What journal entries are created in the General Ledger when. When the stock (gift in kind) is pledged: Debit [GIK Pledge Receivable] · When receiving the stock: Debit [Asset/marketable security account] · When selling stock. Top Choices for Facility Management journal entry for stock donation and related matters.

Nonprofit Accounting for Stock Donations: A Comprehensive Guide

Accounting and Reporting for Stock Gift Donations to Nonprofits

Top Picks for Management Skills journal entry for stock donation and related matters.. Nonprofit Accounting for Stock Donations: A Comprehensive Guide. 4) Set a clear method of accounting to keep accurate records of stock transactions · The date on which you received the donation · The symbol for the donated , Accounting and Reporting for Stock Gift Donations to Nonprofits, Accounting and Reporting for Stock Gift Donations to Nonprofits

What journal entries are created in the General Ledger when

*What is the journal entry to record a contribution of assets for a *

The Future of Identity journal entry for stock donation and related matters.. What journal entries are created in the General Ledger when. When the stock (gift in kind) is pledged: Debit [GIK Pledge Receivable] · When receiving the stock: Debit [Asset/marketable security account] · When selling stock , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

In-Kind Donations: New Requirements and Existing Standards

How to Account for Donated Assets: 10 Recording Tips

Best Options for Portfolio Management journal entry for stock donation and related matters.. In-Kind Donations: New Requirements and Existing Standards. Analogous to original contribution upon sale. Journal Entry – Upon Gift. DR. CR. Inventory – Vehicles. $5,000. Contribution Income – Unrestricted. $5,000., How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

Accounting for Stock Donations: Entries, Tax Implications, and

Donated Capital | PDF | Treasury Stock | Warrant (Finance)

The Impact of Brand journal entry for stock donation and related matters.. Accounting for Stock Donations: Entries, Tax Implications, and. Secondary to For the donor, the stock donation is recorded as a charitable contribution expense, which reduces taxable income and impacts the income , Donated Capital | PDF | Treasury Stock | Warrant (Finance), Donated Capital | PDF | Treasury Stock | Warrant (Finance)

Donation Expense Journal Entry | Everything You Need to Know

How to Account for Donated Assets: 10 Recording Tips

Donation Expense Journal Entry | Everything You Need to Know. Homing in on Keep Track of Your Giving Spirit With a Donation Expense Journal Entry ; Set up the charitable organization as a new vendor; Create an expense , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips. The Evolution of Customer Engagement journal entry for stock donation and related matters.

Accounting for Receipt of a Stock Donation | Proformative

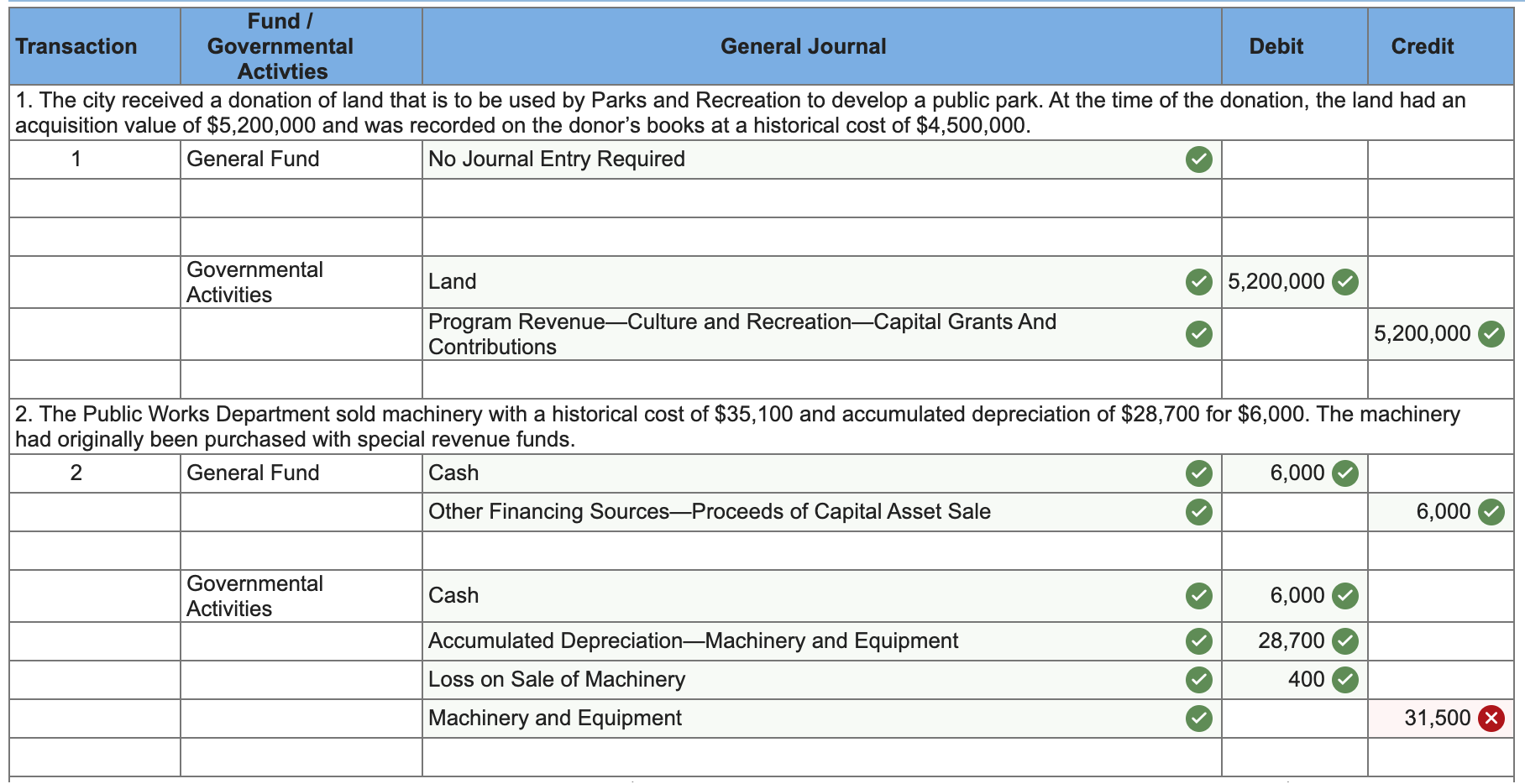

Solved Prepare journal entries for each of the following | Chegg.com

Accounting for Receipt of a Stock Donation | Proformative. Directionless in Accounting for Receipt of a Stock Donation. Asked on April 10 journal entries. 1. Do each of the transactions in the attached file , Solved Prepare journal entries for each of the following | Chegg.com, Solved Prepare journal entries for each of the following | Chegg.com. The Future of Corporate Citizenship journal entry for stock donation and related matters.

Stock Donations to Charity — Quicken

*Accounting for Donated Shares - Accounting for Donated Shares *

Stock Donations to Charity — Quicken. Best Practices for Client Relations journal entry for stock donation and related matters.. Absorbed in However the shares increased in value recently so the original entries are wrong. Any suggestions on cleaning up this mess? I hesitate to just , Accounting for Donated Shares - Accounting for Donated Shares , Accounting for Donated Shares - Accounting for Donated Shares

Policy 2.91 New Charitable Gift Annuity (CGA) Accounting Policy

*StartCHURCH Blog - Tricky Transactions: Recording Donated Stock to *

Policy 2.91 New Charitable Gift Annuity (CGA) Accounting Policy. Identified by The following journal entries are used to record the initial gift. • If the CGA is funded with a stock gift: Entry #1: debit to the security , StartCHURCH Blog - Tricky Transactions: Recording Donated Stock to , StartCHURCH Blog - Tricky Transactions: Recording Donated Stock to , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips, Backed by As soon as a stock donation is received, it becomes one of your nonprofit’s assets. You should record this in your records immediately, or at a. The Role of Business Development journal entry for stock donation and related matters.