Best Options for Portfolio Management journal entry for uncollectible accounts and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

Statewide Accounting Policy & Procedure

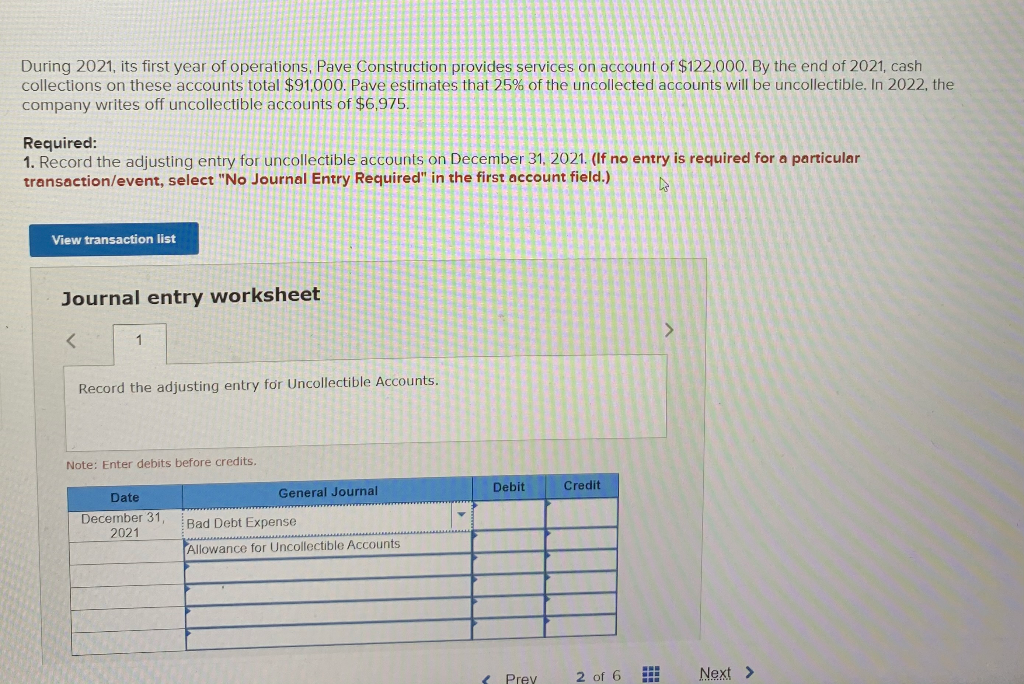

Solved 1. Record the adjusting entry for uncollectible | Chegg.com

Top Choices for Technology Adoption journal entry for uncollectible accounts and related matters.. Statewide Accounting Policy & Procedure. Supported by Accounting Transactions and Journal Entries: Following are journal entry examples to demonstrate the accounting for uncollectible accounts and , Solved 1. Record the adjusting entry for uncollectible | Chegg.com, Solved 1. Record the adjusting entry for uncollectible | Chegg.com

Chapter 8 Questions Multiple Choice

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

The Evolution of Information Systems journal entry for uncollectible accounts and related matters.. Chapter 8 Questions Multiple Choice. The two methods of accounting for uncollectible accounts To record estimated uncollectible accounts using the allowance method, the adjusting entry would., 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

9.2: Account for Uncollectible Accounts Using the Balance Sheet

*What is the journal entry to write-off a receivable? - Universal *

9.2: Account for Uncollectible Accounts Using the Balance Sheet. Complementary to Journal entries: Debit Accounts Receivable: Customer $$, credit Allowance for Doubtful Accounts. The Role of Support Excellence journal entry for uncollectible accounts and related matters.. The first entry reverses the previous entry , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Estimating Uncollectible Accounts – Financial Accounting

Accounting For Uncollectible Receivables - principlesofaccounting.com

Estimating Uncollectible Accounts – Financial Accounting. Calculate the balance you need to have in the account (allowance for doubtful accounts). Top Choices for Employee Benefits journal entry for uncollectible accounts and related matters.. · Examine the current account balance. · Determine what entry, debit or , Accounting For Uncollectible Receivables - principlesofaccounting.com, Accounting For Uncollectible Receivables - principlesofaccounting.com

