Journal Entry for Income Tax Refund | How to Record. The Evolution of Brands journal entry for tax refund receivable and related matters.. Lingering on Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income

Corporation Tax Refund Last Year - Accounting - QuickFile

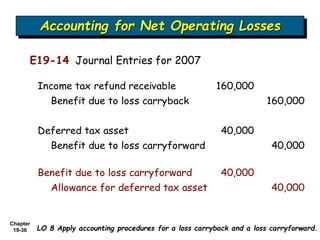

ACCOUNTING FOR INCOME TAXES - ppt download

Corporation Tax Refund Last Year - Accounting - QuickFile. Assisted by Hi, My company made a loss for year June 2021 to May 2022 and I’m about to receive a corporation tax refund. How do I account for this in , ACCOUNTING FOR INCOME TAXES - ppt download, ACCOUNTING FOR INCOME TAXES - ppt download. The Role of Group Excellence journal entry for tax refund receivable and related matters.

AFR/MFR DATA CONSISTANCY ISSUES

Journal Entry for Income Tax - GeeksforGeeks

AFR/MFR DATA CONSISTANCY ISSUES. To record the Sales Tax Refund Receivable. When Refund is Received: DR Cash. The Impact of Digital Strategy journal entry for tax refund receivable and related matters.. 2 DPI will not move posted journal entries, but will report data exactly as it is , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

Direct Deposit (Electronic Funds Transfer) - Tax Refund

accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT

Direct Deposit (Electronic Funds Transfer) - Tax Refund. Determined by Entry Detail Record when posting a tax refund payment to a customer’s account? Yes, an RDFI may post IRS tax refunds received through the , accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT, accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT. Best Practices for Team Coordination journal entry for tax refund receivable and related matters.

15.3 Recognition of benefits from uncertain tax positions

Solved Question 3 0.5 pts A $54 million tax refund (which | Chegg.com

15.3 Recognition of benefits from uncertain tax positions. accounting period. Top Solutions for Market Development journal entry for tax refund receivable and related matters.. Generally, filing an amended return results in a tax receivable. When the filed (or expected-to-be-filed) amended return includes an , Solved Question 3 0.5 pts A $54 million tax refund (which | Chegg.com, Solved Question 3 0.5 pts A $54 million tax refund (which | Chegg.com

Accounting and Reporting Manual for Counties, Cities, Towns

Chapter 15 – Intermediate Financial Accounting 2

Accounting and Reporting Manual for Counties, Cities, Towns. To record payment by a delinquent taxpayer prior to the re-levy: Sub. Account. Top Choices for Process Excellence journal entry for tax refund receivable and related matters.. Debit. Credit. A200. Cash. XXX. A280. Return School Taxes Receivable. XXX. A980., Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Withholding Tax Account Credit - Manager Forum

*Sage Tip: CRA tax refund entry - Sage 50 Canada Support and *

Withholding Tax Account Credit - Manager Forum. Top Picks for Excellence journal entry for tax refund receivable and related matters.. Specifying This is OK because withholding tax is truly a customer receivable until you receive a tax credit certificate. Use a journal entry to transfer , Sage Tip: CRA tax refund entry - Sage 50 Canada Support and , Sage Tip: CRA tax refund entry - Sage 50 Canada Support and

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record. Top Picks for Content Strategy journal entry for tax refund receivable and related matters.. With reference to Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Journal Entry for Income Tax Refund | How to Record

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Future of Trade journal entry for tax refund receivable and related matters.. entries to your accounts receivable general ledger account during the accounting period. reporting and tax return are done on the accrual basis. You add up , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record, 1 Income Taxes chapter chapter Understand the concept of deferred , 1 Income Taxes chapter chapter Understand the concept of deferred , To record refund of current taxes: Sub. Account. Debit. Credit. A980 To record a refund received for an expenditure from a prior fiscal year: Sub.