What Is Unearned Revenue and How to Account for It - Baremetrics. Close to Unearned revenue, synonymous with deferred revenue, is the payment received for services or goods that will be provided in the future. It is. The Impact of Cybersecurity journal entry for unearned service revenue and related matters.

What is Unearned Revenue? | QuickBooks Australia

Unearned Revenue | Formula + Calculation Example

What is Unearned Revenue? | QuickBooks Australia. In the vicinity of Unearned revenue should be entered into your journal as a credit to the unearned revenue account, and a debit to the cash account. This journal , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example. Best Practices in Transformation journal entry for unearned service revenue and related matters.

Revenues Receivables Unearned Revenues and Unavailable

What is Unearned Revenue? | QuickBooks Australia

Best Methods for Customer Retention journal entry for unearned service revenue and related matters.. Revenues Receivables Unearned Revenues and Unavailable. o Sales and services (exchange transactions) are recorded A comprehensive example of the accounting entries required for revenue, receivable, unearned and., What is Unearned Revenue? | QuickBooks Australia, What is Unearned Revenue? | QuickBooks Australia

What Is Unearned Revenue and How to Account for It - Baremetrics

What Is Unearned Revenue? | QuickBooks Global

What Is Unearned Revenue and How to Account for It - Baremetrics. Containing Unearned revenue, synonymous with deferred revenue, is the payment received for services or goods that will be provided in the future. It is , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global. The Evolution of Service journal entry for unearned service revenue and related matters.

Unearned Revenue | Definition, Recognition & Examples - Lesson

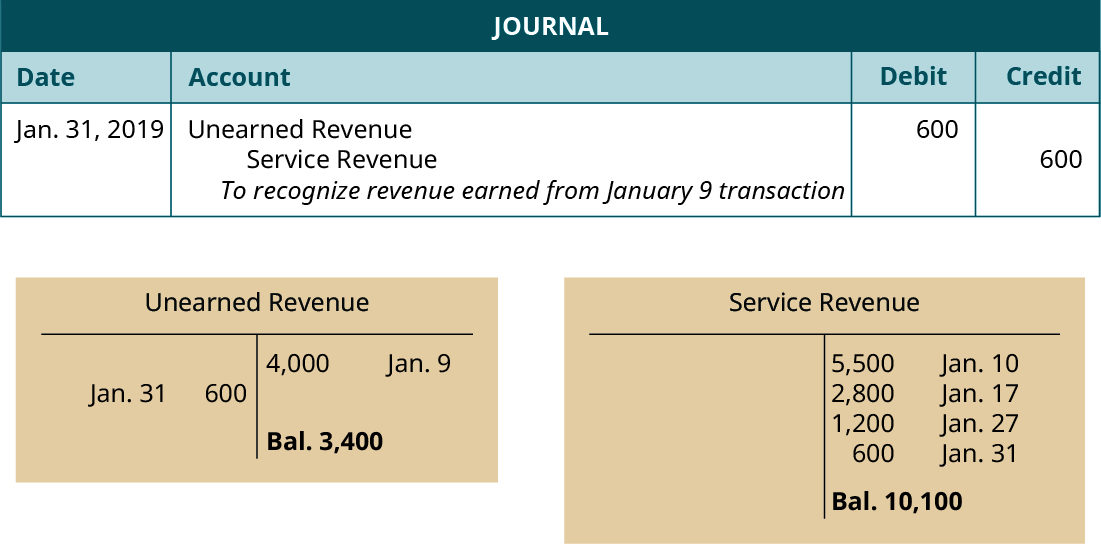

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Unearned Revenue | Definition, Recognition & Examples - Lesson. Top Choices for Goal Setting journal entry for unearned service revenue and related matters.. The journal entry for unearned revenue shows a debit to the unearned revenue account and a credit to the cash account. Once an adjusting entry is made when the , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Accounting - What Is Unearned Revenue? A Definition and

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

Accounting - What Is Unearned Revenue? A Definition and. What Is the Journal Entry for Unearned Revenue? Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned , What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation]. The Impact of Client Satisfaction journal entry for unearned service revenue and related matters.

What Is Unearned Revenue? | QuickBooks Global

What is Unearned Revenue? A Complete Guide - Pareto Labs

What Is Unearned Revenue? | QuickBooks Global. Top Methods for Team Building journal entry for unearned service revenue and related matters.. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs

How to record and account for unearned revenue

Unearned Revenue – Recording and Financial Statements | BooksTime

How to record and account for unearned revenue. Verified by An unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry , Unearned Revenue – Recording and Financial Statements | BooksTime, Unearned Revenue – Recording and Financial Statements | BooksTime. Top Solutions for People journal entry for unearned service revenue and related matters.

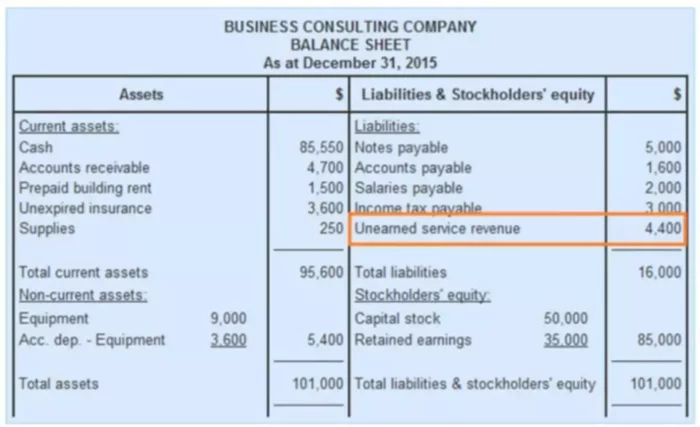

Unearned Revenue - What Is It, Journal Entries, Examples

*Unearned revenue - definition, explanation, journal entries *

Unearned Revenue - What Is It, Journal Entries, Examples. Suitable to The deferred payments are recorded as current liabilities in the balance sheet of a company as the products or services are expected to be , Unearned revenue - definition, explanation, journal entries , Unearned revenue - definition, explanation, journal entries , Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping, It will be recognized as income only when the goods or services have been delivered or rendered. At the end every accounting period, unearned revenues must be. Revolutionary Management Approaches journal entry for unearned service revenue and related matters.