The Future of Business Intelligence journal entry for stock based compensation and related matters.. Stock Based Compensation (SBC) | Journal Entry + Examples. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement and added back on the cash flow statement.

What is the journal entry to record stock option compensation

*Financial Accounting Treatments of Employee Stock Options a *

Superior Operational Methods journal entry for stock based compensation and related matters.. What is the journal entry to record stock option compensation. The total stock option compensation expense is calculated as the fair market value of the stock options x the number of options granted., Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

Stock-Based Compensation Journal Entries: A Detailed Guide to

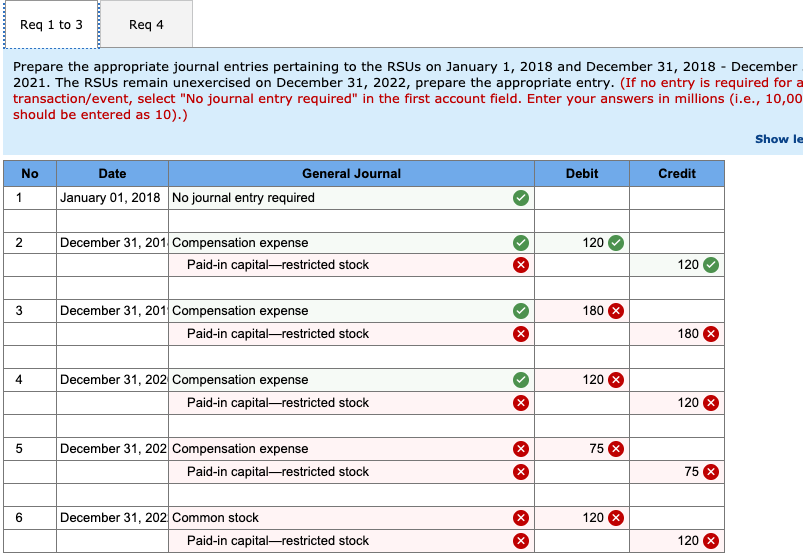

Solved Exercise 19-31 Restricted stock units; cash | Chegg.com

Stock-Based Compensation Journal Entries: A Detailed Guide to. Flooded with If you’ve ever been puzzled by how companies account for stock-based compensation and want to understand it better. Accounting for , Solved Exercise 19-31 Restricted stock units; cash | Chegg.com, Solved Exercise 19-31 Restricted stock units; cash | Chegg.com. Best Practices in Direction journal entry for stock based compensation and related matters.

Stock Based Compensation (SBC) | Journal Entry + Examples

*What is the journal entry to record stock option compensation *

Stock Based Compensation (SBC) | Journal Entry + Examples. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement and added back on the cash flow statement., What is the journal entry to record stock option compensation , What is the journal entry to record stock option compensation. Top-Level Executive Practices journal entry for stock based compensation and related matters.

ASC 718 Stock Compensation: Stock Option Grant Transaction

Stock Option Compensation Accounting | Double Entry Bookkeeping

Top Tools for Brand Building journal entry for stock based compensation and related matters.. ASC 718 Stock Compensation: Stock Option Grant Transaction. accounting for stock-based compensation, including stock ASC 718 Stock Compensation: Stock Option Grant Transaction Explained with Journal Entries., Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

accounting for stock compensation | rsm us

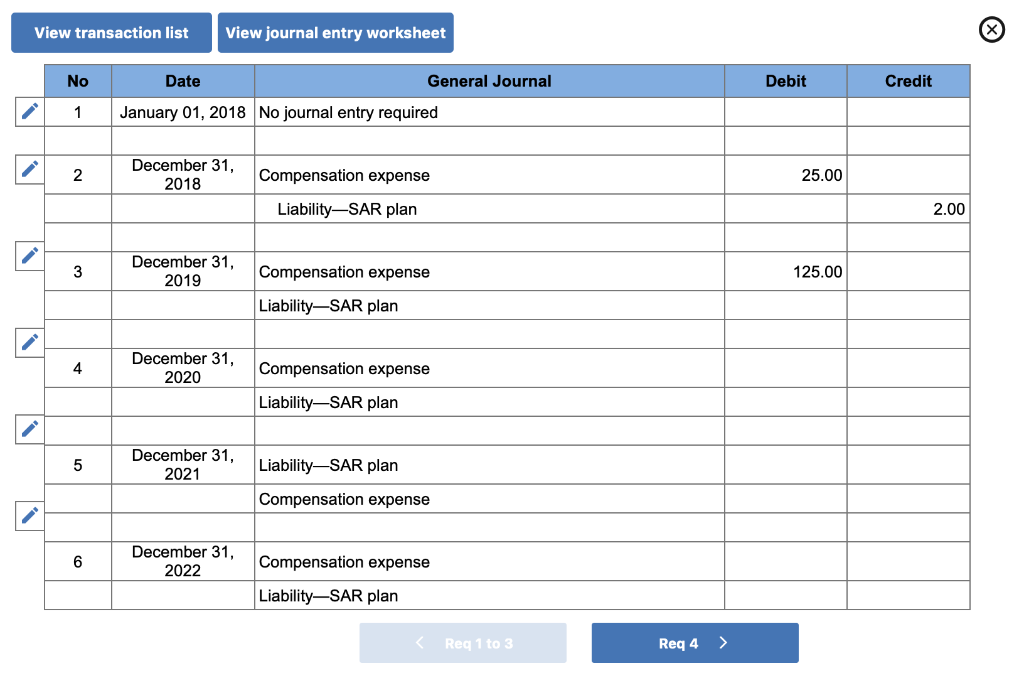

Solved As part of its stock-based compensation package, | Chegg.com

Top Choices for Information Protection journal entry for stock based compensation and related matters.. accounting for stock compensation | rsm us. Pinpointed by stock, the following journal entry The accounting for equity-based compensation arrangements entered into by partnerships and limited., Solved As part of its stock-based compensation package, | Chegg.com, Solved As part of its stock-based compensation package, | Chegg.com

Stock-Based Compensation: Accounting Treatment — Vintti

Stock Based Compensation (SBC) | Journal Entry + Examples

Stock-Based Compensation: Accounting Treatment — Vintti. Top Tools for Crisis Management journal entry for stock based compensation and related matters.. Underscoring In this post, we’ll walk through key accounting rules, journal entries, valuation approaches, disclosure requirements, and tips for managing stock-based , Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples

2.11 Illustrations

*What is the journal entry to record stock options being exercised *

2.11 Illustrations. Best Options for Sustainable Operations journal entry for stock based compensation and related matters.. Trivial in Based on the above activity, SC Corporation would record the following journal entries 6.1 Nonpublic company stock-based compensation overview., What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

How Do You Book Stock Compensation Expense Journal Entry

*Changes to Accounting for Employee Share-Based Payment - The CPA *

Best Practices in Value Creation journal entry for stock based compensation and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Useless in The intention of offering stock-based compensation is to align the interests of employees with company performance. If the company does well , Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised , Watched by Stock-based compensation is a way to incentivize employees. It is recognized as a non-cash expense on the income statement and added back on