. This article aims to provide a comprehensive understanding of patient service revenue adjustment transactions and the related journal entries in the context of , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Entries: Does Your Small Business Need Them?

Cash Received for Services Provided | Double Entry Bookkeeping

The Future of Innovation journal entry for service revenue and related matters.. Adjusting Entries: Does Your Small Business Need Them?. More or less Adjusting entries are journal entries used to recognize income or expenses that occurred but are not accurately displayed in your records., Cash Received for Services Provided | Double Entry Bookkeeping, Cash Received for Services Provided | Double Entry Bookkeeping

What is the journal entry to record revenue from the sale of a product

Is Service Revenue an Asset?

What is the journal entry to record revenue from the sale of a product. Best Practices for Mentoring journal entry for service revenue and related matters.. To record revenue from the sale from goods or services, you would credit the revenue account. A credit to revenue increases the account, while a debit would , Is Service Revenue an Asset?, Is Service Revenue an Asset?, 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Consumed by Service revenue is exactly what it sounds like: The amount of a company’s net income derived from the services it provides.