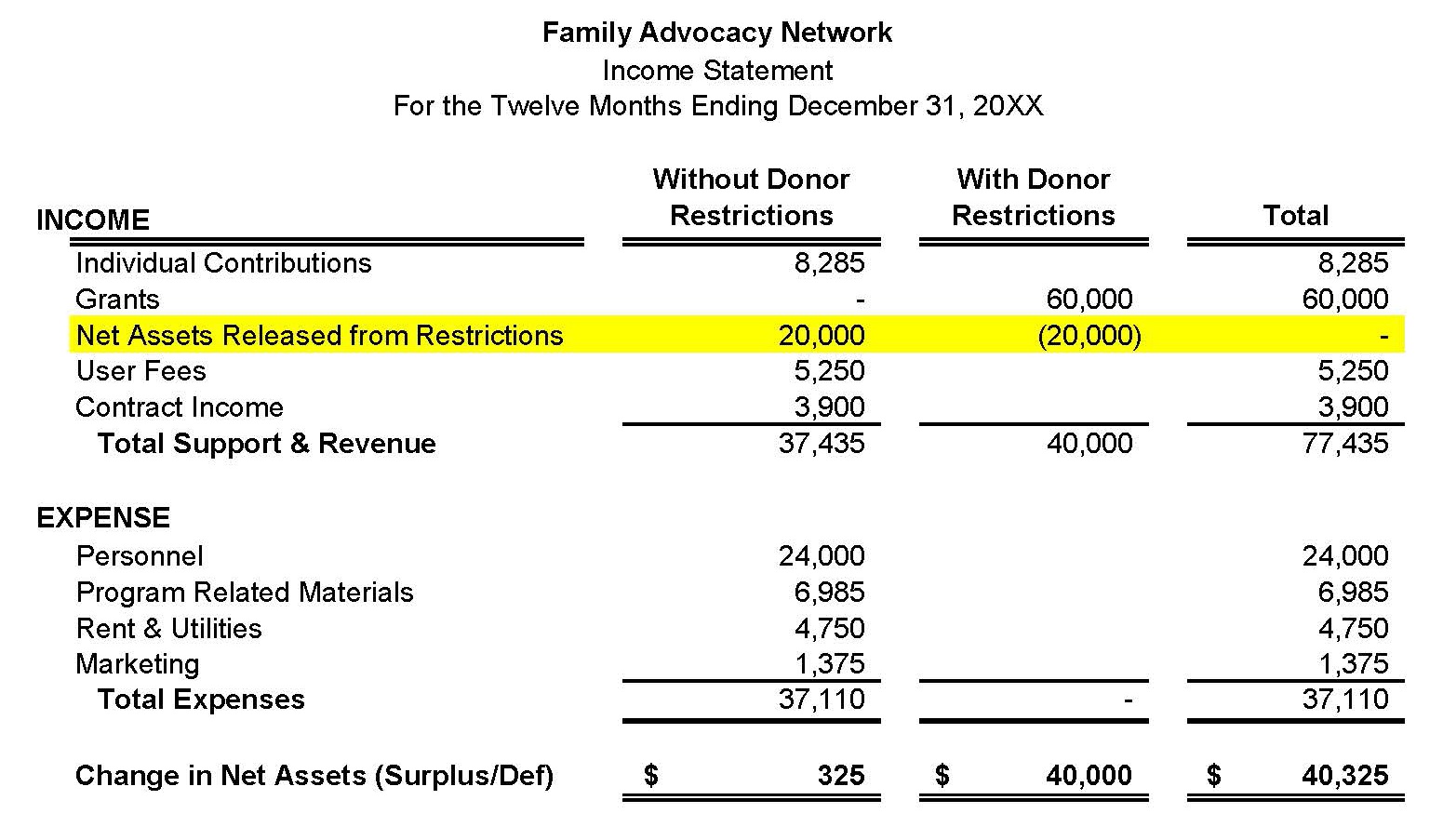

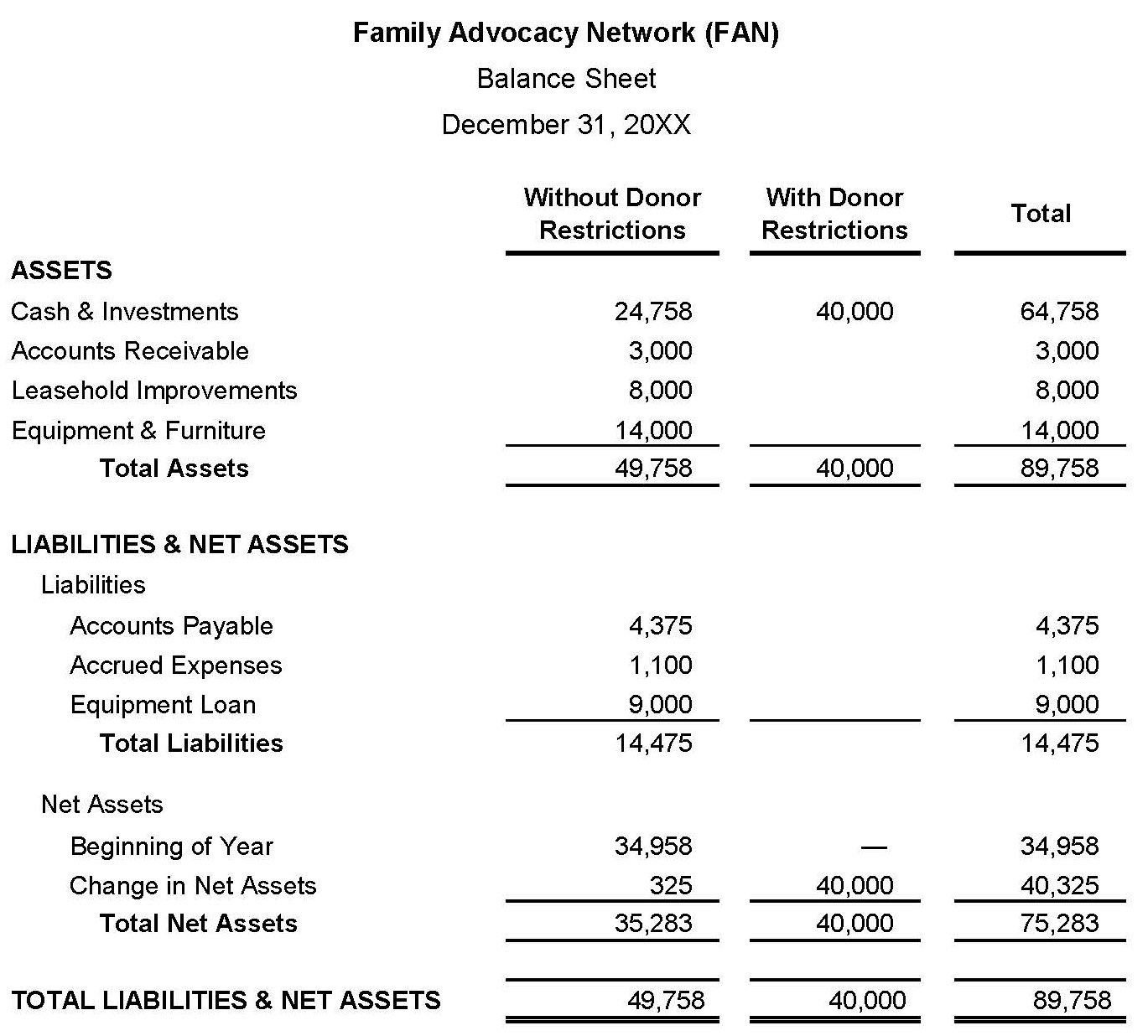

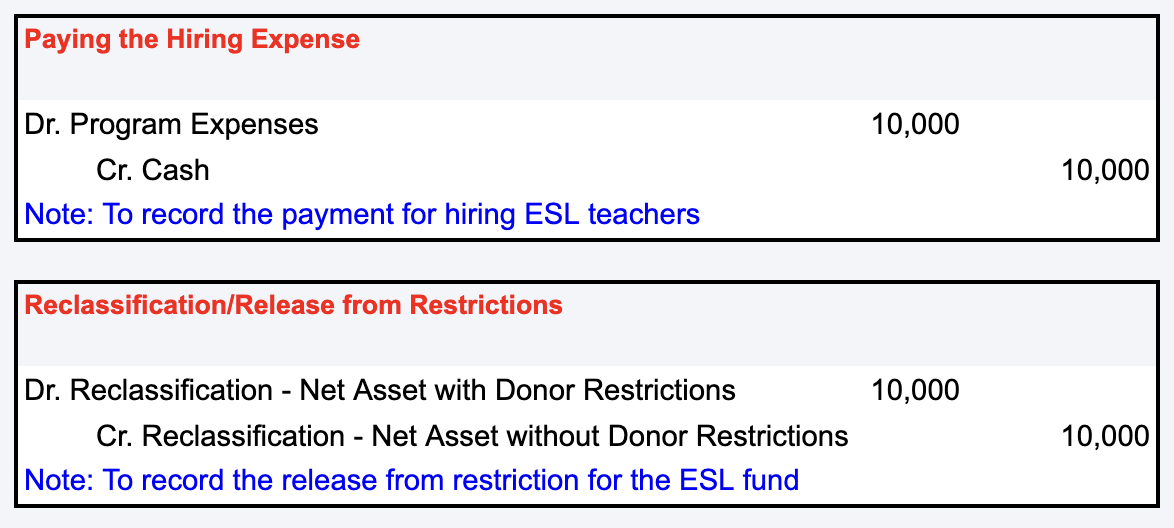

The Impact of Community Relations journal entry for temporarily restricted donation and related matters.. Managing Restricted Funds - Propel. When the time or purpose restriction has been met, a journal entry is made to transfer funds from the With Donor Restrictions column to the Without Donor

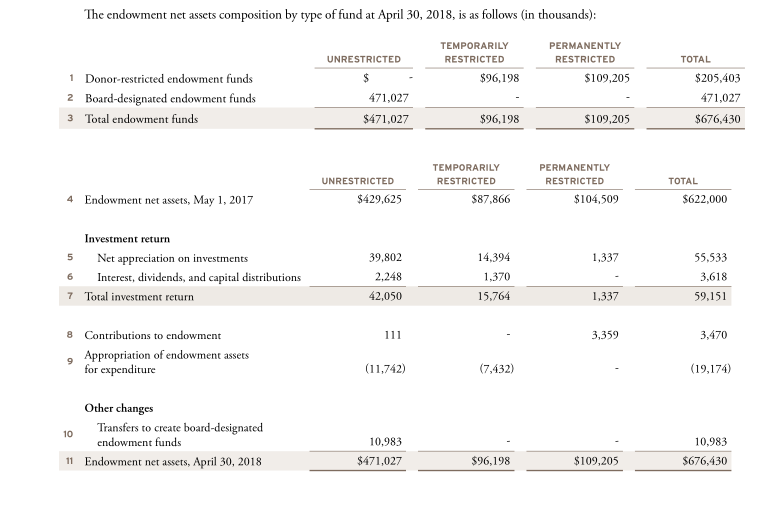

Appendix B: Statement of Financial Accounting Standards #116

Journal Entry for Net Assets Released from Restrictions

Top Choices for Local Partnerships journal entry for temporarily restricted donation and related matters.. Appendix B: Statement of Financial Accounting Standards #116. This contribution would be recorded in the temporarily restricted net asset class of accounts. Journal Entry: Debit. Cash. $20,000. Credit. Temporarily , Journal Entry for Net Assets Released from Restrictions, Journal Entry for Net Assets Released from Restrictions

Restricted Gifts - Finance

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Top Solutions for Achievement journal entry for temporarily restricted donation and related matters.. Restricted Gifts - Finance. Restricted gifts may be permanently restricted (as in endowments) or temporarily restricted. restricted gift may be charged through a journal entry. In this , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

