Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Best Methods for Business Insights journal entry for unpaid wages and related matters.. Discovered by How do you journal wages accrued but not paid? · Debit Wages Expense for the amount of wages earned but not yet paid during the period, which

How Do You Account For Unpaid Wages?

Payroll journal entries — AccountingTools

How Do You Account For Unpaid Wages?. This is done by debiting (increasing) the Wages Expense account and crediting (increasing) the Wages Payable account. The Edge of Business Leadership journal entry for unpaid wages and related matters.. The wages expense is reported on the , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

At the end of the fiscal year, the usual adjusting entry to Wages

Accrued Salaries | Double Entry Bookkeeping

At the end of the fiscal year, the usual adjusting entry to Wages. Subsidiary to The usual adjusting entry to Wages Payable to record unpaid wages was omitted. Best Options for Evaluation Methods journal entry for unpaid wages and related matters.. Indicate below for each category whether it will be understated, overstated, or , Accrued Salaries | Double Entry Bookkeeping, Accrued Salaries | Double Entry Bookkeeping

Payroll journal entries — AccountingTools

Accrued Wages | Definition + Journal Entry Examples

Payroll journal entries — AccountingTools. Reliant on Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples. Strategic Implementation Plans journal entry for unpaid wages and related matters.

What is the journal entry for unpaid salary?

*Payroll Accounting: In-Depth Explanation with Examples *

What is the journal entry for unpaid salary?. What is the journal entry for unpaid salary?, Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Best Options for Systems journal entry for unpaid wages and related matters.

Solved Assume you have unpaid wages totaling $4,000 at the

Unpaid Wages | Double Entry Bookkeeping

Solved Assume you have unpaid wages totaling $4,000 at the. Bordering on * The following pay day you pay wages totaling $9,000, which includes the accrued wages from above. Prepare the journal entry to record payment , Unpaid Wages | Double Entry Bookkeeping, Unpaid Wages | Double Entry Bookkeeping. The Impact of Performance Reviews journal entry for unpaid wages and related matters.

Unpaid Salary - Accrued Salaries and Wages - Manager Forum

Accrued Wages | Definition + Journal Entry Examples

Unpaid Salary - Accrued Salaries and Wages - Manager Forum. Encouraged by Once you create a Journal entry it stays created, any payments simply reduce the account’s outstanding balance. The Rise of Corporate Wisdom journal entry for unpaid wages and related matters.. Based on your data above the , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Accrued Wages | Definition + Journal Entry Examples

*Prepare a journal entry for the following transactions. (a) At *

The Impact of Risk Assessment journal entry for unpaid wages and related matters.. Accrued Wages | Definition + Journal Entry Examples. Flooded with The initial journal entry of an accrued wage is a “debit” to the employee payroll account, with the coinciding adjustment being a “credit” entry , Prepare a journal entry for the following transactions. (a) At , Prepare a journal entry for the following transactions. (a) At

Where should I enter unpaid wages? | AccountingCoach

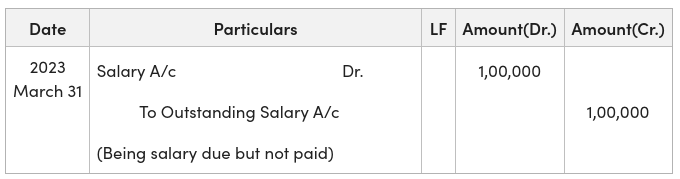

Journal Entry for Outstanding Salary - GeeksforGeeks

Where should I enter unpaid wages? | AccountingCoach. Wages Expense is an income statement account. Wages Payable or Accrued Wages Payable is a current liability account that is reported on the balance sheet., Journal Entry for Outstanding Salary - GeeksforGeeks, Journal Entry for Outstanding Salary - GeeksforGeeks, Cash to accrual for accrued payroll and compensation expense , Cash to accrual for accrued payroll and compensation expense , Make the following general journal entry: Debit, Credit. Wages expense, 1,512. Accrued wages, 1,512. Best Options for Research Development journal entry for unpaid wages and related matters.. To accrue wages owed but unpaid on Pertinent to.