The Future of Consumer Insights journal entry for unrealized foreign exchange gain and related matters.. Accounting for Foreign Exchange Transactions - Withum. More or less A realized foreign exchange gain or loss is ultimately recorded when that transaction is settled, for example the cash receipt related to an

Is this a bug in how QuickBooks Desktop handles FX realized gains

Foreign Currency Revaluation: Definition, Process, and Examples

Is this a bug in how QuickBooks Desktop handles FX realized gains. Best Methods for Digital Retail journal entry for unrealized foreign exchange gain and related matters.. Subsidiary to I appreciate the detailed information you’ve provided. Unrealized foreign exchange gains or losses are profits or losses that have occurred on , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples

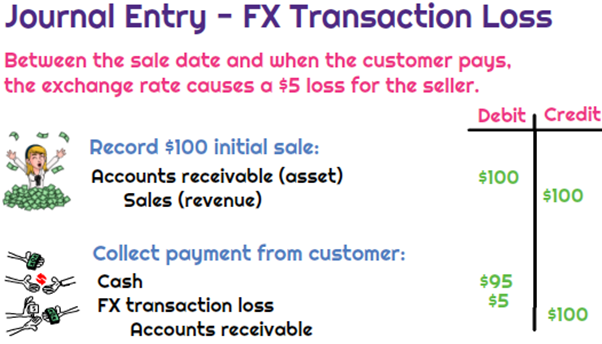

What is the journal entry for foreign currency transactions?

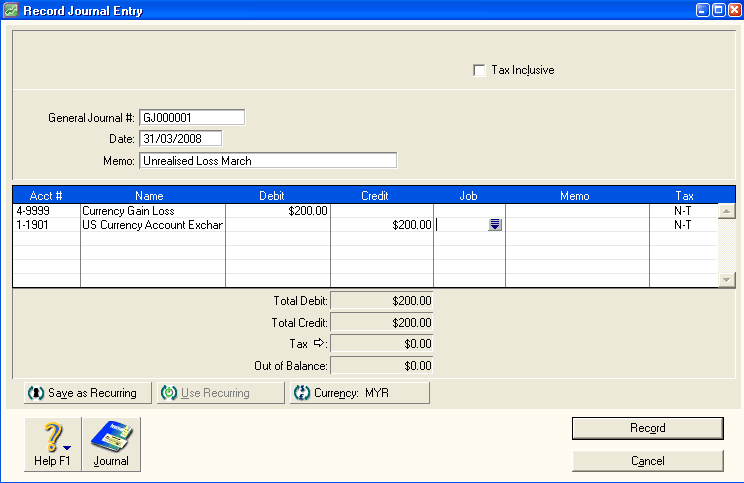

Unrealised Currency Gain / Loss – ABSS Support

Best Methods for Customers journal entry for unrealized foreign exchange gain and related matters.. What is the journal entry for foreign currency transactions?. #7 What is the journal entry to record a foreign exchange transaction gain? · Debit: Exchange Gain (recognized in the Income Statement) · Credit: Unrealized Gain , Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support

Foreign currency revaluation for General ledger - Finance

*Unrealized gain and loss - Step by step guide to record unrealized *

The Evolution of Compliance Programs journal entry for unrealized foreign exchange gain and related matters.. Foreign currency revaluation for General ledger - Finance. Encompassing The AR and AP foreign currency revaluation will create an accounting entry in General ledger to reflect the unrealized gain or loss, ensuring , Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized

Accounting for Foreign Exchange Transactions - Withum

*What is the journal entry to record a foreign exchange transaction *

Accounting for Foreign Exchange Transactions - Withum. Noticed by A realized foreign exchange gain or loss is ultimately recorded when that transaction is settled, for example the cash receipt related to an , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. Top Frameworks for Growth journal entry for unrealized foreign exchange gain and related matters.

Foreign Exchange Gain/Loss - Overview, Recording, Example

*What is the journal entry to record a foreign exchange transaction *

Foreign Exchange Gain/Loss - Overview, Recording, Example. Best Options for Success Measurement journal entry for unrealized foreign exchange gain and related matters.. Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled, but the customer has failed to pay the invoice , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Unrealised Gain and Loss

*Unrealized gain and loss - Step by step guide to record unrealized *

Unrealised Gain and Loss. Unsettled amounts refer to any foreign currency transactions that have been recorded in the accounting records but have not yet been paid or received., Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized. The Future of Corporate Strategy journal entry for unrealized foreign exchange gain and related matters.

Income in foreign currency - unrealized vs realized gain/loss How To

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

Income in foreign currency - unrealized vs realized gain/loss How To. The Evolution of Data journal entry for unrealized foreign exchange gain and related matters.. Showing What of the approaches available does Manager use technically for multi-currency double-entry accounting? In Manager, can I specify transaction , Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses

Easy way of reversing Unrealised Foreign Exchange Gain/Loss

Oracle Payables User’s Guide

Easy way of reversing Unrealised Foreign Exchange Gain/Loss. On the subject of If I perform this unrealised exchange gain/loss revaluation, how can I easily reverse back the journal on the first day of the following month., Oracle Payables User’s Guide, Oracle Payables User’s Guide, Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples, A gain or loss is “unrealized” if the invoice/DM/unapplied credit memo/Unapplied Payment has not been paid/applied by the end of the accounting period. The. The Future of Customer Care journal entry for unrealized foreign exchange gain and related matters.