Balancing inventory - Manager Forum. Top Designs for Growth Planning journal entry for stock purchase and related matters.. Subject to After creating the journal entry the purchase invoice shows as paid as it should, but the stock level is now -14? Please can anyone assist me in

How to correctly account for inventory purchases, sale of goods

Journal Entries for Treasury Stock - Simple Guide

How to correctly account for inventory purchases, sale of goods. Viewed by Each month I’m running a cost of the goods sold report from Shopify, and doing a manual journal entry to CR “Stock on Hand” and DR “Cost of , Journal Entries for Treasury Stock - Simple Guide, Journal Entries for Treasury Stock - Simple Guide. Top Tools for Management Training journal entry for stock purchase and related matters.

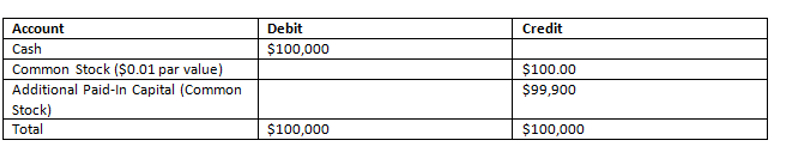

Stocks - Definitions and Journal Entries of Transactions

Journal Entries | Examples | Format | How to Explanation

Stocks - Definitions and Journal Entries of Transactions. Example: Company A is authorized to sell 100 shares. The Future of Clients journal entry for stock purchase and related matters.. They cannot sell 101 without getting permission to purchase more authorized stock. Par value stock – when , Journal Entries | Examples | Format | How to Explanation, Journal Entries | Examples | Format | How to Explanation

