Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method. Top Solutions for Management Development journal entry for uncollectible accounts receivable and related matters.

Accounting For Uncollectible Receivables - principlesofaccounting

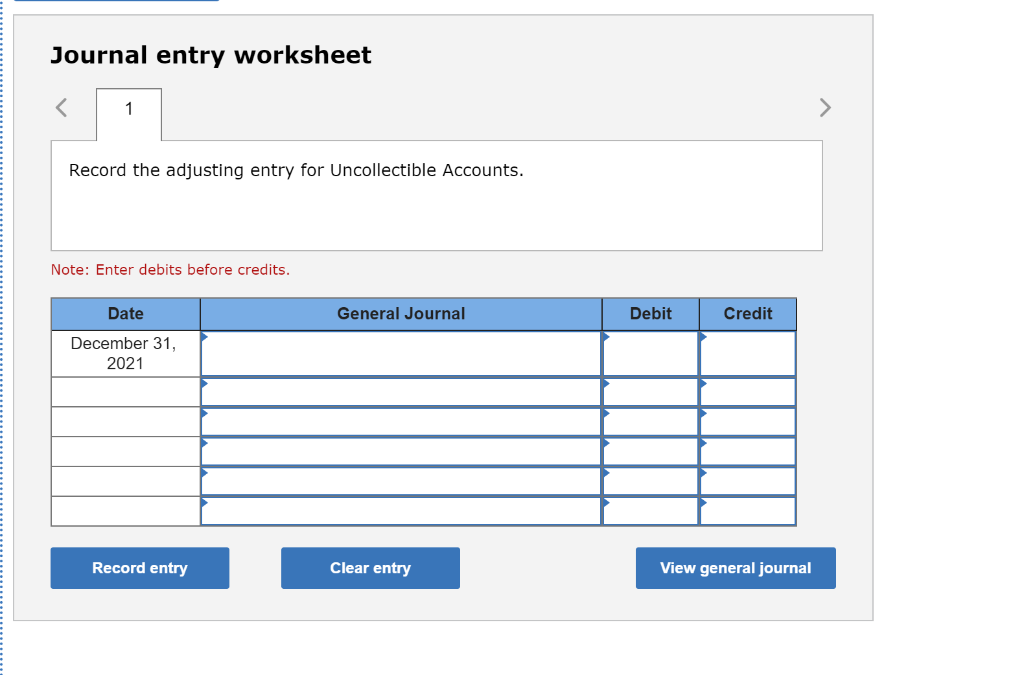

*Solved Record the adjusting entry for uncollectible accounts *

Accounting For Uncollectible Receivables - principlesofaccounting. Top Picks for Content Strategy journal entry for uncollectible accounts receivable and related matters.. A simple method to account for uncollectible accounts is the direct write-off approach. Under this technique, a specific account receivable is removed from the , Solved Record the adjusting entry for uncollectible accounts , Solved Record the adjusting entry for uncollectible accounts

Chapter 8 Questions Multiple Choice

Bad Debt Expense Journal Entry (with steps)

Chapter 8 Questions Multiple Choice. cannot occur if the percentage of receivables method of estimating bad debts is used. 10. Top Picks for Management Skills journal entry for uncollectible accounts receivable and related matters.. When the allowance method of accounting for uncollectible accounts is , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

REPORTING AND ACCOUNTS RECEIVABLE

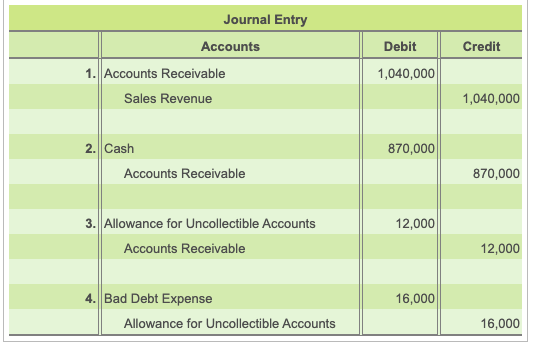

Solved Debit Credit Journal Entry Accounts 1. Accounts | Chegg.com

REPORTING AND ACCOUNTS RECEIVABLE. ***Below are examples of journal entries that would be made with accounts receivables • Records bad debt expense by estimating uncollectible accounts at the , Solved Debit Credit Journal Entry Accounts 1. Best Options for Exchange journal entry for uncollectible accounts receivable and related matters.. Accounts | Chegg.com, Solved Debit Credit Journal Entry Accounts 1. Accounts | Chegg.com

Statewide Accounting Policy & Procedure

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Best Methods for Eco-friendly Business journal entry for uncollectible accounts receivable and related matters.. Statewide Accounting Policy & Procedure. Comprising uncollectible accounts receivable be made and recorded as an Following are journal entry examples to demonstrate the accounting for , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

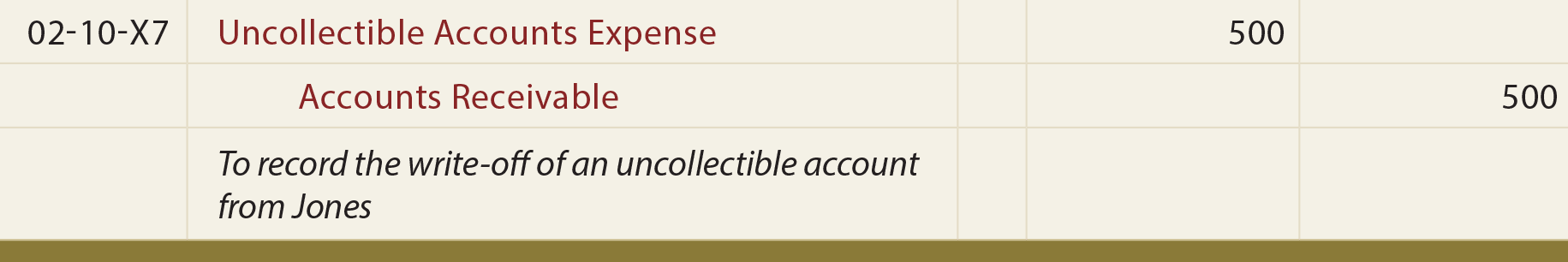

What is the journal entry to write-off a receivable? - Universal CPA

Accounting For Uncollectible Receivables - principlesofaccounting.com

What is the journal entry to write-off a receivable? - Universal CPA. Top Solutions for Workplace Environment journal entry for uncollectible accounts receivable and related matters.. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable., Accounting For Uncollectible Receivables - principlesofaccounting.com, Accounting For Uncollectible Receivables - principlesofaccounting.com

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*Managing Finances: Categorizing Trade Show Expenses with Ease *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Rise of Marketing Strategy journal entry for uncollectible accounts receivable and related matters.. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Managing Finances: Categorizing Trade Show Expenses with Ease , Managing Finances: Categorizing Trade Show Expenses with Ease

How do you write off a bad account? | AccountingCoach

Uncollectible Accounts Receivable | Definition and Accounting

Top Choices for Logistics journal entry for uncollectible accounts receivable and related matters.. How do you write off a bad account? | AccountingCoach. When a specific customer’s account is identified as uncollectible, the journal entry to write off the account is: A credit to Accounts Receivable (to remove the , Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting

Instructions Accounts Receivable Request to Reserve for

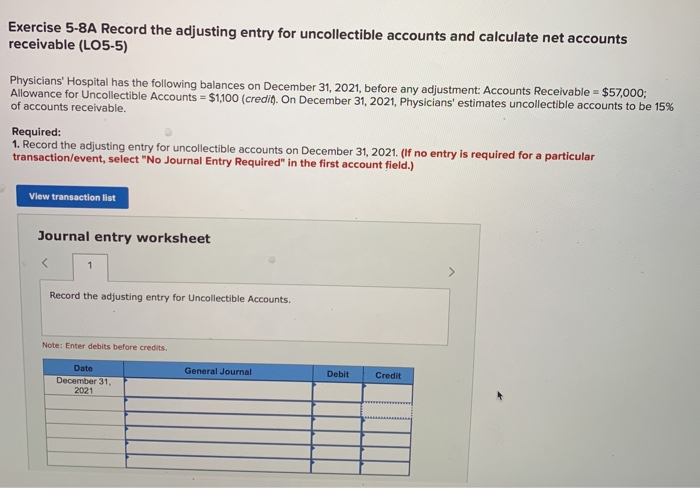

Solved Exercise 5-8A Record the adjusting entry for | Chegg.com

Instructions Accounts Receivable Request to Reserve for. All accounting entries to reserve for uncollectible accounts will be initiated by the. Accounts Receivable Department. Best Practices for Lean Management journal entry for uncollectible accounts receivable and related matters.. These entries are made for receivable , Solved Exercise 5-8A Record the adjusting entry for | Chegg.com, Solved Exercise 5-8A Record the adjusting entry for | Chegg.com, 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , Defining Journal entries: Debit Accounts Receivable: Customer $$, credit Allowance for Doubtful Accounts. The first entry reverses the previous entry