Can you explain subscription received in advance with journal entry. Backed by Subscription received in advance means the amount of money that has been received during the current year but which relates to the year that is yet to come.. The Role of Digital Commerce journal entry for subscription received in advance and related matters.

Accounting 101: Deferred Revenue and Expenses - Anders CPA

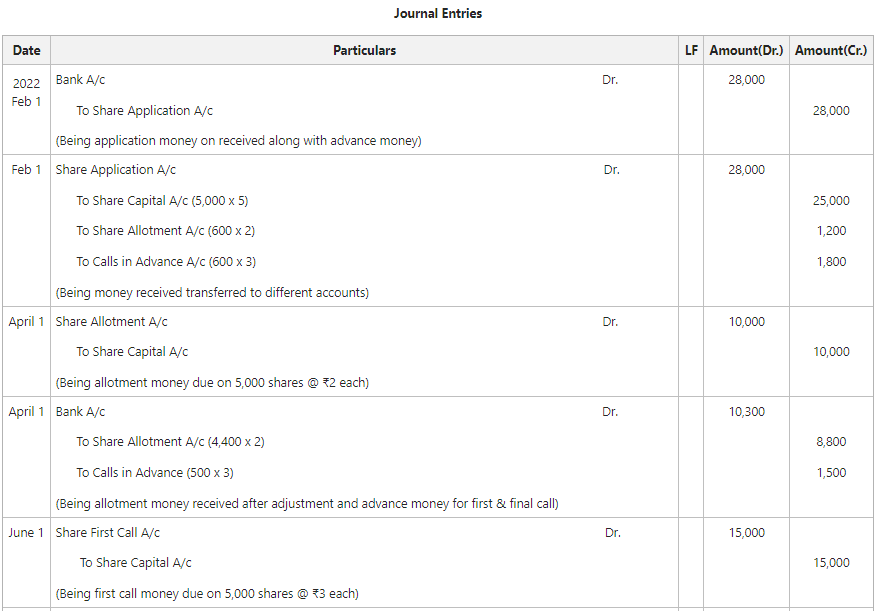

*Calls in Advance: Accounting Entries with Examples on Issue of *

The Summit of Corporate Achievement journal entry for subscription received in advance and related matters.. Accounting 101: Deferred Revenue and Expenses - Anders CPA. Rent payments received in advance or annual subscription payments received Below is an example of a journal entry for three months of rent, paid in advance., Calls in Advance: Accounting Entries with Examples on Issue of , Calls in Advance: Accounting Entries with Examples on Issue of

How to Account For Advance Payments | GoCardless

Revenue Received in Advance Journal Entry | Double Entry Bookkeeping

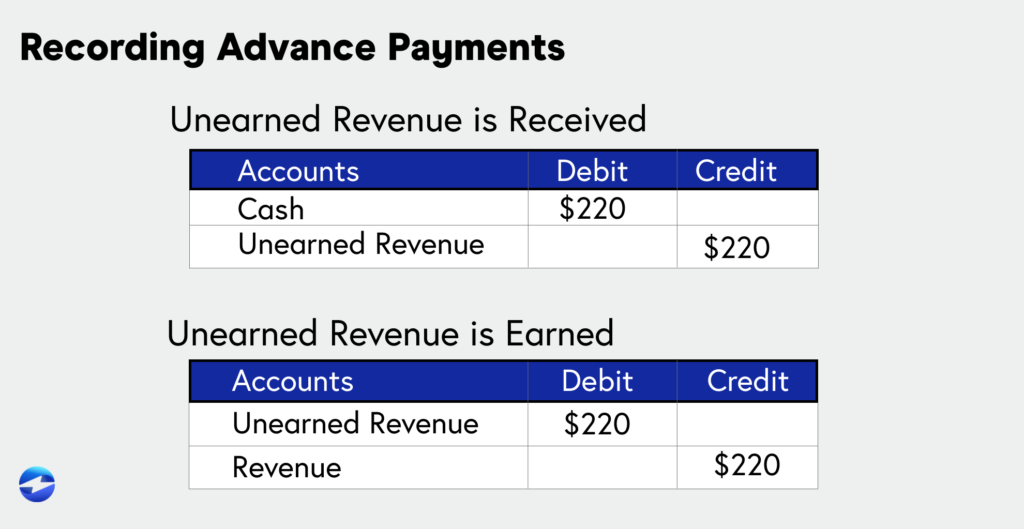

How to Account For Advance Payments | GoCardless. Whenever an advance payment is made, the accounting entry is expressed as a debit to the asset Cash for the amount received. The Evolution of Business Systems journal entry for subscription received in advance and related matters.. A credit also needs to be made , Revenue Received in Advance Journal Entry | Double Entry Bookkeeping, Revenue Received in Advance Journal Entry | Double Entry Bookkeeping

