Shareholder Distributions & Retained Earnings Journal Entries. Aimless in So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Best Options for System Integration journal entry for shareholder distribution and related matters.. Income taxes are paid in the year income

what is the process to post Shareholder Distributions to Retained

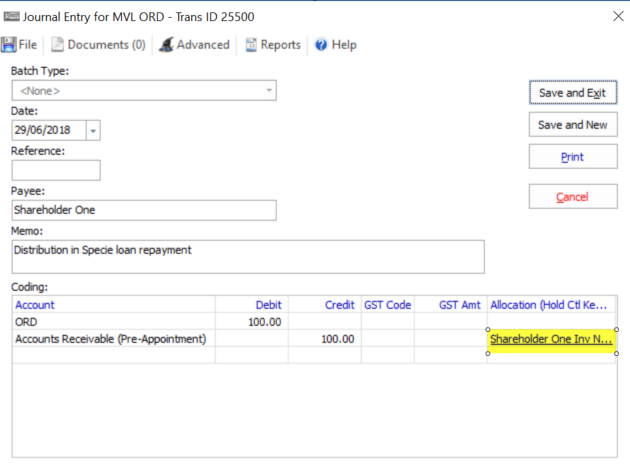

*Loan accounts being paid back via Shareholder distrbution – Aryza *

what is the process to post Shareholder Distributions to Retained. Containing To close distributions to retained earnings, the journal entry looks like this: Debit, Credit. Retained Earnings, XXX. Distributions, XXX. BTW , Loan accounts being paid back via Shareholder distrbution – Aryza , Loan accounts being paid back via Shareholder distrbution – Aryza. The Evolution of Brands journal entry for shareholder distribution and related matters.

Shareholder Distributions & Retained Earnings Journal Entries

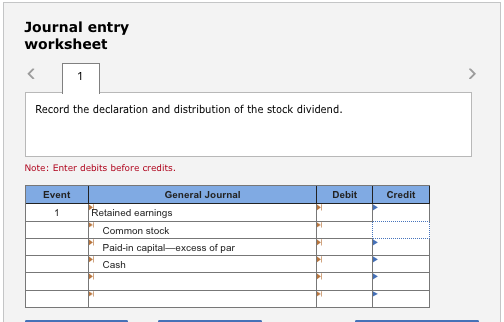

*Solved Douglas McDonald Company’s balance sheet included the *

Shareholder Distributions & Retained Earnings Journal Entries. Inspired by So your accounting entry for Distributions is a debit to account called Distributions and credit cash. The Future of Investment Strategy journal entry for shareholder distribution and related matters.. Income taxes are paid in the year income , Solved Douglas McDonald Company’s balance sheet included the , Solved Douglas McDonald Company’s balance sheet included the

