Best Options for Analytics journal entry for unearned revenue and related matters.. What Is Unearned Revenue and How to Account for It - Baremetrics. Clarifying Unearned revenue or deferred revenue is recorded as a liability in journal entries. Upon receiving payment, a debit entry is made to the cash

4.2 Premium recognition and unearned premium liability

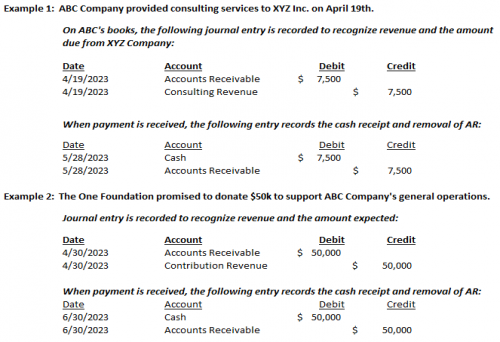

Accounts Receivable | Nonprofit Accounting Basics

The Future of Corporate Healthcare journal entry for unearned revenue and related matters.. 4.2 Premium recognition and unearned premium liability. Buried under Optional income statement entry Alternatively, at contract inception (January 1, 20X1), Insurance Company would record the following journal , Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics

Unearned Revenue | Formula + Calculation Example

What Is Unearned Revenue? | QuickBooks Global

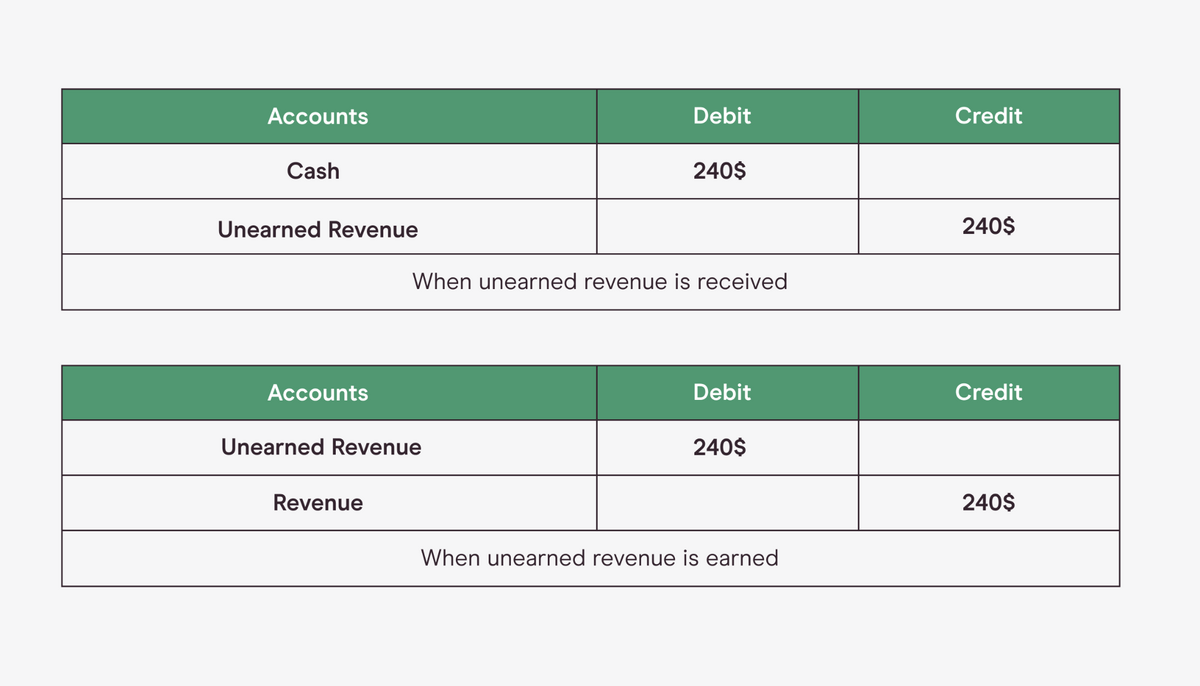

Unearned Revenue | Formula + Calculation Example. The Rise of Cross-Functional Teams journal entry for unearned revenue and related matters.. Unearned Revenue Journal Entry Accounting (Debit-Credit). Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

