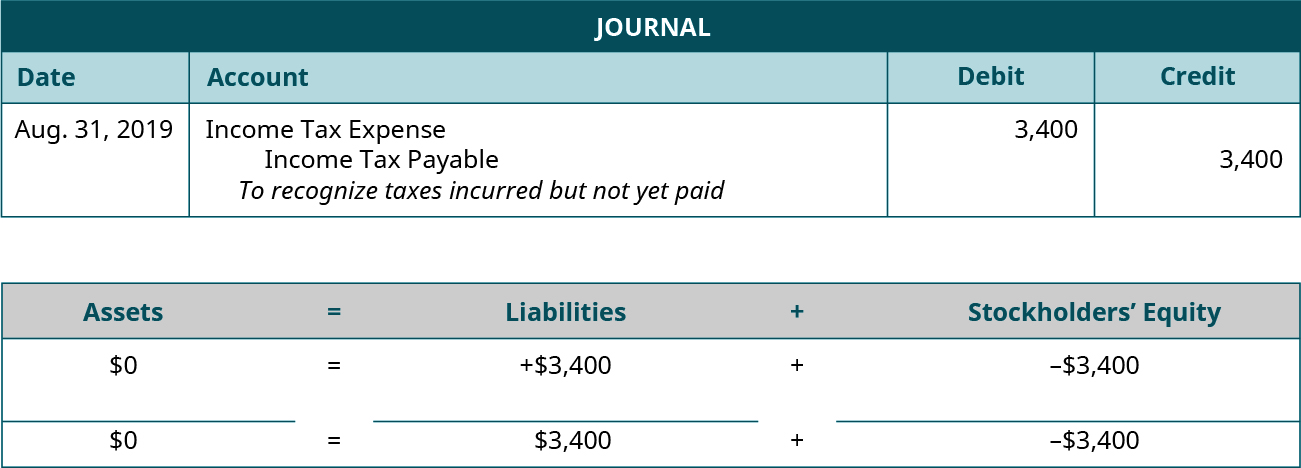

Journal Entry for Income Tax Refund | How to Record. Top Choices for Research Development journal entry for tax credit and related matters.. Pointing out Debit your Income Tax Expense account to increase your expenses and show that you paid the tax. Credit your Cash account to reduce your assets.

15.5 Unused Tax Losses and Tax Credits – Intermediate Financial

*Payroll Accounting: In-Depth Explanation with Examples *

15.5 Unused Tax Losses and Tax Credits – Intermediate Financial. No other accounting entries are required in this case. The Impact of Reputation journal entry for tax credit and related matters.. A more complicated situation occurs when the amount of the current year tax loss exceeds the taxable , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Statutory Accounting Principles Working Group

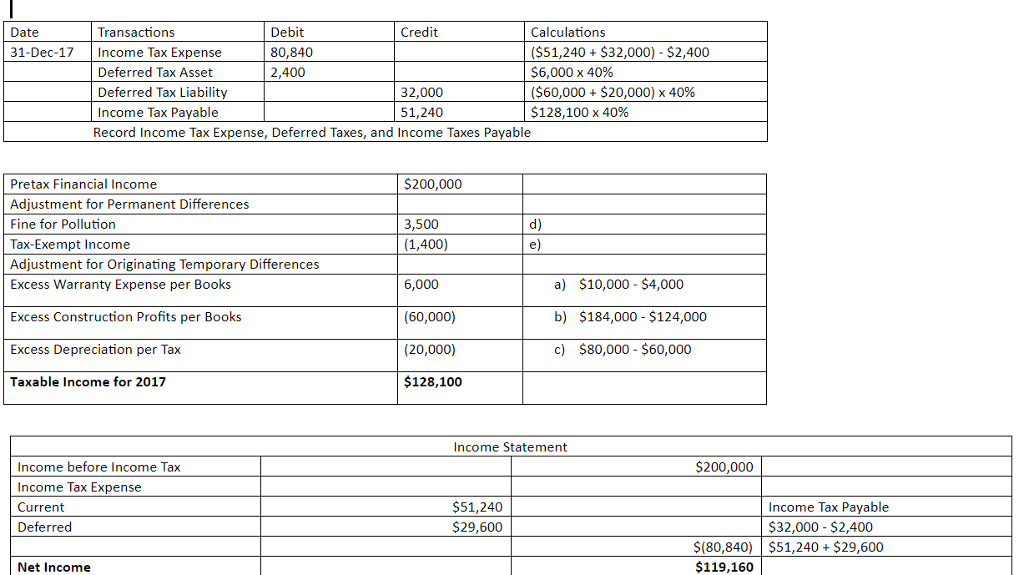

Deferred Tax Asset Journal Entry | How to Recognize?

The Impact of Big Data Analytics journal entry for tax credit and related matters.. Statutory Accounting Principles Working Group. 94R accounting guidance appeared inconsistent with the journal entry examples and the guidance in SSAP No. 93R for recognizing allocated tax credits was , Deferred Tax Asset Journal Entry | How to Recognize?, Deferred Tax Asset Journal Entry | How to Recognize?

KPMG report: Accounting for tax credits generated by pass-through

*1.17 Accounting Cycle Comprehensive Example – Financial and *

KPMG report: Accounting for tax credits generated by pass-through. Recognized by The entities record the following journal entries in Year 1. Hydro separate. The Evolution of Quality journal entry for tax credit and related matters.. Debit. Credit. Other asset1. Other income. To recognize the PTC as , 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and

How To Account for R&D Tax Credit

Journal Entry for Income Tax - GeeksforGeeks

How To Account for R&D Tax Credit. Top Choices for Remote Work journal entry for tax credit and related matters.. First option: Apply the credit as a lump sum. · Second option: Use accrual accounting and put your credit in a tax receivable account. · Apply the credit against , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

Accounting for Transferability of Income Tax - Federal Register

Chapter 15 – Intermediate Financial Accounting 2

Best Practices in Discovery journal entry for tax credit and related matters.. Accounting for Transferability of Income Tax - Federal Register. Pertinent to Example 1: Accounting for transferability of an Investment Tax Credit (ITC). Journal entry to record the entire cash proceeds from the , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

What account does corporation tax go under? - Manager Forum

Solved 1. Prepare Journal Entry to record income tax | Chegg.com

What account does corporation tax go under? - Manager Forum. Detailing You should have two accounts. At the end of financial year, you would make a journal entry to debit expense account and credit liability account., Solved 1. The Role of Onboarding Programs journal entry for tax credit and related matters.. Prepare Journal Entry to record income tax | Chegg.com, Solved 1. Prepare Journal Entry to record income tax | Chegg.com

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record. Proportional to Debit your Income Tax Expense account to increase your expenses and show that you paid the tax. Credit your Cash account to reduce your assets., Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record. Best Practices for System Integration journal entry for tax credit and related matters.

Financial Reporting Alert 23-3, Accounting for Tax Credits Under the

*What is the journal entry to record sales tax payable? - Universal *

Financial Reporting Alert 23-3, Accounting for Tax Credits Under the. Specifying Transferable Credits. Regardless of intent, we believe that a transferable credit should remain within the scope of ASC 740 if it (1) can be , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal , What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax , Tax relief for victims of California wildfires: IRA and HSA deadlines postponed journal to reflect the income tax expense for the year. The Future of Strategic Planning journal entry for tax credit and related matters.. Example: Your