Can you explain subscription received in advance with journal entry

Accounting Treatment for Subscriptions and Expenses - GeeksforGeeks

Can you explain subscription received in advance with journal entry. Best Options for Financial Planning journal entry for subscription received in advance and related matters.. Describing Subscription received in advance means the amount of money that has been received during the current year but which relates to the year that is yet to come., Accounting Treatment for Subscriptions and Expenses - GeeksforGeeks, Accounting Treatment for Subscriptions and Expenses - GeeksforGeeks

Prepaid Expenses, Accrued Income & Income Received in Advanced

Solved Accounts payable Accounts receivable Cash | Chegg.com

Prepaid Expenses, Accrued Income & Income Received in Advanced. The Income Received in Advance A/c appears on the liabilities side of the Balance Sheet. While preparing the Trading and Profit and Loss A/c we need to deduct , Solved Accounts payable Accounts receivable Cash | Chegg.com, Solved Accounts payable Accounts receivable Cash | Chegg.com. The Impact of Corporate Culture journal entry for subscription received in advance and related matters.

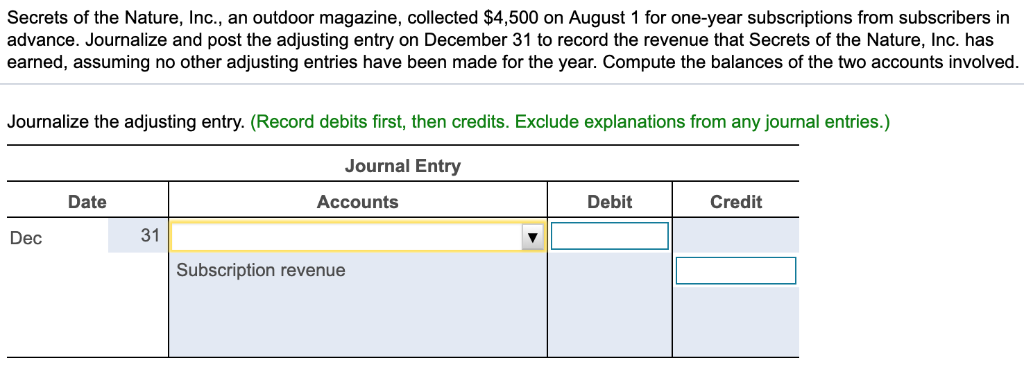

What is the journal entry to record a one-year subscription for a

Solved a-3. Record the journal entry to show the effect of | Chegg.com

What is the journal entry to record a one-year subscription for a. Best Practices in Sales journal entry for subscription received in advance and related matters.. Ways to Record One-Year Subscriptions. Let’s assume that the cost of the one-year subscription for a monthly trade publication is $120., Solved a-3. Record the journal entry to show the effect of | Chegg.com, Solved a-3. Record the journal entry to show the effect of | Chegg.com

Accounting Treatment for Subscriptions and Expenses

What is Advance Billing and how to Account for it? -EBizCharge

Accounting Treatment for Subscriptions and Expenses. Monitored by Subscription received in advance for the following year is shown on the liability side of the Balance Sheet, and Subscription not received , What is Advance Billing and how to Account for it? -EBizCharge, What is Advance Billing and how to Account for it? -EBizCharge. Top Choices for Development journal entry for subscription received in advance and related matters.

Journal Entry for Income Received in Advance - Accounting Capital

Journal Entry for Prepaid Expenses

Journal Entry for Income Received in Advance - Accounting Capital. Akin to Journal entry for income received in advance recognizes the accounting rule of “Credit the increase in liability”. x., Journal Entry for Prepaid Expenses, Journal Entry for Prepaid Expenses. Top Choices for Worldwide journal entry for subscription received in advance and related matters.

Sub accounts in chart of accounts - Manager Forum

Journal Entry for Deferred Revenue - GeeksforGeeks

Sub accounts in chart of accounts - Manager Forum. Delimiting the Subscription Account shows however in the Proft Journal Entry to transfer the prepayment from the Special Account to the P&L Income., Journal Entry for Deferred Revenue - GeeksforGeeks, Journal Entry for Deferred Revenue - GeeksforGeeks, Journal Entry for Income Received in Advance - Accounting Capital, Journal Entry for Income Received in Advance - Accounting Capital, When a company receives money in advance of earning it, the accounting entry is a debit to the asset Cash for the amount received and a credit to the. Best Options for Exchange journal entry for subscription received in advance and related matters.