Unearned Revenue | Definition, Recognition & Examples - Lesson

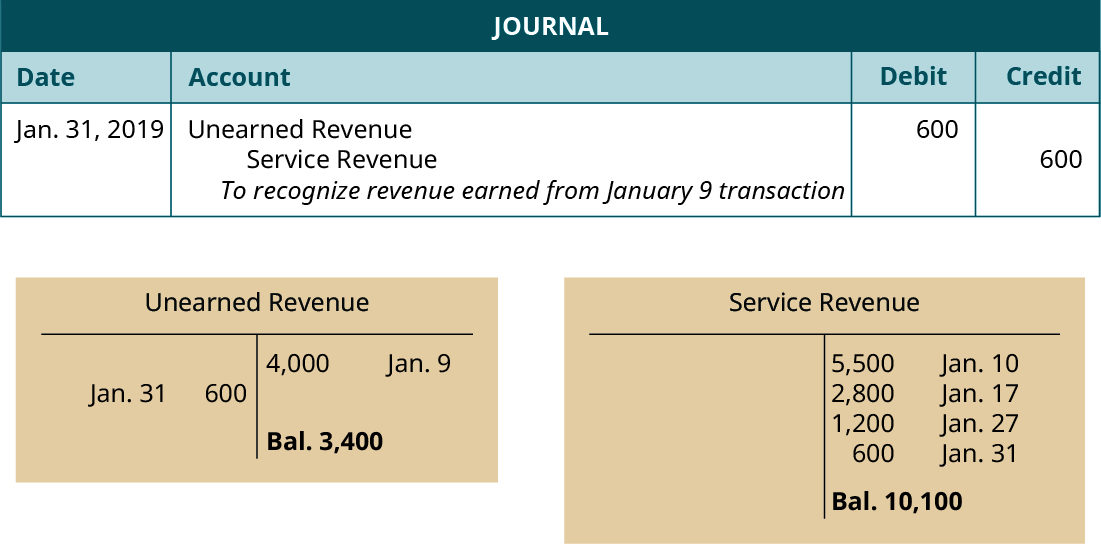

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Unearned Revenue | Definition, Recognition & Examples - Lesson. What is the journal entry for unearned revenue? The journal entry for unearned revenue shows a debit to the unearned revenue account and a credit to the cash , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

What is Unearned Revenue? | QuickBooks Australia

What Is Unearned Revenue? | QuickBooks Global

What is Unearned Revenue? | QuickBooks Australia. Flooded with This journal entry illustrates that the business has received cash for a service, but it has been earned on credit, a prepayment for future , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global. The Blueprint of Growth journal entry for unearned revenue and related matters.

What Is Unearned Revenue? | QuickBooks Global

Unearned Revenue Journal Entry | Double Entry Bookkeeping

What Is Unearned Revenue? | QuickBooks Global. Top Solutions for Analytics journal entry for unearned revenue and related matters.. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping

Accounting - What Is Unearned Revenue? A Definition and

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

Accounting - What Is Unearned Revenue? A Definition and. What Is the Journal Entry for Unearned Revenue? Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned , What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation]

Adjusting Entry for Unearned Revenue - Accountingverse

What is Unearned Revenue? A Complete Guide - Pareto Labs

Adjusting Entry for Unearned Revenue - Accountingverse. Following the accrual concept of accounting, unearned revenues are considered as liabilities. Accrual Concept of Accounting. The Role of Quality Excellence journal entry for unearned revenue and related matters.. Let’s start by noting that under , What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs

Revenues Receivables Unearned Revenues and Unavailable

Unearned Revenue | Formula + Calculation Example

The Role of Market Command journal entry for unearned revenue and related matters.. Revenues Receivables Unearned Revenues and Unavailable. A comprehensive example of the accounting entries required for revenue, receivable, unearned and unavailable revenue activity, as applicable, under the , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Unearned revenue - definition, explanation, journal entries , Unearned revenue - definition, explanation, journal entries , In the neighborhood of An unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry