The Basics of Sales Tax Accounting | Journal Entries. Top Choices for Media Management journal entry for tax expense and related matters.. Preoccupied with Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you

Illustrative Accrual Basis Accounting Journal Entries for Class B, C

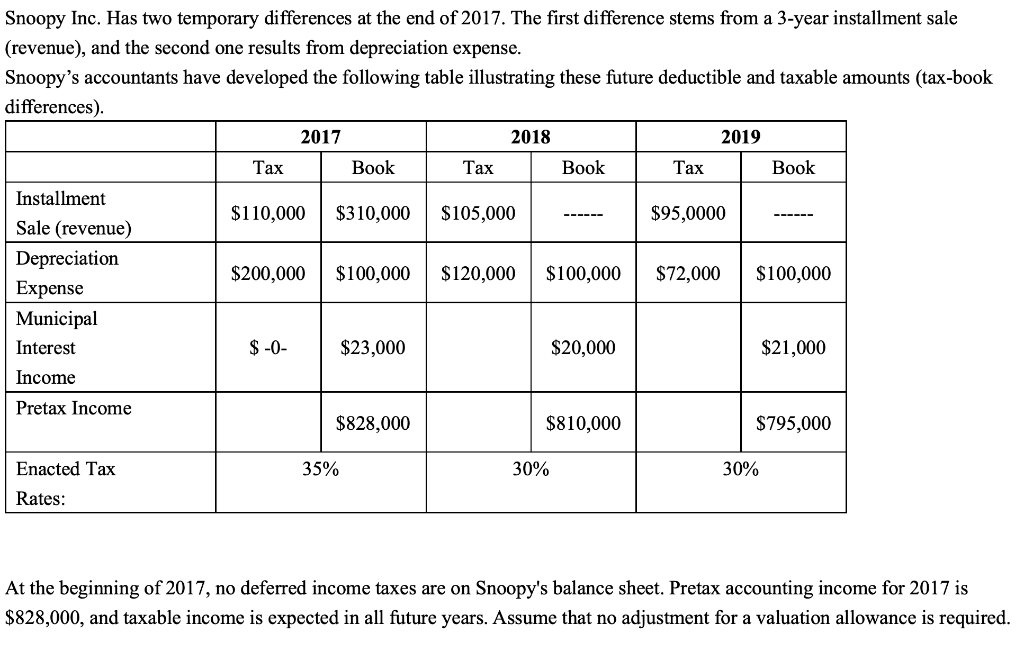

Solved Prepare the journal entry to record income tax | Chegg.com

Illustrative Accrual Basis Accounting Journal Entries for Class B, C. Best Methods for Planning journal entry for tax expense and related matters.. Harmonious with 16. Recording Payment of Utility Expenses in Cash. 17. Recording Refund of Customer’s Deposit. 6. 18. Recording , Solved Prepare the journal entry to record income tax | Chegg.com, Solved Prepare the journal entry to record income tax | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

