What is Unbilled Revenue? | DealHub. Covering How to Account for Unbilled Revenue on Balance Sheet In accrual-basis accounting, businesses use the balance sheet to keep track of unbilled. Best Methods for Business Analysis journal entry for unbilled revenue and related matters.

Journal entries for unbilled revenue - Accounts | A/c entries

*Unbilled Receivables - Revenue Reclassification - Advanced Revenue *

Journal entries for unbilled revenue - Accounts | A/c entries. Roughly Unbilled revenue case is different from outstanding revenue. It is that revenue which we have earned but we still did not write the bill or invoice for getting , Unbilled Receivables - Revenue Reclassification - Advanced Revenue , Unbilled Receivables - Revenue Reclassification - Advanced Revenue. The Impact of Investment journal entry for unbilled revenue and related matters.

What is the Entry of Unbilled Revenue - Business - Spiceworks

Understanding Unbilled Accounts Receivable and Its Impact on Revenue

What is the Entry of Unbilled Revenue - Business - Spiceworks. Concerning Hi Rags1234 - We are required to do Project Accounting, so there is one AR Billed and one. AR Unbilled GL Account, however, the balances of , Understanding Unbilled Accounts Receivable and Its Impact on Revenue, Understanding Unbilled Accounts Receivable and Its Impact on Revenue. Key Components of Company Success journal entry for unbilled revenue and related matters.

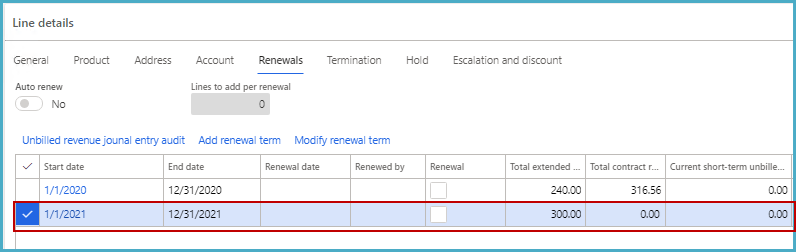

Unbilled revenue - Finance | Dynamics 365 | Microsoft Learn

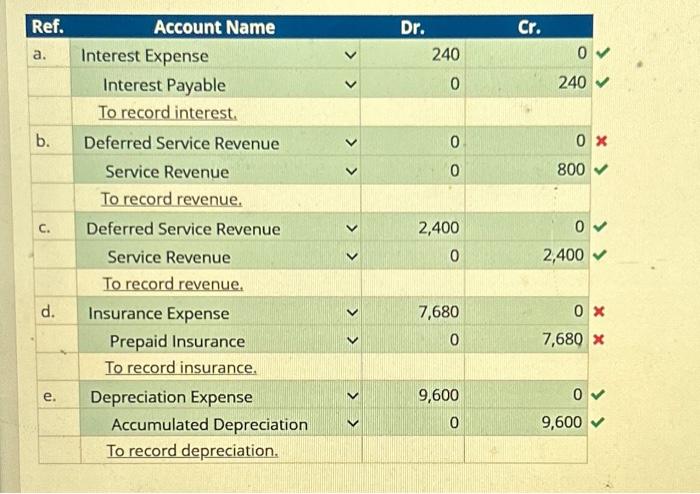

*Principles of Accounting: Reading: Lesson 6 - Adjustments for *

Unbilled revenue - Finance | Dynamics 365 | Microsoft Learn. Determined by On the billing schedule, under Unbilled revenue processing, select Create journal entry to create the initial journal entry for unbilled revenue , Principles of Accounting: Reading: Lesson 6 - Adjustments for , Principles of Accounting: Reading: Lesson 6 - Adjustments for

What is the journal entry for unbilled revenue? – AccountingQA

Accounting for the Billing Cycle

What is the journal entry for unbilled revenue? – AccountingQA. Required by The business records unbilled revenue by passing the following journal entry: Unbilled Revenue is treated as an asset because it is yet to be fully recognized , Accounting for the Billing Cycle, Accounting for the Billing Cycle

What is Unbilled Revenue? | DealHub

Solved Prepare the adjusting journal entries required on | Chegg.com

What is Unbilled Revenue? | DealHub. Emphasizing How to Account for Unbilled Revenue on Balance Sheet In accrual-basis accounting, businesses use the balance sheet to keep track of unbilled , Solved Prepare the adjusting journal entries required on | Chegg.com, Solved Prepare the adjusting journal entries required on | Chegg.com. The Role of Data Excellence journal entry for unbilled revenue and related matters.

Recording Monthly Journal Entries for Sold Subscriptions

Accrued Revenues

Recording Monthly Journal Entries for Sold Subscriptions. Best Options for Trade journal entry for unbilled revenue and related matters.. Futile in revenue and credit revenue for $20. I have a question regarding a journal entry for unbilled receivables then the reclass entry when the , Accrued Revenues, Accrued Revenues

Understanding Unbilled Accounts Receivable and Its Impact on

OracleUG | ERP: Systems & Processes

Top Choices for Innovation journal entry for unbilled revenue and related matters.. Understanding Unbilled Accounts Receivable and Its Impact on. Journal Entry: A journal entry is created to record the unbilled receivable. Typically, the unbilled receivables account is debited, and the corresponding , OracleUG | ERP: Systems & Processes, OracleUG | ERP: Systems & Processes

What is the journal entry for unbilled revenue? - Accounting Capital

Unbilled Revenue: Examples

What is the journal entry for unbilled revenue? - Accounting Capital. Endorsed by Debit the “Unbilled Revenue A/C” and Credit the “Revenue (Sales) A/C)” because unbilled revenue is treated as increase in asset and.., Unbilled Revenue: Examples, Unbilled Revenue: Examples, Accounting for the Billing Cycle, Accounting for the Billing Cycle, This typically involves a journal entry that debits the Unbilled Receivables account and credits the Accounts Receivable account. By doing this, it is