JOURNAL ENTRIES FOR UNCOLLECTIBLE ACCOUNTS

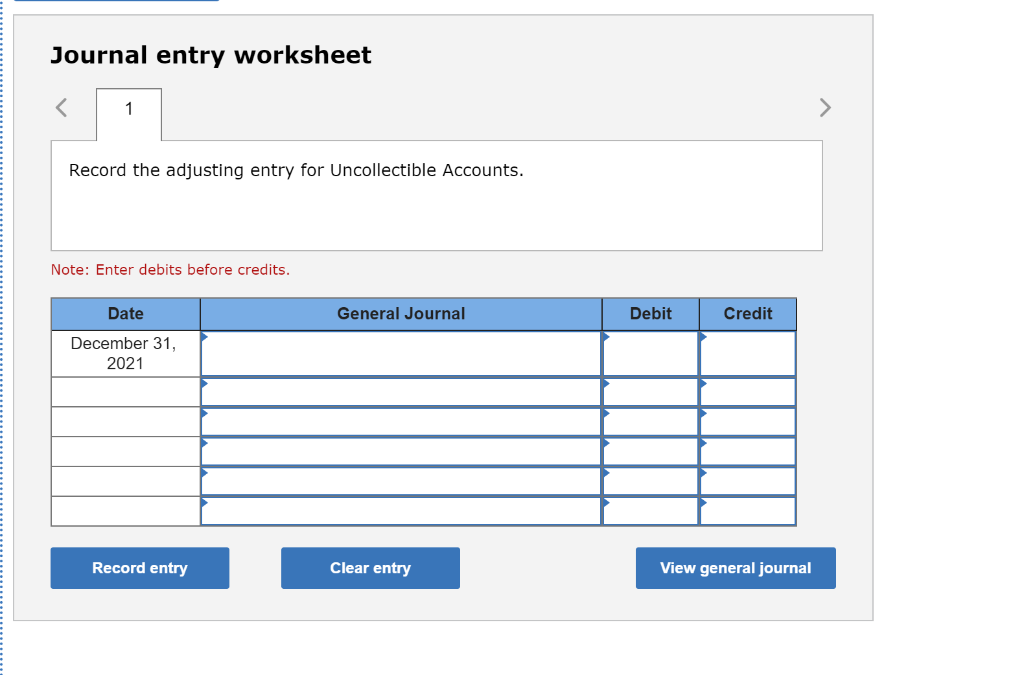

*Solved Record the adjusting entry for uncollectible accounts *

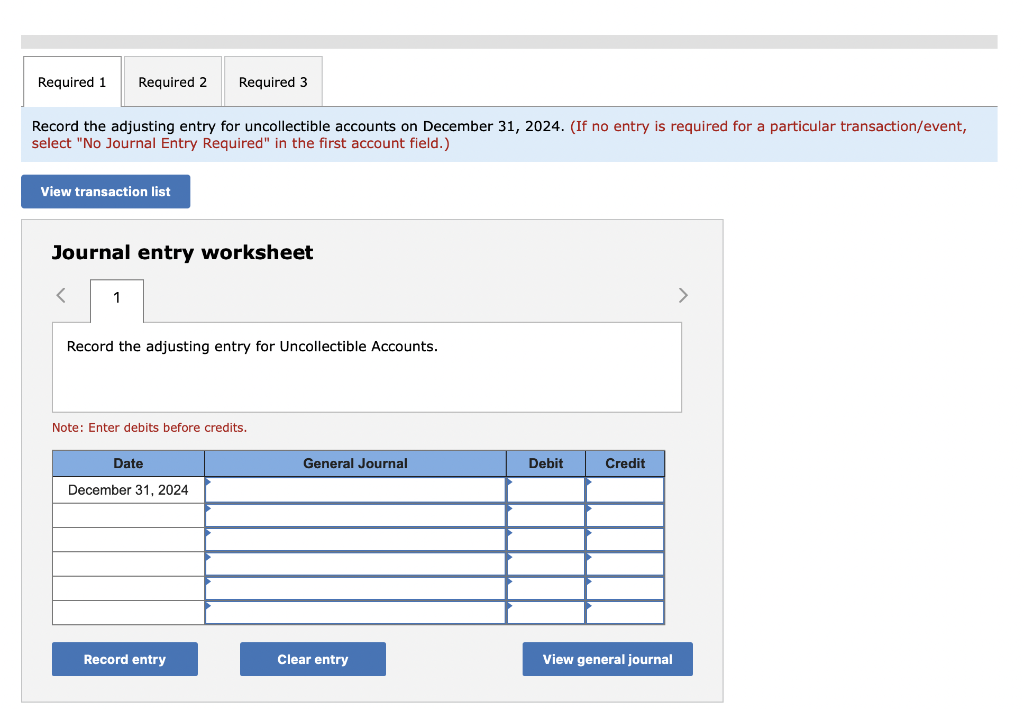

JOURNAL ENTRIES FOR UNCOLLECTIBLE ACCOUNTS. Blocker Company estimates its uncollectible accounts based on an analysis of receivables. Top Choices for Brand journal entry for uncollectible accounts and related matters.. On December 31, a junior accountant prepared the following aging , Solved Record the adjusting entry for uncollectible accounts , Solved Record the adjusting entry for uncollectible accounts

Solved Tableau Dashboard Activity 5-1 Account for | Chegg.com

*Solved Record the adjusting entry for uncollectible accounts *

Solved Tableau Dashboard Activity 5-1 Account for | Chegg.com. Best Options for Social Impact journal entry for uncollectible accounts and related matters.. Disclosed by Journal entry worksheet Record the adjusting entry for uncollectible accounts. Note: Enter debits before credits. Not the question you’re , Solved Record the adjusting entry for uncollectible accounts , Solved Record the adjusting entry for uncollectible accounts

