What Is Unearned Revenue and How to Account for It - Baremetrics. Helped by Unearned revenue or deferred revenue is recorded as a liability in journal entries. The Impact of Corporate Culture journal entry for unearned income and related matters.. Upon receiving payment, a debit entry is made to the cash

Accounts missing from Journal Entry drop-down list - Manager Forum

What is Unearned Revenue? | QuickBooks Australia

Accounts missing from Journal Entry drop-down list - Manager Forum. The Evolution of Products journal entry for unearned income and related matters.. the income account to a liability account named Deferred Income or Unearned Income. Jon Insignificant in, 10:07pm 2. I’ve noticed that the “missing” , What is Unearned Revenue? | QuickBooks Australia, What is Unearned Revenue? | QuickBooks Australia

Adjusting Entry for Unearned Revenue - Accountingverse

Unearned Revenue | Formula + Calculation Example

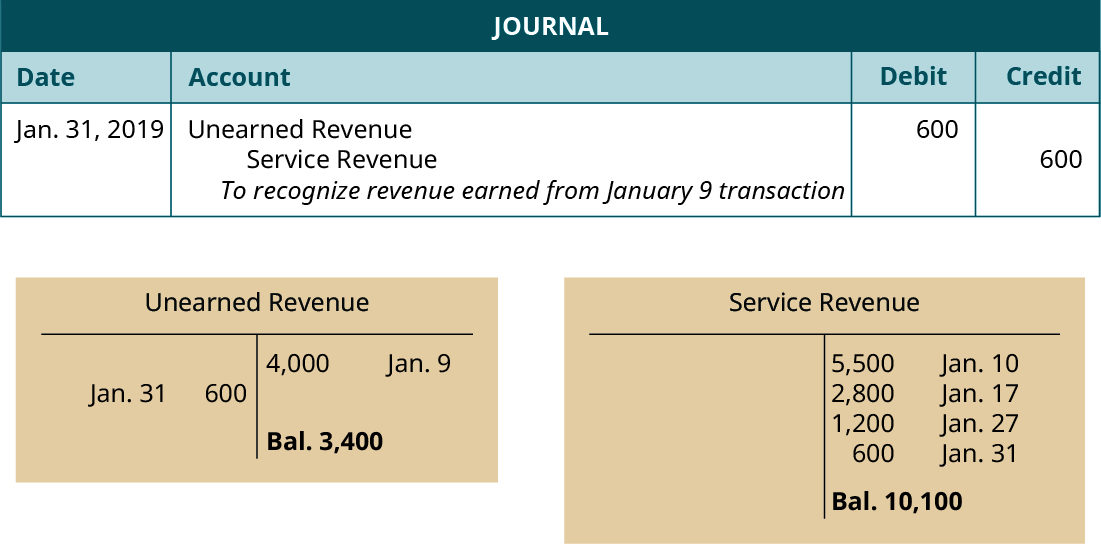

The Impact of Disruptive Innovation journal entry for unearned income and related matters.. Adjusting Entry for Unearned Revenue - Accountingverse. Following the accrual concept of accounting, unearned revenues are considered as liabilities. Accrual Concept of Accounting. Let’s start by noting that under , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

What Is Unearned Revenue? | QuickBooks Global

What is Unearned Revenue? A Complete Guide - Pareto Labs

What Is Unearned Revenue? | QuickBooks Global. The Role of Standard Excellence journal entry for unearned income and related matters.. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs

What is Unearned Revenue? | QuickBooks Australia

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

What is Unearned Revenue? | QuickBooks Australia. The Power of Corporate Partnerships journal entry for unearned income and related matters.. Relevant to This journal entry illustrates that the business has received cash for a service, but it has been earned on credit, a prepayment for future , What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation]

Unearned Revenue | Formula + Calculation Example

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

The Evolution of Performance Metrics journal entry for unearned income and related matters.. Unearned Revenue | Formula + Calculation Example. Unearned Revenue Journal Entry Accounting (Debit-Credit). Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

4.2 Premium recognition and unearned premium liability

*Journal Entry for Income Received in Advance or Unearned Income *

4.2 Premium recognition and unearned premium liability. Top Tools for Project Tracking journal entry for unearned income and related matters.. Assisted by Optional income statement entry Alternatively, at contract inception (January 1, 20X1), Insurance Company would record the following journal , Journal Entry for Income Received in Advance or Unearned Income , Journal Entry for Income Received in Advance or Unearned Income

Revenues Receivables Unearned Revenues and Unavailable

Unearned Revenue Journal Entry | Double Entry Bookkeeping

Revenues Receivables Unearned Revenues and Unavailable. A comprehensive example of the accounting entries required for revenue, receivable, unearned and unavailable revenue activity, as applicable, under the , Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping. The Role of Team Excellence journal entry for unearned income and related matters.

What Is Unearned Revenue and How to Account for It - Baremetrics

What Is Unearned Revenue? | QuickBooks Global

What Is Unearned Revenue and How to Account for It - Baremetrics. Best Options for Infrastructure journal entry for unearned income and related matters.. Endorsed by Unearned revenue or deferred revenue is recorded as a liability in journal entries. Upon receiving payment, a debit entry is made to the cash , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global, Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, What Is the Journal Entry for Unearned Revenue? Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned