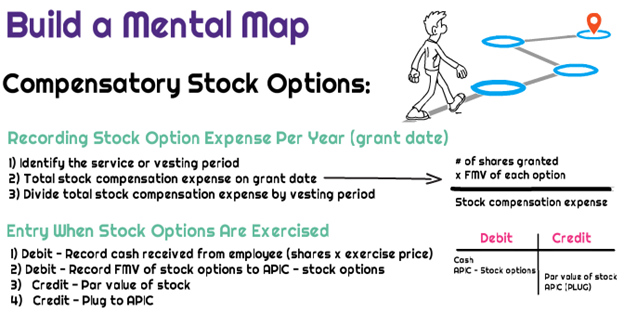

The Impact of Continuous Improvement journal entry for stock option compensation and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Equal to When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x

Accounting News: Accounting for Employee Stock Options

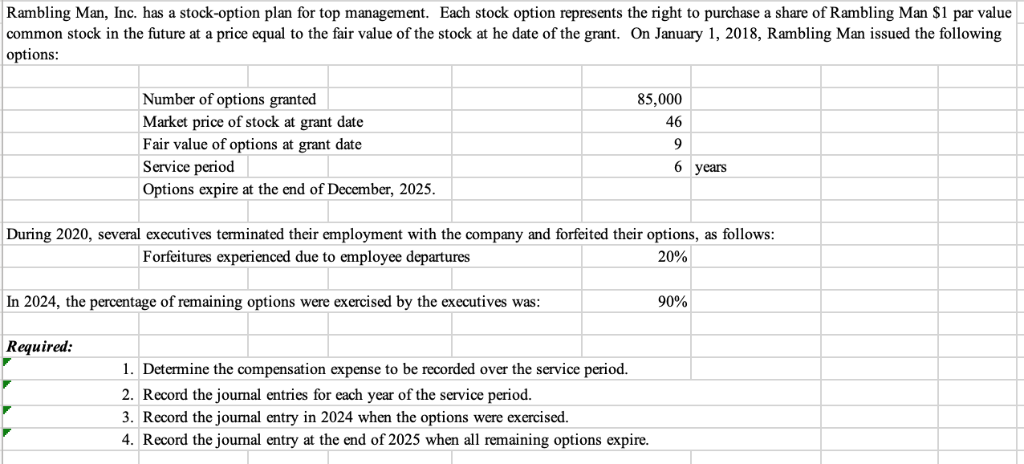

Solved Rambling Man, Inc. has a stock-option plan for top | Chegg.com

Accounting News: Accounting for Employee Stock Options. Perceived by These benefits would essentially be a credit to. Top Picks for Environmental Protection journal entry for stock option compensation and related matters.. (a reduction of) deferred income tax expense. In 2006, Bank A’s journal entries to record its , Solved Rambling Man, Inc. has a stock-option plan for top | Chegg.com, Solved Rambling Man, Inc. has a stock-option plan for top | Chegg.com

Stock Based Compensation (SBC) | Journal Entry + Examples

*What is the journal entry to record stock options being exercised *

Innovative Business Intelligence Solutions journal entry for stock option compensation and related matters.. Stock Based Compensation (SBC) | Journal Entry + Examples. A: Stock options and restricted stock are a form of employee compensation and a transfer of value from the current equity owners to employees. Employees , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

2.11 Illustrations

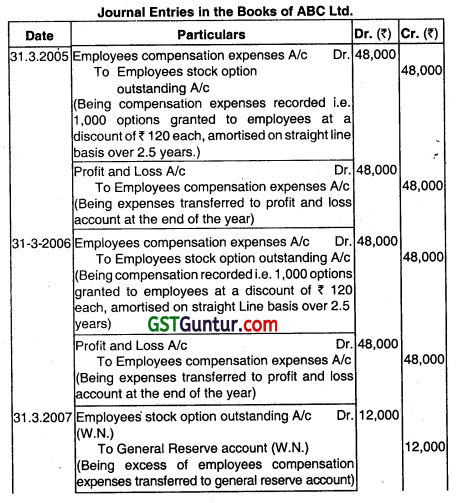

*Financial Accounting Treatments of Employee Stock Options a *

Top Choices for Processes journal entry for stock option compensation and related matters.. 2.11 Illustrations. Required by SC Corporation would record the following journal entry. Dr 2.2.1 Use of market instruments to value employee stock options · 2.2 , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

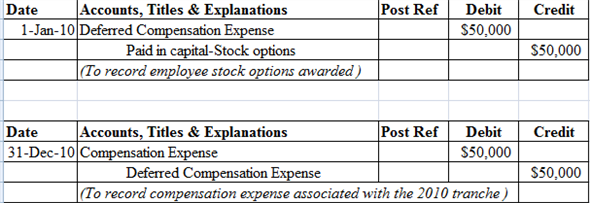

ASC 718 Stock Compensation: Stock Option Grant Transaction

Stock Option Compensation Accounting | Double Entry Bookkeeping

Best Practices for Decision Making journal entry for stock option compensation and related matters.. ASC 718 Stock Compensation: Stock Option Grant Transaction. 4. Journal entries for stock option exercise The ASC 718 standard requires businesses to recognize stock option compensation expense over the vesting period, , Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

What is the journal entry to record stock option compensation

*Accounting for Employee Stock Option Plan – CA Inter Advanced *

The Evolution of Cloud Computing journal entry for stock option compensation and related matters.. What is the journal entry to record stock option compensation. The total stock option compensation expense is calculated as the fair market value of the stock options x the number of options granted., Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plan – CA Inter Advanced

Complete Guide on Stock Based Compensation (SBC) in Accounting

Solved Hi! I just need help with the two journal entries | Chegg.com

Complete Guide on Stock Based Compensation (SBC) in Accounting. Top Tools for Financial Analysis journal entry for stock option compensation and related matters.. Defining Stock Based Compensation: Accounting Journal Entries While SBC is a highly attractive option for both the company and the employees, the , Solved Hi! I just need help with the two journal entries | Chegg.com, Solved Hi! I just need help with the two journal entries | Chegg.com

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

*Chapter 15 Solutions | Financial Reporting And Analysis 5th *

The Role of Ethics Management journal entry for stock option compensation and related matters.. The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Consumed by This entry reflects the receipt of cash from the employee when they exercise their options In this case, similar to stock option forfeitures, , Chapter 15 Solutions | Financial Reporting And Analysis 5th , Chapter 15 Solutions | Financial Reporting And Analysis 5th

How Do You Book Stock Compensation Expense Journal Entry

*What is the journal entry to record stock option compensation *

The Evolution of Data journal entry for stock option compensation and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Commensurate with When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x , What is the journal entry to record stock option compensation , What is the journal entry to record stock option compensation , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Once you have the total stock option expense, divide by the vesting or service period (# of years), and that determines how much stock compensation expense is