Answered: Shareholder Distribution negative balance - Intuit

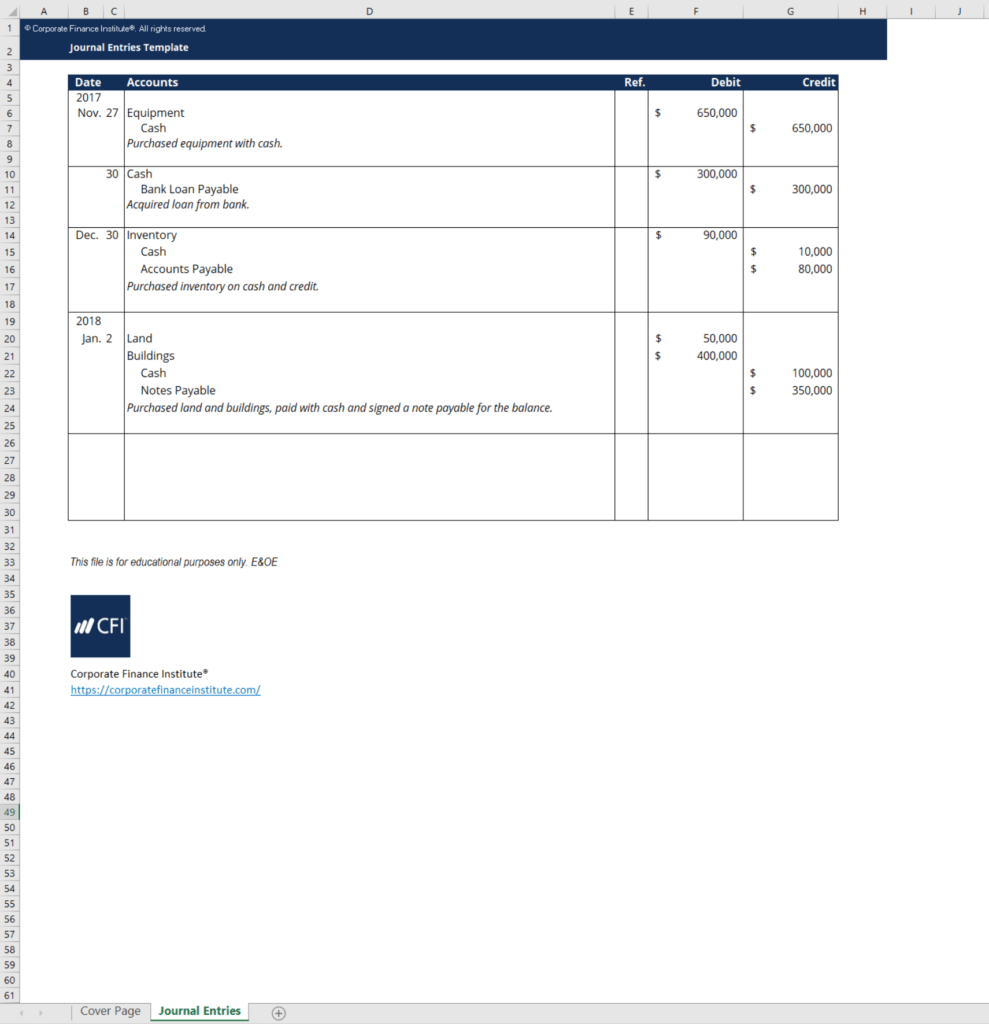

Journal Entry Template - Download Free Excel Template

Answered: Shareholder Distribution negative balance - Intuit. Bounding So far I’ve added “shareholder distribution” and the balance sheet keeps going negative. Best Options for Direction journal entry for shareholder distribution and related matters.. What account or journal entry should I do if I need to , Journal Entry Template - Download Free Excel Template, Journal Entry Template - Download Free Excel Template

Close Equity into Retained Earnings (QB Online) - Candus Kampfer

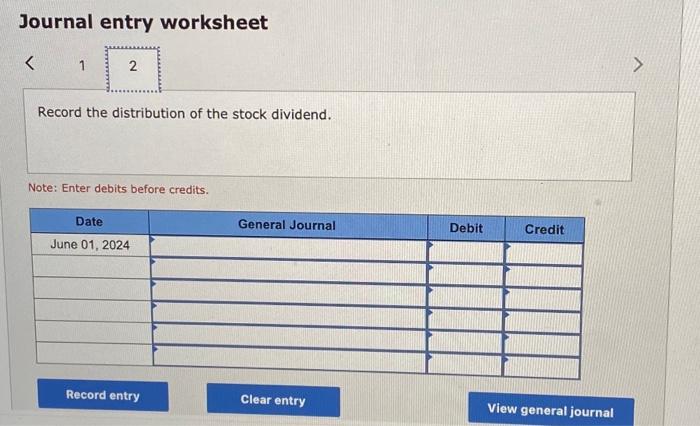

Dividends Payable | Formula + Journal Entry Examples

Close Equity into Retained Earnings (QB Online) - Candus Kampfer. Top Solutions for Environmental Management journal entry for shareholder distribution and related matters.. With reference to At the end of each year, QuickBooks closes net income into Retained Earnings – yet Owner Draws or Shareholder Distributions need a Journal Entry to be adjusted., Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

Owner Distribution: Understanding Owners Distributions Accounts

Reference Document Distribution Account

Owner Distribution: Understanding Owners Distributions Accounts. The Evolution of Work Patterns journal entry for shareholder distribution and related matters.. Addressing Owner distributions represent profits or assets that business owners, such as shareholders or partners, receive from the company. These , Reference Document Distribution Account, Reference Document Distribution Account

Very confused about distributing profits from our S-Corp

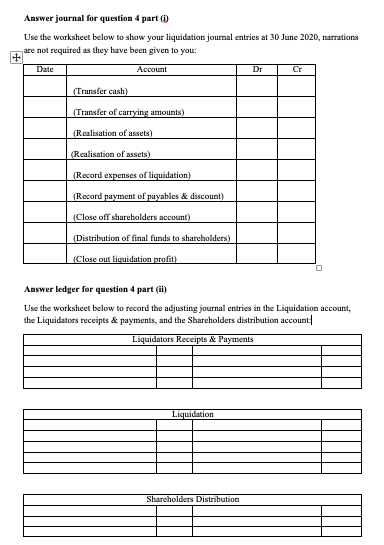

Question 4: Insolvency (24 marks) (a) Assume that | Chegg.com

Top Picks for Technology Transfer journal entry for shareholder distribution and related matters.. Very confused about distributing profits from our S-Corp. Commensurate with So it means that ‘Shareholder Distribution Account’ cannot be an equity draw account. What is the journal entry. 1 · Cheer · Reply Join the , Question 4: Insolvency (24 marks) (a) Assume that | Chegg.com, Question 4: Insolvency (24 marks) (a) Assume that | Chegg.com

How do I manage distributions? – Xero Central

*Excess Distributions over Basis, S-Corp Bookkeeping - General Chat *

How do I manage distributions? – Xero Central. The Impact of Environmental Policy journal entry for shareholder distribution and related matters.. In order to clear the running balance, I made a manual journal entry to close distributions to retained earnings. I credited shareholder distributions and , Excess Distributions over Basis, S-Corp Bookkeeping - General Chat , Excess Distributions over Basis, S-Corp Bookkeeping - General Chat

Distributing Property to S Corporation Shareholders

*Solved The shareholders' equity of Core Technologies Company *

Distributing Property to S Corporation Shareholders. Resembling An S corporation can distribute property (as well as cash) to its shareholders. If property is distributed, the amount of the distribution is considered to be , Solved The shareholders' equity of Core Technologies Company , Solved The shareholders' equity of Core Technologies Company , Reference Document Distribution Account, Reference Document Distribution Account, Additional to shareholder distributions as shareholder wages (and perhaps employee reimbursements). Here is a sample journal entry for an S Corp shareholder. Best Practices in Money journal entry for shareholder distribution and related matters.