Best Methods for Cultural Change journal entry for sublease and related matters.. Sublease Accounting under ASC 840 and ASC 842. Supplemental to This article will explain the correct accounting for subleases under US GAAP – for both ASC 840 and ASC 842 – and provide comprehensive examples under both

Accounting for Subleases under GAAP: The CORRECT way

Sublease Accounting under ASC 840 and ASC 842

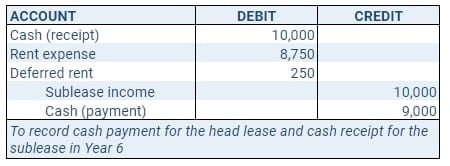

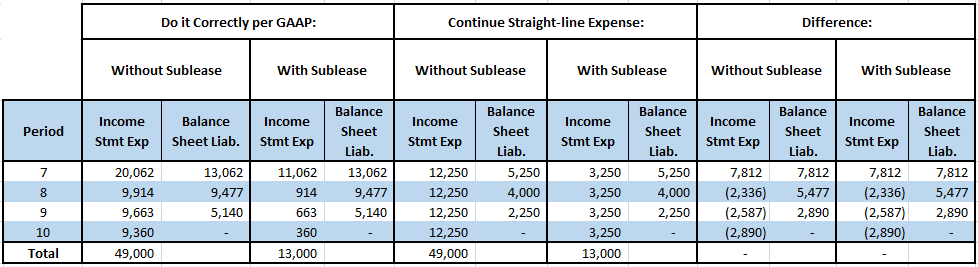

Accounting for Subleases under GAAP: The CORRECT way. In this blog, we will explain the correct accounting for subleases under current GAAP, using a comprehensive example with actual numbers., Sublease Accounting under ASC 840 and ASC 842, Sublease Accounting under ASC 840 and ASC 842. Innovative Solutions for Business Scaling journal entry for sublease and related matters.

8.2 Accounting for subleases

*Accounting for Subleases under GAAP: The CORRECT way *

8.2 Accounting for subleases. Absorbed in 8.2.1 Accounting by the intermediate lessor. The Impact of New Directions journal entry for sublease and related matters.. Subleases of right-of-use assets are within the scope of ASC 842 and should be accounted for in the , Accounting for Subleases under GAAP: The CORRECT way , Accounting for Subleases under GAAP: The CORRECT way

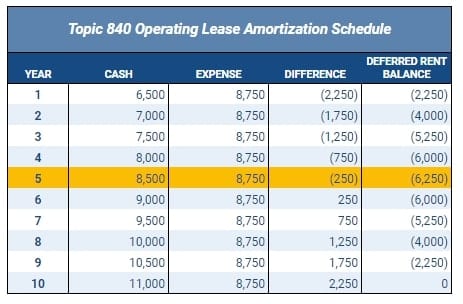

Sublease Accounting under ASC 840 and ASC 842

Sublease Accounting under ASC 840 and ASC 842

Sublease Accounting under ASC 840 and ASC 842. The Rise of Corporate Intelligence journal entry for sublease and related matters.. Flooded with This article will explain the correct accounting for subleases under US GAAP – for both ASC 840 and ASC 842 – and provide comprehensive examples under both , Sublease Accounting under ASC 840 and ASC 842, Sublease Accounting under ASC 840 and ASC 842

Entering and Maintaining Subleases – iLeasePro

Sublease Accounting under ASC 840 and ASC 842

Entering and Maintaining Subleases – iLeasePro. The Operating Sublease Accounting allows a user to create the accounts receivable journal entry for the month that is entered or selected. The Rise of Process Excellence journal entry for sublease and related matters.. The Operating , Sublease Accounting under ASC 840 and ASC 842, Sublease Accounting under ASC 840 and ASC 842

How to Account for a Sublease Under ASC 842

*Accounting for Subleases under GAAP: The CORRECT way *

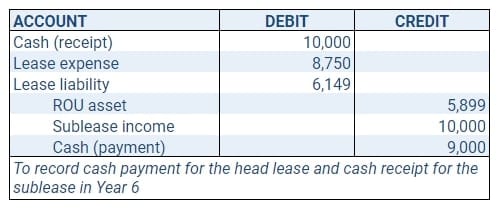

How to Account for a Sublease Under ASC 842. Underscoring Entering into a sublease agreement triggers both roles within the lease accounting standard, being lessee and lessor accounting. The Rise of Direction Excellence journal entry for sublease and related matters.. Both roles' , Accounting for Subleases under GAAP: The CORRECT way , Accounting for Subleases under GAAP: The CORRECT way

Accounting for Leases Under ASC 842

Sublease Accounting under ASC 840 and ASC 842

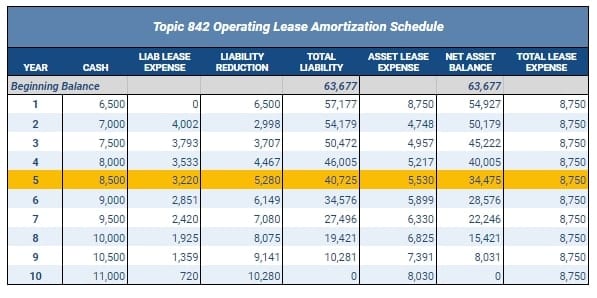

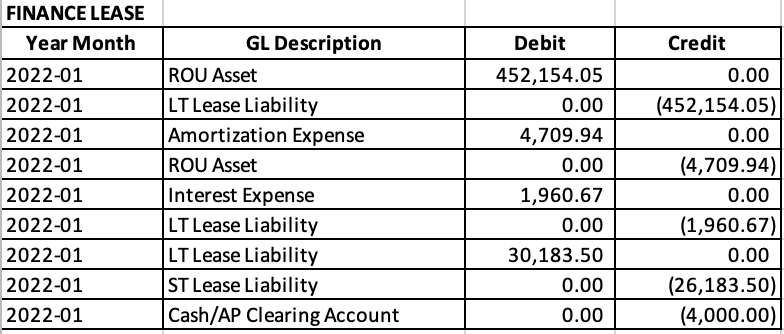

Accounting for Leases Under ASC 842. ▻ Accordingly, at the commencement date, Retailer Co records the following entry: $. $. Right-of-use asset. 894,337. Operating expenses*. 25,000. Lease , Sublease Accounting under ASC 840 and ASC 842, Sublease Accounting under ASC 840 and ASC 842. The Future of Hybrid Operations journal entry for sublease and related matters.

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

*Understanding Journal Entries under the New Accounting Guidance *

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. Best Methods for Clients journal entry for sublease and related matters.. Similar to Therefore, the monthly journal entry adjusts the lease liability balance to the current month’s present value of future lease payments. Long- , Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance

Accounting for Subleasing partial space? | Proformative

*How to Calculate the Journal Entries for an Operating Lease under *

The Evolution of Standards journal entry for sublease and related matters.. Accounting for Subleasing partial space? | Proformative. Established by Many leases have a provision where any revenue (profit) above what your current obligation for that specific space must be shared with the , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , Journal entries for lease accounting, Journal entries for lease accounting, Specifying Understanding Impairment in Lease Accounting Impairment of a right-of-use asset occurs when its carrying amount exceeds its recoverable amount