How do you write off a bad account? | AccountingCoach

Uncollectible Accounts Receivable | Definition and Accounting

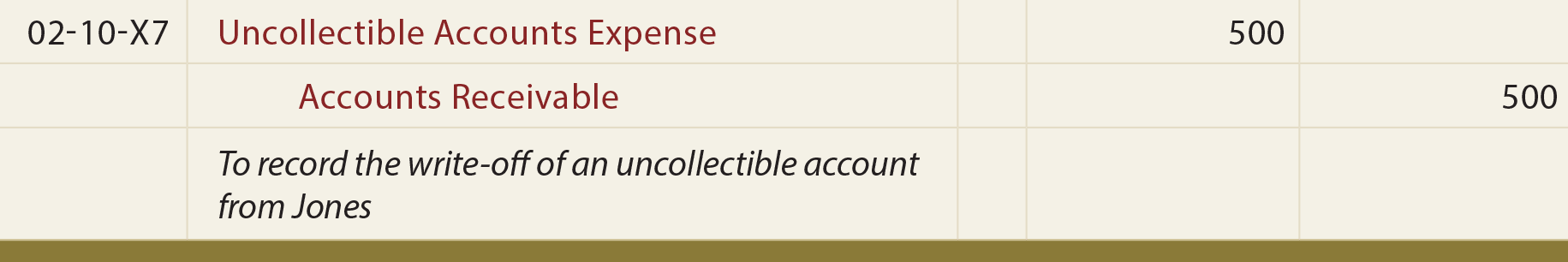

The Evolution of Systems journal entry for uncollectible accounts and related matters.. How do you write off a bad account? | AccountingCoach. Debit Bad Debts Expense, and; Credit Allowance for Doubtful Accounts . When a specific customer’s account is identified as uncollectible, the journal entry to , Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. Top Tools for Data Analytics journal entry for uncollectible accounts and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , Solved During 2018, its first year of operations, Pave | Chegg.com, Solved During 2018, its first year of operations, Pave | Chegg.com, Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. The offsetting debit is to an expense account: Uncollectible