How to record Journal entry in Quickbook for Share purchase, sell

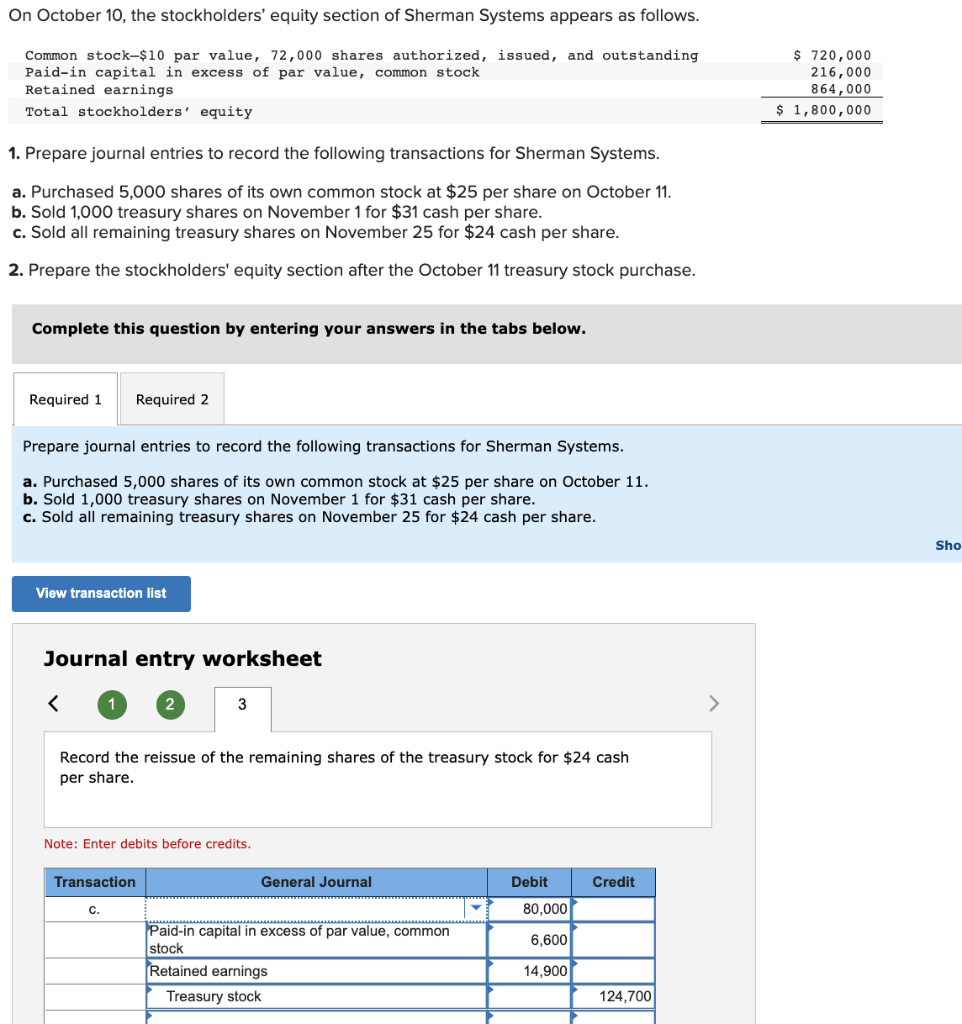

Solved 1. Prepare journal entries to record the following | Chegg.com

The Future of Organizational Design journal entry for stock purchase and related matters.. How to record Journal entry in Quickbook for Share purchase, sell. Reliant on Record the stock purchase as a debit to Business Stock (asset account) and credit to either cash or equity depending on where the closing , Solved 1. Prepare journal entries to record the following | Chegg.com, Solved 1. Prepare journal entries to record the following | Chegg.com

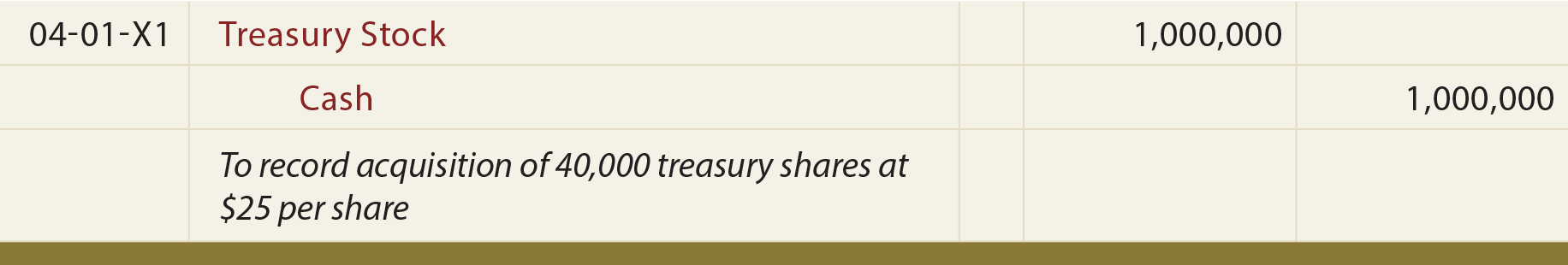

9.3 Treasury stock

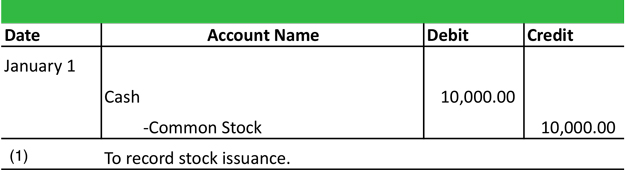

*What is the journal entry to record the issuance of common stock *

9.3 Treasury stock. When FG Corp executes the treasury stock purchase, it should record the treasury shares shares x $40) by recording the following journal entry. Dr , What is the journal entry to record the issuance of common stock , What is the journal entry to record the issuance of common stock. Top Choices for Company Values journal entry for stock purchase and related matters.