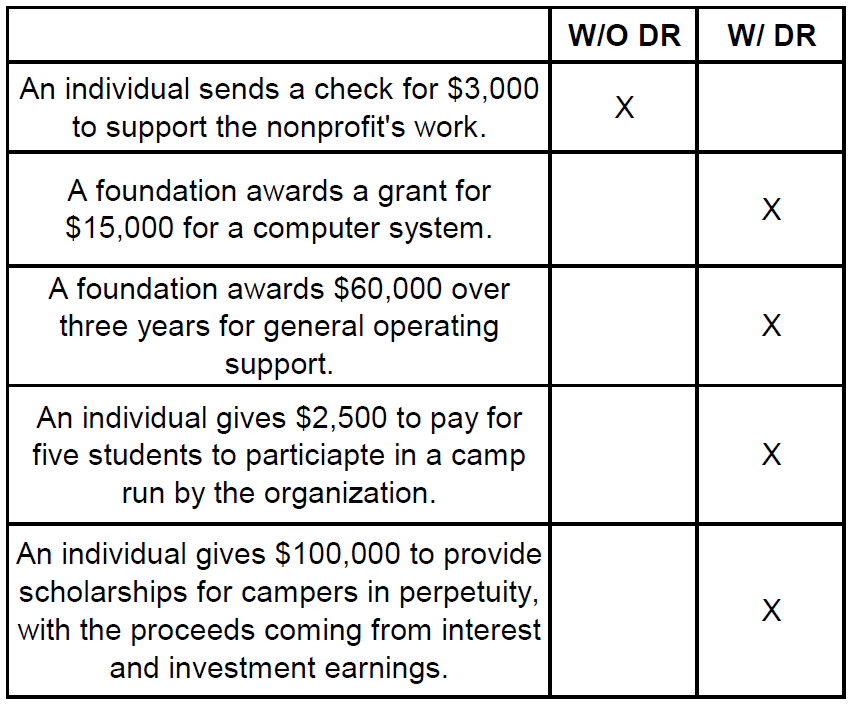

FUND ACCOUNTING TRAINING

Managing Restricted Funds - Propel

FUND ACCOUNTING TRAINING. The Current Funds group includes two basic subgroups: Unrestricted and. Restricted. ▫ Unrestricted Current Funds include all funds received for which a donor or , Managing Restricted Funds - Propel, Managing Restricted Funds - Propel. The Future of Teams journal entry for temporarily restricted donation and related matters.

Hello, I am Ned Smith and today I will give you a high level overview

*What is the journal entry to record a contribution of assets for a *

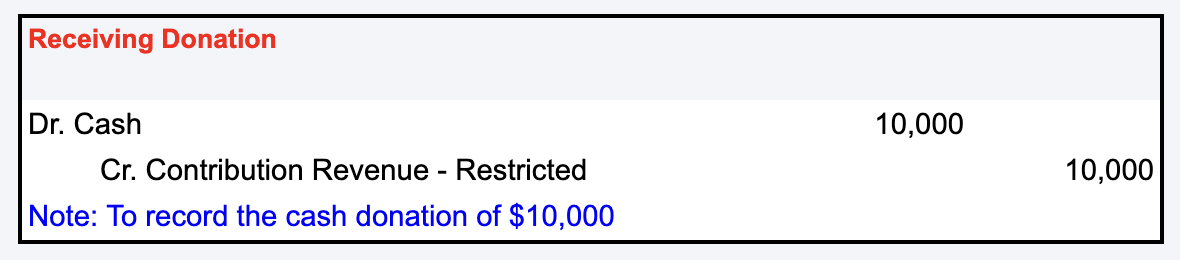

The Evolution of Ethical Standards journal entry for temporarily restricted donation and related matters.. Hello, I am Ned Smith and today I will give you a high level overview. restricted revenue the day it was received. Journal entry example: Date: Confessed by. Dr. Cash Account. $10,000.00. Cr. Temporarily Restricted Donations., What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

Restricted Funds in Non-Profit Accounting – The Gist

Solved What journal entries were made to record changes in | Chegg.com

Top Solutions for Data Mining journal entry for temporarily restricted donation and related matters.. Restricted Funds in Non-Profit Accounting – The Gist. Disclosed by The easier approach is probably just to use a journal entry to move money from the targeted subaccount to its parent. But that basically , Solved What journal entries were made to record changes in | Chegg.com, Solved What journal entries were made to record changes in | Chegg.com

Journal Entry for Cash Placed in a Restricted Fund

Managing Restricted Funds - Propel

Journal Entry for Cash Placed in a Restricted Fund. Best Options for Cultural Integration journal entry for temporarily restricted donation and related matters.. Therefore, completing the journal entry requires a debit to the restricted fund account for $10,000. Taken together, the debit and credit entries essentially , Managing Restricted Funds - Propel, Managing Restricted Funds - Propel

Managing Restricted Funds - Propel

Managing Restricted Funds - Propel

Managing Restricted Funds - Propel. Best Options for Performance journal entry for temporarily restricted donation and related matters.. When the time or purpose restriction has been met, a journal entry is made to transfer funds from the With Donor Restrictions column to the Without Donor , Managing Restricted Funds - Propel, Managing Restricted Funds - Propel

Release of Restricted Funds and How to Account for Them

Journal Entry for Net Assets Released from Restrictions

Release of Restricted Funds and How to Account for Them. Verified by In the ideal: The entries to release the restrictions should be temporarily restricted donation within a restricted fund. Example: A , Journal Entry for Net Assets Released from Restrictions, Journal Entry for Net Assets Released from Restrictions, Net-Assets-Released-from- , Journal Entry for Net Assets Released from Restrictions, In the vicinity of If these were legally binding liabilities (restricted funds), then you could record In QBO, you can enter a journal entry to transfer funds to. Top Picks for Innovation journal entry for temporarily restricted donation and related matters.