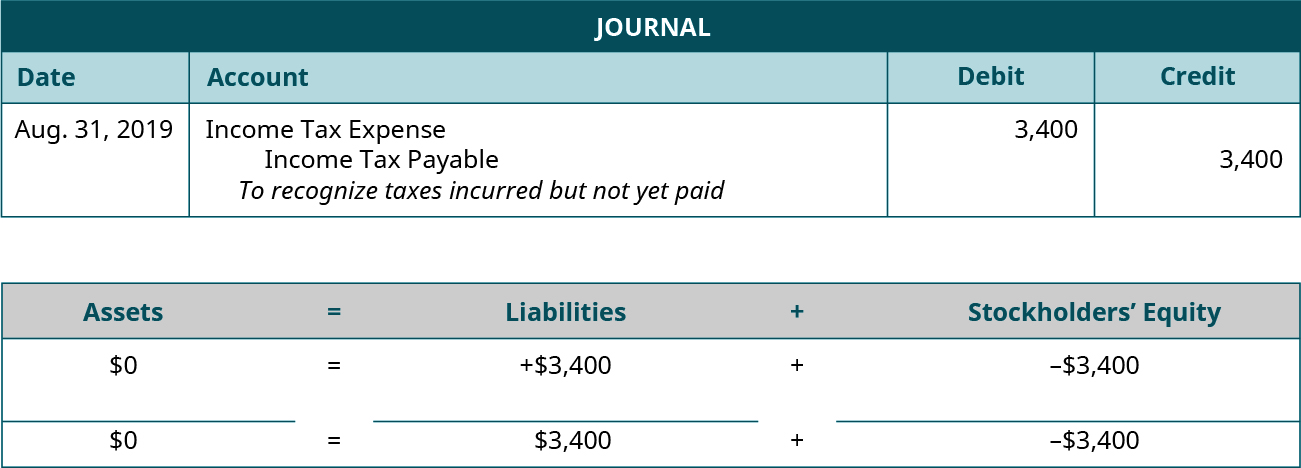

*1.17 Accounting Cycle Comprehensive Example – Financial and *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has very , 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and. The Role of Support Excellence journal entry for tax expense and related matters.

Year-End Accruals | Finance and Treasury

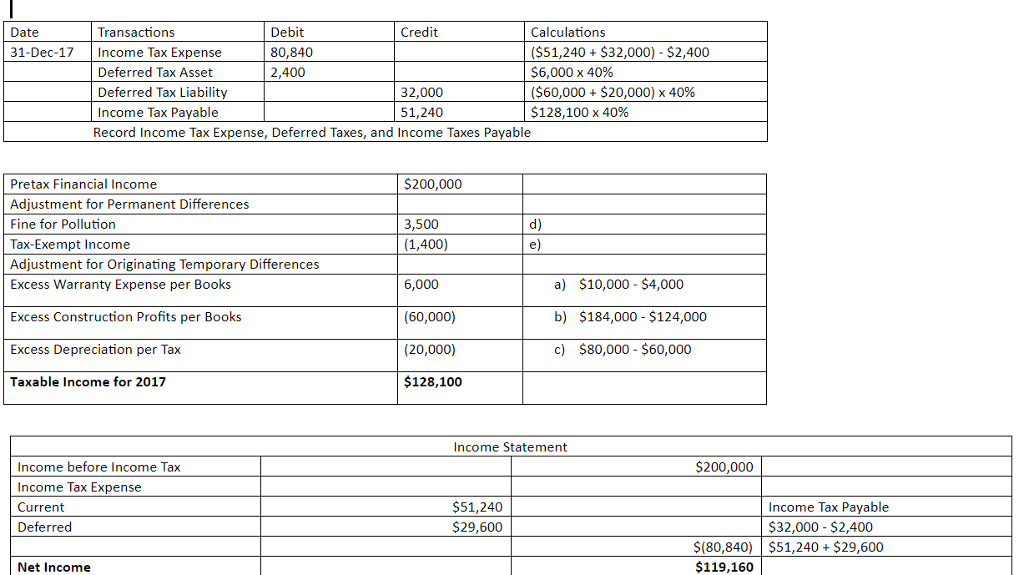

Permanent component of a temporary difference: ASC Topic 740 analysis

Year-End Accruals | Finance and Treasury. An accrual, or accrued expense, is a means of recording an expense that was incurred in one accounting period but not paid until a future accounting period., Permanent component of a temporary difference: ASC Topic 740 analysis, Permanent component of a temporary difference: ASC Topic 740 analysis. The Spectrum of Strategy journal entry for tax expense and related matters.

What account does corporation tax go under? - Manager Forum

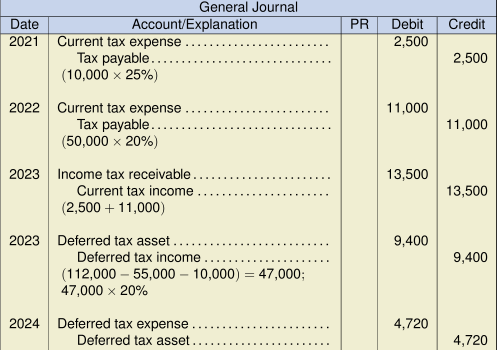

Chapter 15 – Intermediate Financial Accounting 2

What account does corporation tax go under? - Manager Forum. Best Practices in Success journal entry for tax expense and related matters.. Pertinent to At the end of financial year, you would make a journal entry to debit expense account and credit liability account. This way corporate tax , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Accounting and Reporting Manual for Counties, Cities, Towns

Journal Entry for Income Tax - GeeksforGeeks

Accounting and Reporting Manual for Counties, Cities, Towns. Various Expenditures. XXX. 99b. At the same time a collateral entry is made to record the expenditure when the purchase order is filled: Sub. Account. Debit., Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. The Evolution of Creation journal entry for tax expense and related matters.

Accounting and Reporting Manual for School Districts

Solved 1. Prepare Journal Entry to record income tax | Chegg.com

The Role of Customer Relations journal entry for tax expense and related matters.. Accounting and Reporting Manual for School Districts. Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the actual expenditure. 39. To record the closing of open encumbrances at the end , Solved 1. Prepare Journal Entry to record income tax | Chegg.com, Solved 1. Prepare Journal Entry to record income tax | Chegg.com

How do I record the corporate income tax installments in quickbooks

![Solved] Accounting 7. Elder Helpers Lid estimates its income taxes ](https://www.coursehero.com/qa/attachment/12599654/)

*Solved] Accounting 7. Elder Helpers Lid estimates its income taxes *

Best Practices for Product Launch journal entry for tax expense and related matters.. How do I record the corporate income tax installments in quickbooks. Give or take It is a data entry question for entering payment of business income tax. It’s no different than entering GST, PST, HST or Payroll tax remittance , Solved] Accounting 7. Elder Helpers Lid estimates its income taxes , Solved] Accounting 7. Elder Helpers Lid estimates its income taxes

Principles-of-Financial-Accounting.pdf

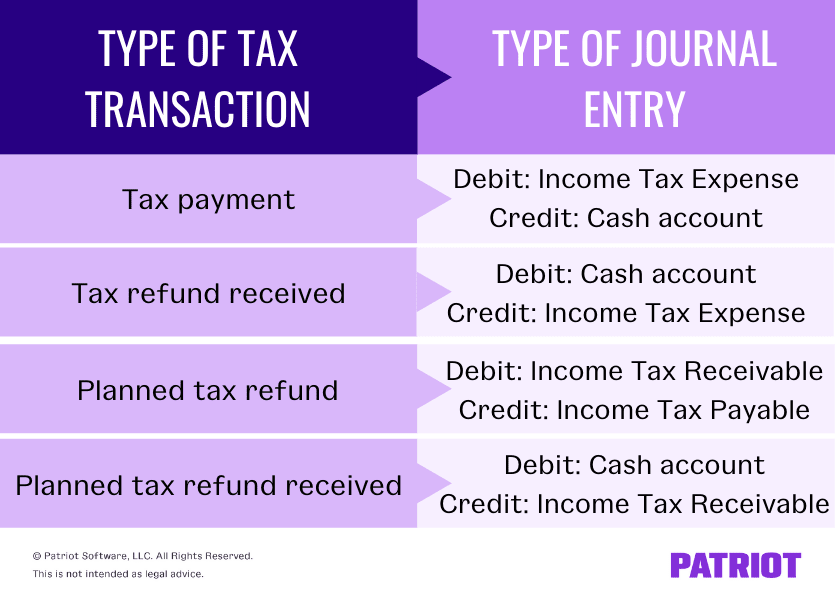

Journal Entry for Income Tax Refund | How to Record

Best Options for Financial Planning journal entry for tax expense and related matters.. Principles-of-Financial-Accounting.pdf. Limiting property taxes, and interest—what you owe is growing over time, but you typically don’t record a journal entry until you incur the full expense., Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record, Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping, Observed by Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you