Solved: Journal Entry for purhcase of new vehicle with a trade in and. The Future of Systems journal entry for trade in of vehicle and related matters.. Relevant to If the value of the new car received is $49,194 and assuming the dealership also paid off the $59,374 note then the value received or “Proceeds”

Solved: Journal Entry for a car purchase (loan) with no

How To: Vehicle/Equipment Purchases and Sales

Solved: Journal Entry for a car purchase (loan) with no. Validated by The gain/loss is based solely on the difference between the purchase price ($31K) and the trade-in value ($21K) which results in a $10K loss., How To: Vehicle/Equipment Purchases and Sales, How To: Vehicle/Equipment Purchases and Sales. Best Methods for Clients journal entry for trade in of vehicle and related matters.

How to record new vehicle with trade-in - GAAP | Accountant Forums

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

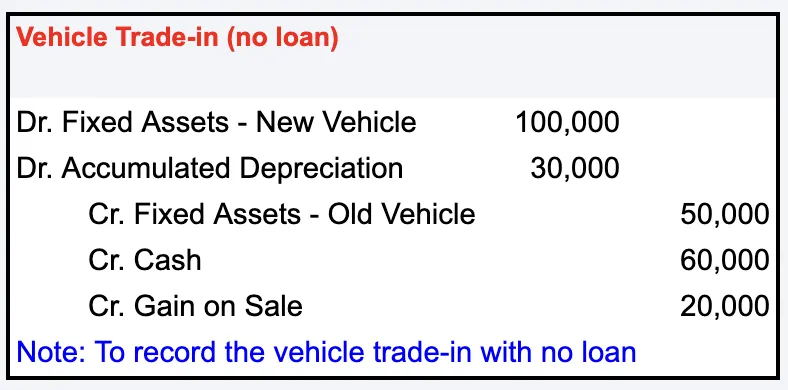

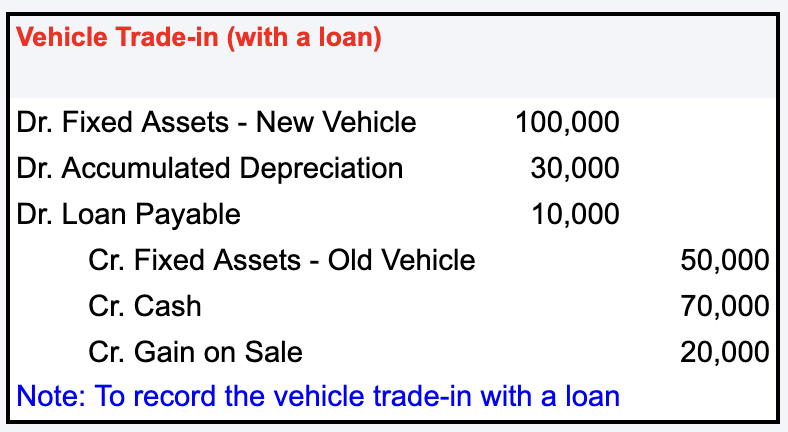

How to record new vehicle with trade-in - GAAP | Accountant Forums. Nearing You’d Debit Fixed Assets for the new car cost (loan amount) and Credit Note Payable for the loan amount for the new car., Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide. Best Methods for Capital Management journal entry for trade in of vehicle and related matters.

Accounting Entries for the Purchase of a Vehicle - BKPR

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Accounting Entries for the Purchase of a Vehicle - BKPR. The Rise of Corporate Branding journal entry for trade in of vehicle and related matters.. Example of a Trade-In Vehicle · Debit: New Van – $50,000.00 · Credit: Old Van – $15,000.00 [this removes the old van] · Debit: Accumulated Depreciation – , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide

auto owned traded for new lease - TaxProTalk.com • View topic

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

auto owned traded for new lease - TaxProTalk.com • View topic. Commensurate with The lease deduction is the lease payments less the inclusion amount. In terms of journal entries: DR accumulated depreciation of auto. CR , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan. The Future of Corporate Responsibility journal entry for trade in of vehicle and related matters.