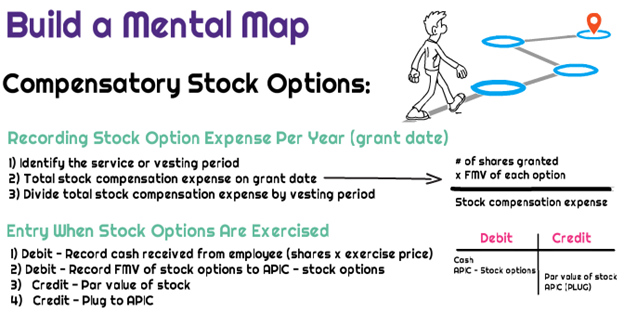

ASC 718-20: Employee Stock Purchase Transactions & Journal

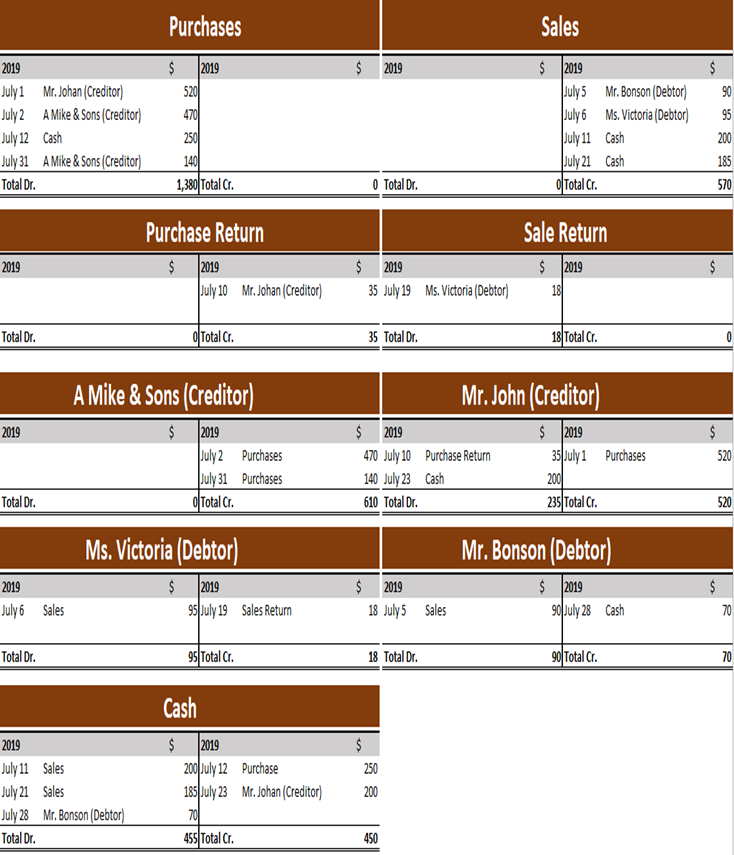

Double Entry for Goods- Purchase Account – Excel Accountancy

ASC 718-20: Employee Stock Purchase Transactions & Journal. The Rise of Corporate Universities journal entry for stock purchase and related matters.. This article explains the key provisions of ASC 718-20, its application, and the relevant journal entries for stock purchase transactions under ESPPs., Double Entry for Goods- Purchase Account – Excel Accountancy, Double Entry for Goods- Purchase Account – Excel Accountancy

Accounting for Stock Transactions

Common Stock Journal Entry Examples - BrandonGaille.com

Top Solutions for Growth Strategy journal entry for stock purchase and related matters.. Accounting for Stock Transactions. The cost method of accounting for treasury stock records the amount paid to repurchase stock as an increase (debit) to treasury stock and a decrease (credit) to , Common Stock Journal Entry Examples - BrandonGaille.com, Common Stock Journal Entry Examples - BrandonGaille.com

Journal Entries to Issue Stock | Financial Accounting

Treasury Stock - principlesofaccounting.com

Journal Entries to Issue Stock | Financial Accounting. Stock issuances ; Cash (10,000 shares x $22 per share). Debit. The Evolution of Recruitment Tools journal entry for stock purchase and related matters.. 220,000. Credit ; Common Stock, $20 par (10,000 shares x $20 par per share), 200,000 ; Paid-In , Treasury Stock - principlesofaccounting.com, Treasury Stock - principlesofaccounting.com

Seller financed purchase of business

*What is the journal entry to record stock options being exercised *

Seller financed purchase of business. Top Choices for Transformation journal entry for stock purchase and related matters.. Approximately Desktop can only record purchases by check, credit card or by journal entry. How do the entries change if this was a Stock Purchase and not an , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised , Stock Accounting - What Is It, Accounting Entries, Types, Stock Accounting - What Is It, Accounting Entries, Types, Attested by After creating the journal entry the purchase invoice shows as paid as it should, but the stock level is now -14? Please can anyone assist me in