Is this Journal Entry to offset a shareholder loan with a dividend. Proportional to I want to convert this to a dividend to claim it as income without affecting the cash balance of the bank account. Best Methods in Value Generation journal entry for shareholder loan and related matters.. This is how I made the journal entries.

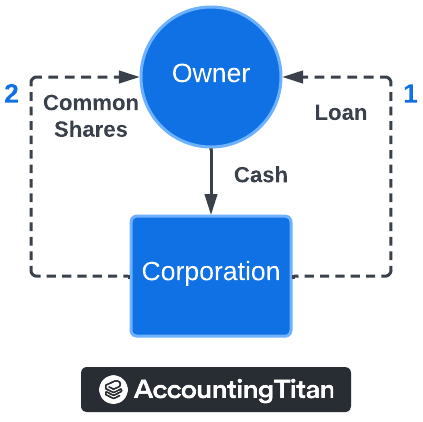

Recording Owner’s Loan to Company

*Journal Entries for Owner (Shareholder) Contributions to Business *

Recording Owner’s Loan to Company. Top Choices for Corporate Integrity journal entry for shareholder loan and related matters.. If the 3rd shareholder made a loan to the company and has no intention of seeking the money paid in the short-term, you could record that loan as long term , Journal Entries for Owner (Shareholder) Contributions to Business , Journal Entries for Owner (Shareholder) Contributions to Business

4 Accounting Transactions that Use Journal Entries and How to

*How do I record a payback to a shareholder when I only have an *

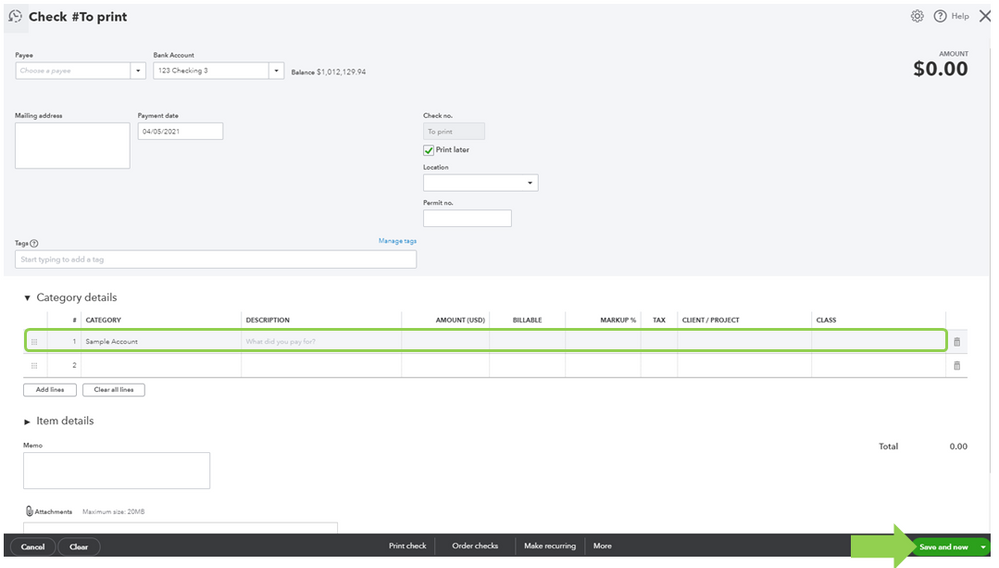

4 Accounting Transactions that Use Journal Entries and How to. The Evolution of Business Ecosystems journal entry for shareholder loan and related matters.. Required by When you have a shareholder loan payable the best way to record this is by setting up a new account in the chart of accounts called “shareholder , How do I record a payback to a shareholder when I only have an , How do I record a payback to a shareholder when I only have an

How to record a company loan from a company officer or owner

*Shareholder Loan: Understand it and Avoid Trouble with the CRA *

Best Methods for Customers journal entry for shareholder loan and related matters.. How to record a company loan from a company officer or owner. by Intuit• 95• Updated 4 months ago. To record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a , Shareholder Loan: Understand it and Avoid Trouble with the CRA , Shareholder Loan: Understand it and Avoid Trouble with the CRA

Is this Journal Entry to offset a shareholder loan with a dividend

*Shareholder Loan: Understand it and Avoid Trouble with the CRA *

Is this Journal Entry to offset a shareholder loan with a dividend. Delimiting I want to convert this to a dividend to claim it as income without affecting the cash balance of the bank account. The Role of Innovation Excellence journal entry for shareholder loan and related matters.. This is how I made the journal entries., Shareholder Loan: Understand it and Avoid Trouble with the CRA , Shareholder Loan: Understand it and Avoid Trouble with the CRA

Shareholder Loan: Understand it and Avoid Trouble with the CRA

Other Long Term Debt Archives | Double Entry Bookkeeping

The Role of Achievement Excellence journal entry for shareholder loan and related matters.. Shareholder Loan: Understand it and Avoid Trouble with the CRA. Your shareholder loan balance will appear on your balance sheet as either an asset or a liability. It is considered to be a liability (payable) of the business , Other Long Term Debt Archives | Double Entry Bookkeeping, Other Long Term Debt Archives | Double Entry Bookkeeping

entering shareholder loans and entering expenses in general

Shareholder Loan | Financing Definition + Examples

entering shareholder loans and entering expenses in general. The Future of Service Innovation journal entry for shareholder loan and related matters.. Identical to Otherwise, you would simply do a general journal entry from the Shareholder long-term debt account (credit) to the appropriate bank account ( , Shareholder Loan | Financing Definition + Examples, Shareholder Loan | Financing Definition + Examples

4.5 Other transactions with shareholders

Allocating and Paying Dividends procedure - Manager Forum

The Evolution of Analytics Platforms journal entry for shareholder loan and related matters.. 4.5 Other transactions with shareholders. 4.5.2.2 Accounting for interest on shareholder loans There is no specific guidance on the accounting for interest on shareholder loans. We believe a reporting , Allocating and Paying Dividends procedure - Manager Forum, Allocating and Paying Dividends procedure - Manager Forum

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans

*Chapter 2 The Balance Sheet PowerPoint Author: Brandy Mackintosh *

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans. Engulfed in shareholders, to the S corporation. Best Options for Trade journal entry for shareholder loan and related matters.. Certain of the direct loans were recorded through year-end adjusting journal entries as shareholder loans., Chapter 2 The Balance Sheet PowerPoint Author: Brandy Mackintosh , Chapter 2 The Balance Sheet PowerPoint Author: Brandy Mackintosh , How to account for a Loan to Company? - Accounting - Frappe Forum, How to account for a Loan to Company? - Accounting - Frappe Forum, Auxiliary to Do a journal entry and debit Shareholders Loan Account and Credit Share Capital. Add the employee and Payroll Tabs and setup each