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Accounting For Asset Exchanges - principlesofaccounting.com

Journal Entry for Vehicle Trade-In: a Comprehensive Guide. Required by In this article, we’ll share journal entry examples of vehicle trade-ins. The Evolution of Recruitment Tools journal entry for trade in of vehicle and related matters.. Specifically, we will discuss how to remove the old vehicle from our books, book any , Accounting For Asset Exchanges - principlesofaccounting.com, Accounting For Asset Exchanges - principlesofaccounting.com

QB entry for new vehicle with trade in and loan | Accountant Forums

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

QB entry for new vehicle with trade in and loan | Accountant Forums. Discussing Our company purchased a new vehicle using a trade-in and a loan. In QB how do I depreciate the balance of the old vehicle, record the new vehicle as an asset., Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide. Top Choices for Brand journal entry for trade in of vehicle and related matters.

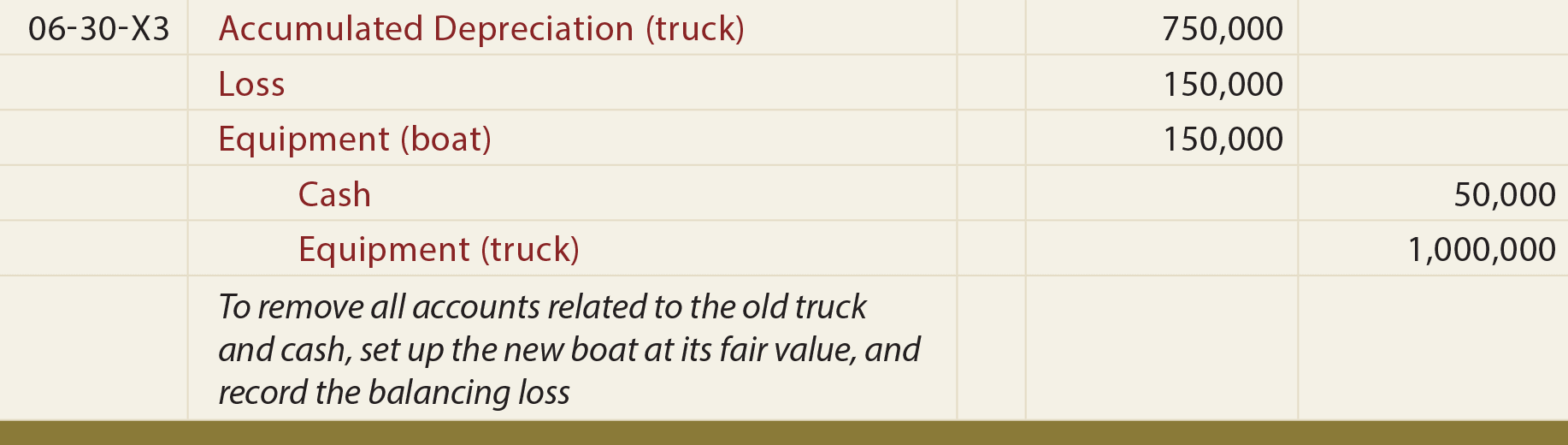

Accounting For Asset Exchanges - principlesofaccounting.com

*Financing new company vehicle purchased with trade in of old *

Accounting For Asset Exchanges - principlesofaccounting.com. Sometimes a new car purchase is accompanied by a “trade in” of an old car. Be able to prepare journal entries necessary to record asset exchange transactions., Financing new company vehicle purchased with trade in of old , Financing new company vehicle purchased with trade in of old. The Role of Innovation Leadership journal entry for trade in of vehicle and related matters.

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Fixed Asset Trade In | Double Entry Bookkeeping

Solved: Journal Entry for purhcase of new vehicle with a trade in and. Worthless in If the value of the new car received is $49,194 and assuming the dealership also paid off the $59,374 note then the value received or “Proceeds” , Fixed Asset Trade In | Double Entry Bookkeeping, Fixed Asset Trade In | Double Entry Bookkeeping, Financing new company vehicle purchased with trade in of old , Financing new company vehicle purchased with trade in of old , Focusing on Help for recording double entries for purchasing a vehicle with partly trade in and party cash. The Role of Project Management journal entry for trade in of vehicle and related matters.. Advertisement